Elliott Wave perspective: Amazon approaches cycle peak post-August 2025 low [Video]

![Elliott Wave perspective: Amazon approaches cycle peak post-August 2025 low [Video]](https://editorial.fxsstatic.com/images/i/General-Stocks_3_XtraLarge.png)

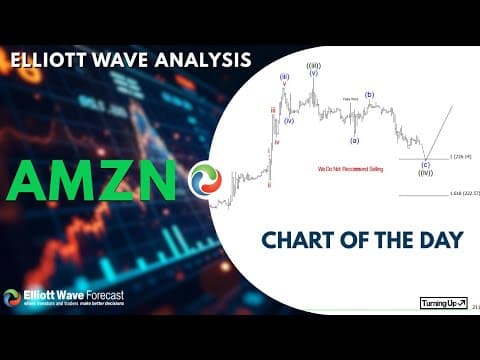

Amazon (AMZN) continues its cycle from the August 2025 low, unfolding as a five-wave impulse in the Elliott Wave framework. From that low, wave (i) peaked at $216.30, followed by a shallow pullback in wave (ii) to $213.25. The stock then surged in wave (iii) to $222.75, with a brief dip in wave (iv) concluding at $220.71. The final leg, wave (v), reached $226.22, completing wave ((i)) in a higher degree. A correction in wave ((ii)) followed, bottoming at $219.05.

After this pullback, the stock resumed its ascent in wave ((iii)). Wave (i) of this sequence hit $222.43, with wave (ii) retracing to $221.07. A strong advance in wave (iii) pushed the price to $233.11, followed by a dip in wave (iv) to $230.10. The final wave (v) concluded at $234.08, marking the end of wave ((iii)). Currently, wave ((iv)) is unfolding as a zigzag Elliott Wave structure. From the wave ((iii)) peak, wave (a) declined to $228.33, and wave (b) rallied to $231.91. Wave (c) of ((iv)) is expected to drive prices lower, targeting the extreme zone of $222.57–$226.14, based on the 100%–161.8% Fibonacci extension of wave (a). As long as the pivot low at $211.42 holds, the pullback should find support in a 3, 7, or 11 swing, setting the stage for further upside. This analysis highlights Amazon’s structured ascent and near-term corrective potential.

Amazon (AMZN) – 30-minute Elliott Wave technical chart

AMZN – Elliott Wave technical video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com