ECB's Lagarde: Inflation is ''much too high'', rates will rise further

European Central Bank President Christine Lagarde has repeated that the cycle of interest-rate increases must ensure that inflation returns to the 2% target over the medium term.

''Must bring inflation back to 2%,'' she said in recent trade, adding again that inflation is ‘much too high’'. She said rates will rise more.

Meanwhile, EURUSD is on the up and traders have been of the mind that the US economy is slowing enough to allow the Federal Reserve to ease its rate-hiking pace.

This is weighing on the greenback and the ongoing speculation that China may ease COVID restrictions is also playing a role in the downside at the start of the week.

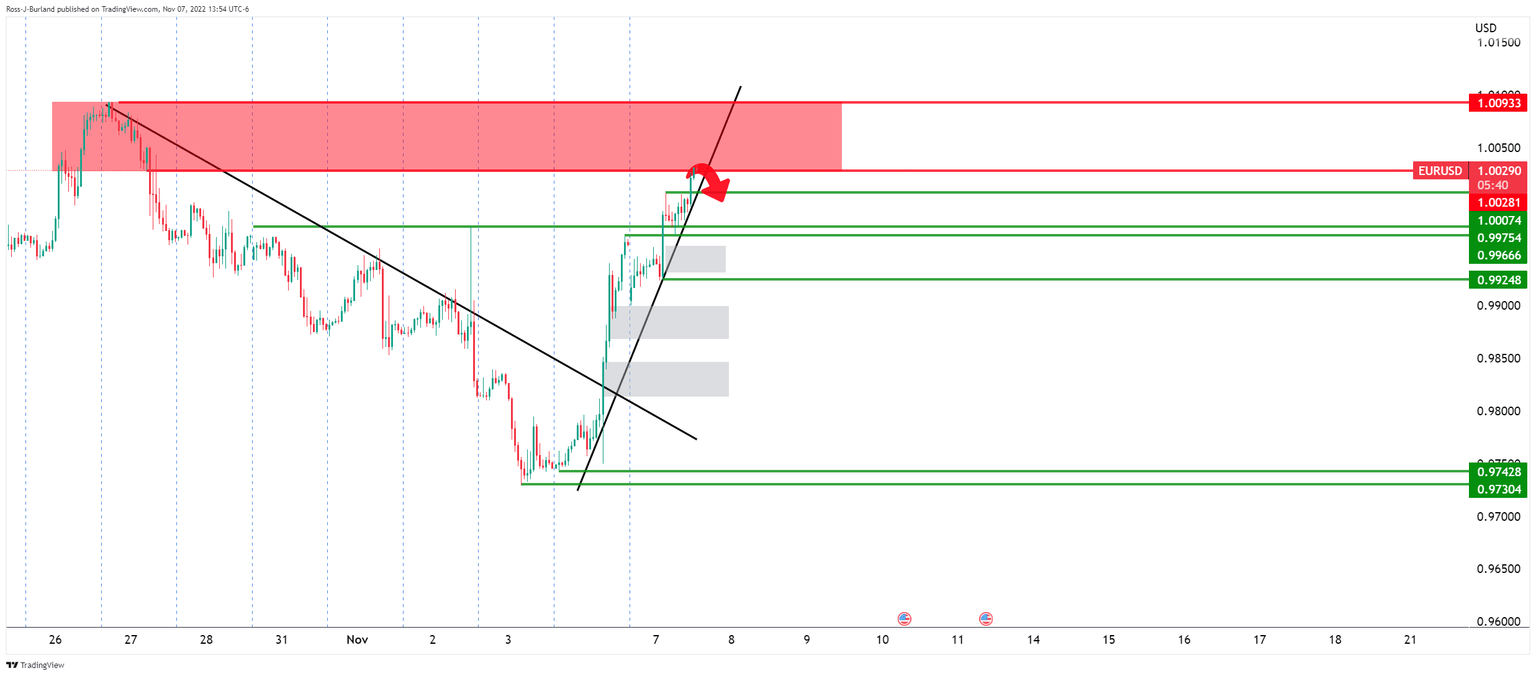

EURUSD has been approaching last month's highs as the following hourly chart illustrates:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.