DXY: Bears looking to bearish wedge breakout, encouraged by COVID-19 second wave

- USD to lose its safe-haven status if COVID-19 appears to be a uniquely US problem.

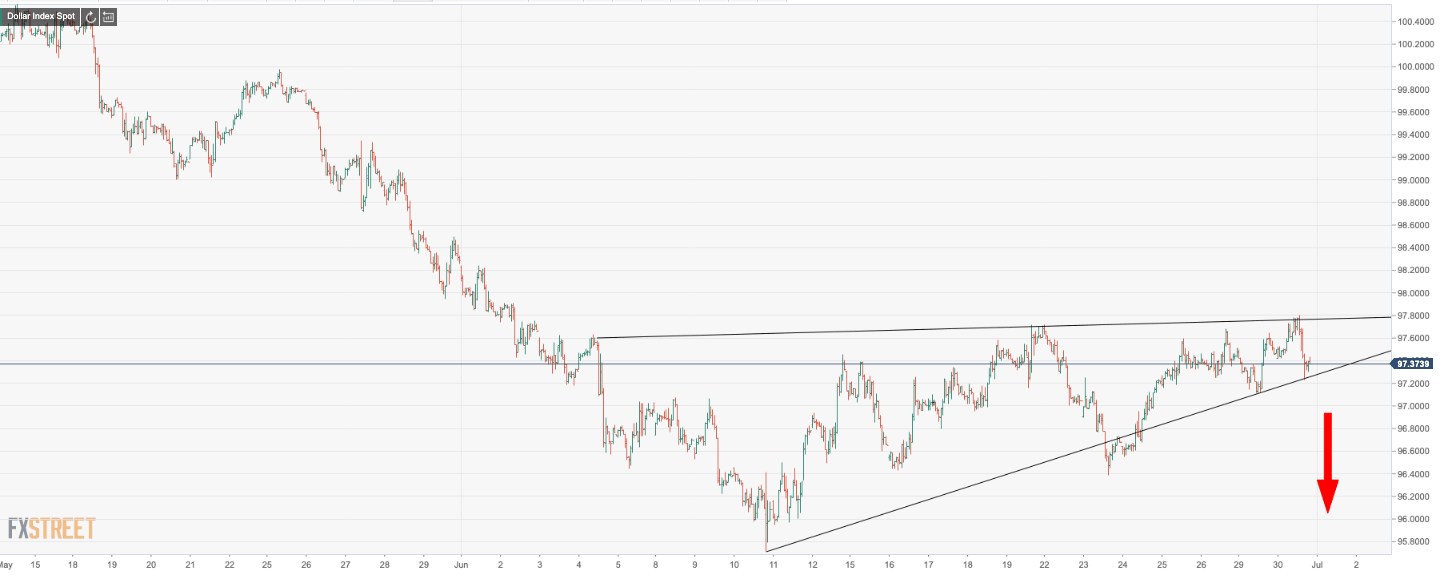

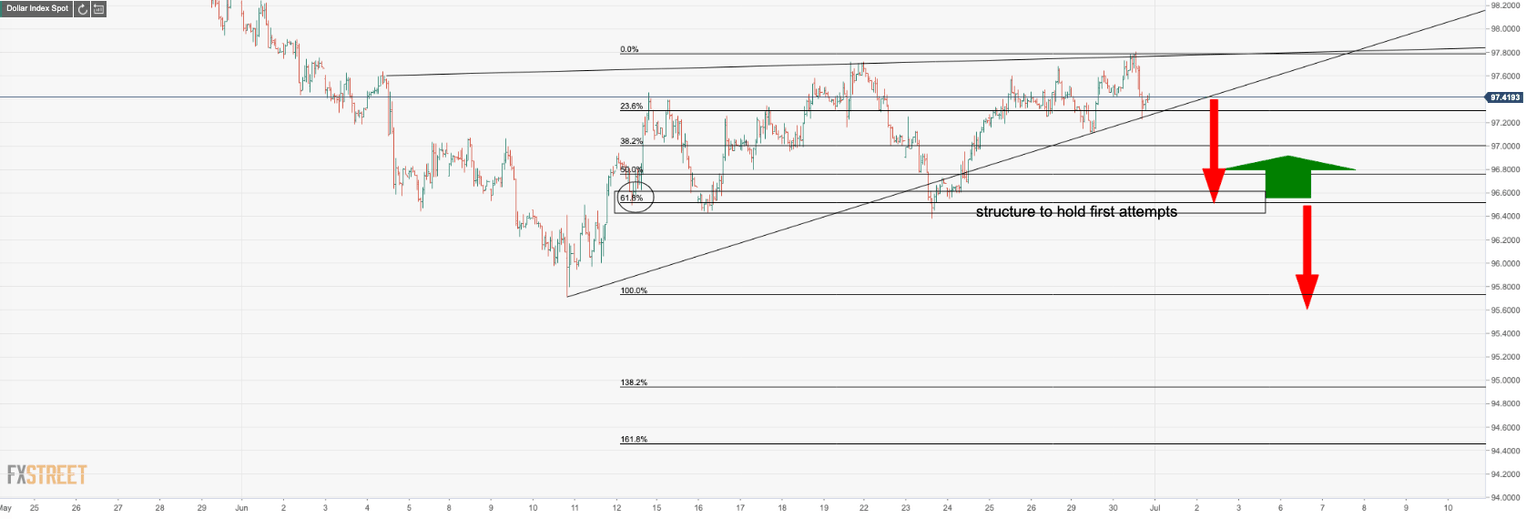

- A technical breakout could lead to a sustained weakening on the greenback.

In a week culminating with US payrolls and the Independence day bank holiday, risk sentiment is likely to remain choppy.

The DXY is one to watch for the remainder of the shortened week, as rising Covid-19 cases in the US keep halting reopening plans, a potential spanner in the works for the mightly dollar.

Looking across the G10s from a 5-day view, the USD is definitely the best performing, but there are questions over both its technical position on the charts and across investment portfolios.

At the time of writing, DXY is trading at 97.42 having ranged between 97.23 and 97.80 and flat on the session in a relatively quiet one for the end of the month.

To date, however, the moves in FX have been reflecting the net losses registered in stock markets.

There has been a higher correlation in FX to equity price of late and the US dollar has certainly fared well as a result of its safe-haven status.

Meanwhile, what has been conflicting to spot FX has been the positioning in the US dollar by both funds and asset managers.

USD has continued to see broad-based selling, although the concerns over a worsening pandemic situation on a global scale could give rise to a repeat of demand for the greenback should we see a collapse similar to the start of the crisis elsewhere.

On the other hand, renewed lockdowns stand to delay the US recovery and should the US economy start to show signs of weakness again pertaining to a second wave on home soil.

The question everyone is now asking is whether investors will start to identify the second wave as a problem unique to the US.

A sell-off on Wall Street has, to date, supported the dollar, however, if the COVID-19 problem is indeed unique to the US, it will perhaps mean that the greenback will not receive the typical boost on bad US news?

Key data ahead

Either way, we could expect to see USD positioning on a volatile footing in the weeks ahead.

Looking ahead to the week, Thursday sees the release of Nonfarm Payroll and we also have manufacturing ISM (perhaps even hitting 50) and reasonably strong consumer confidence.

The renewed uptrend in COVID cases cautions against extrapolating, but the ISM index likely returned to the 50 level and payrolls probably rose strongly again. Another rise in payrolls is being signaled by ADP and Homebase data. However, the unemployment rate was probably held up by a rebound in the participation rate and a fading of the distortion from classification issues,

Analysts at TD Securities explained.

FOMC minutes of the 10 June meeting will also be released and a host of Fed speakers have already started to hit the wires.

-

Fed's Kashkari: Headline unemployment rate deeply flawed as measure of joblessness

-

Powell speech: Second coronavirus wave could force people to withdraw from economic activity

DXY bearish wedge

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.