Dow Jones Industrial Average struggles after NFP jobs miss knocks sentiment lower

- The Dow Jones tumbled over 1.85% on Friday peak-to-trough.

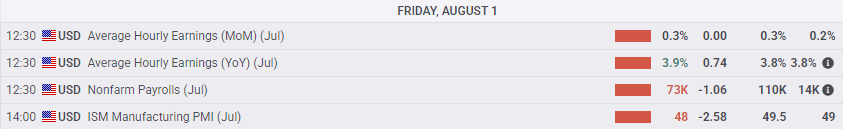

- US NFP jobs figures came in well below expectations alongside steep revisions.

- A shuddering labor market has reignited hopes for more Fed rate cuts soon.

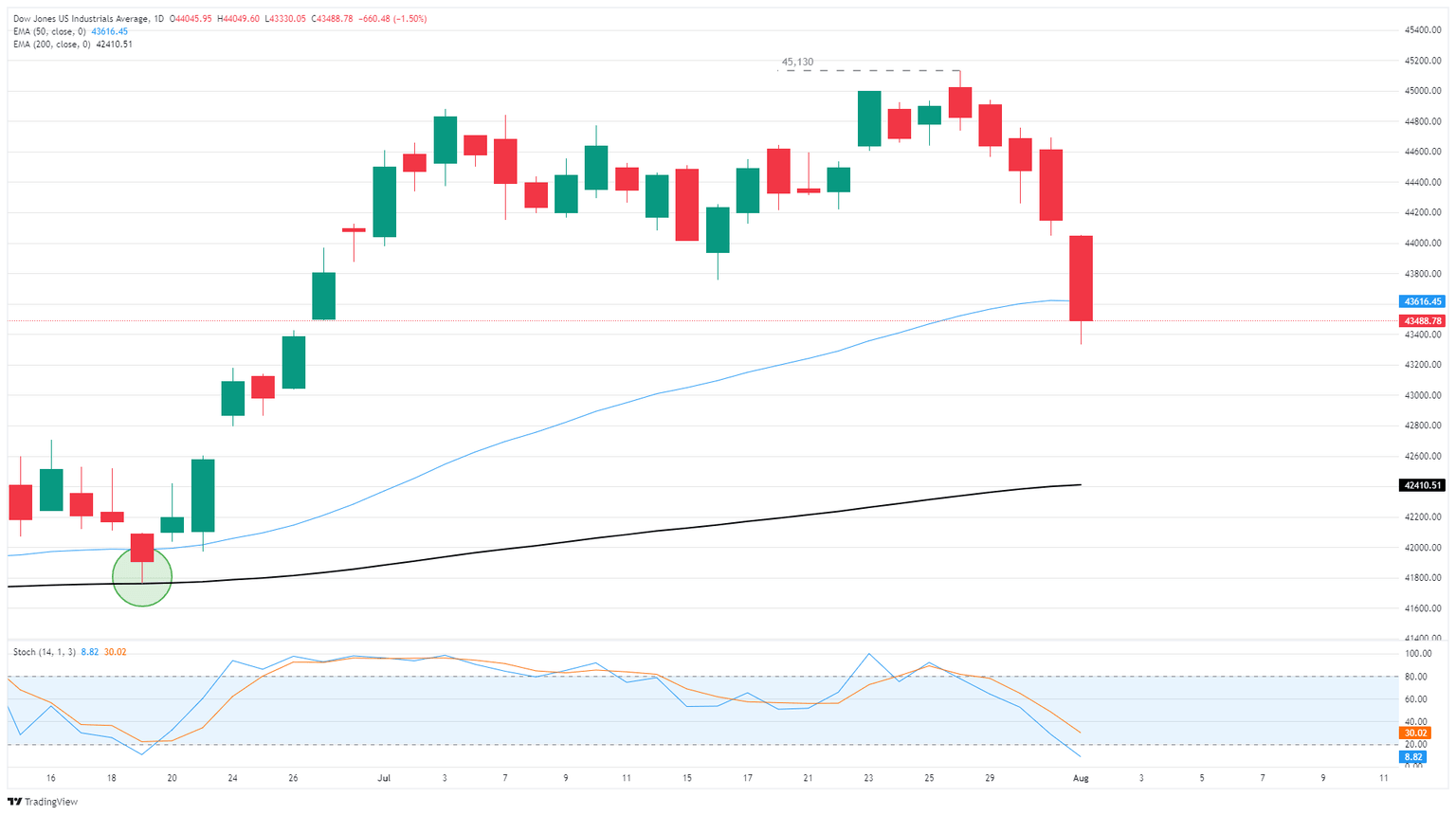

The Dow Jones Industrial Average (DJIA) plummeted almost 2% top-to-bottom on Friday, falling over 800 points from Thursday’s closing bids at its lowest point. Equity markets are scrambling to recover their footing after a disappointing Nonfarm Payrolls (NFP) report that showed the US added far fewer jobs in July than expected.

The Dow Jones fell to a five-week low, tapping 43,330 for the first time since late June and running into technical congestion at the 50-day Exponential Moving Average (EMA) near 43,600. The major equity index saw its worst week since the Trump administration announced global tariffs in early April, and the Dow is down over 3% from Monday's opening bids near 45,000.

NFP down, rate cut hopes up

US NFP net job gains slowed sharply in July, falling to 73K over the month, well below the expected 110K. On top of the downside print, previous months saw a sharp revision lower, with May getting revised down by 125K to 19K and June’s NFP getting adjusted to a scant 14K. The revisions wiped over 250K of net job increases off the books over two months, bringing US NFP net employment increase to just 104K over a three-month period, with further revisions expected in the months to come.

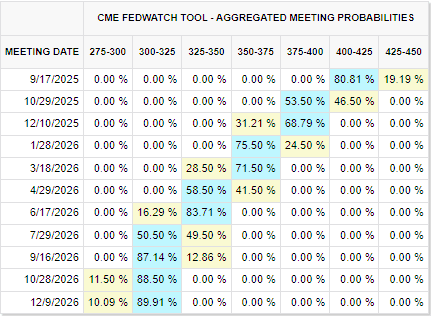

With a sharp downward revision in the US’s labor outlook now on the table, markets are piling back into bets of a rate cut from the Federal Reserve (Fed) in September. Markets had pulled back on rate cut expectations after the Fed held interest rates steady earlier this week, citing a need to monitor additional employment and inflation data. According to the CME’s FedWatch Tool, rate markets are now pricing in upwards of 80% odds of at least a quarter-point rate trim on September 17, up from the 45% odds priced in prior to Friday’s NFP release.

Despite a steepening slowdown in what was considered a healthy labor market until Friday, the US is still grappling with a general decaying in economic data overall: inflationary pressure, mostly from potential tariff impacts, are still biting around the edges of headline inflation metrics, and sentiment surveys at both the business and consumer levels are beginning to throw up red flags.

Underlying economic conditions add to concerns around jobs

July’s US ISM Manufacturing Purchasing Managers Index (PMI) fell to 48.0, marking a fifth straight month below 50.0, with the majority of surveyed firms expecting to see worsening hiring conditions through August. As noted by the Institute for Supply Management (ISM), firms saw a general upswing in orders and general demand, but businesses are still cutting back on their hiring practices and actively managing headcount.

According to the ISM, 79% of the US’s manufacturing sector Gross Domestic Product (GDP) output contracted in July, up sharply from June’s 46% as businesses continue to clamp down on hiring and investment plans. Trade policy uncertainty remains a key thorn in the US economy’s side, even as the Trump administration continues to play on-again, off-again with tariffs.

President Donald Trump’s August 1 deadline on import taxes has turned into another messy delay. President Trump announced early Friday that tariffs, which were set to go into effect at midnight Thursday, are now set to begin on August 7 as the Trump team continues to try to wrangle trade deals out of other countries, with dubious to questionable results thus far.

Read more stock news: Amazon stock sheds 8% as market in turmoil following jobs report

Dow Jones 5-minute chart

Dow Jones daily chart

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Last release: Fri Aug 01, 2025 12:30

Frequency: Monthly

Actual: 73K

Consensus: 110K

Previous: 147K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.