Dow Jones Industrial Average shrugs off rising Middle East tensions

- The Dow Jones rose on Monday, as equities shrugged off weekend turmoil.

- The upbeat mood didn’t last long, as stock market volatility rose on further Middle East escalation.

- Iran has retaliated against US assets in Iraq and Qatar following the Trump administration’s missile strikes over the weekend.

The Dow Jones Industrial Average (DJIA) whipsawed on Monday, churning as investors reacted to headlines that Iran had lashed out at US military assets in the Middle East in retaliation for the weekend’s missile strikes ordered by the Trump administration. Equity markets have moved the goalposts on hoping for a de-escalation in the region, or at least that downside knock-on effects for the US economy will spur the Federal Reserve (Fed) into rate cuts sooner rather than later.

The US launched a series of missile strikes on what were believed to be Iranian nuclear facilities over the weekend. The Trump administration circumvented congressional approval to launch the strikes, a move that will likely draw political backlash within the US government in the weeks to come. Iran responded with target missile strikes against a US Air Force base in Qatar on Monday.

Markets initially roiled in the early hours, with investors fearing a possible closing of the Strait of Hormuz by Iran. Roughly one-fifth of global Crude Oil production flows through the strait, and equity markets were concerned about a possible supply chain shock. Despite the rising tensions, and the US appearing to reverse President Trump’s campaign promise of avoiding getting involved in foreign conflicts, investors are shaking off bearish sentiment. Markets are banking on the Middle East scenario remaining contained for the time being, and there are hopes that a bit of trade turmoil could hinder the US economy enough to prompt the Fed into a fresh round of rate cuts.

Read more stock news: US stocks downplay Iran retaliation concerns as indices edge higher

Dow Jones price forecast

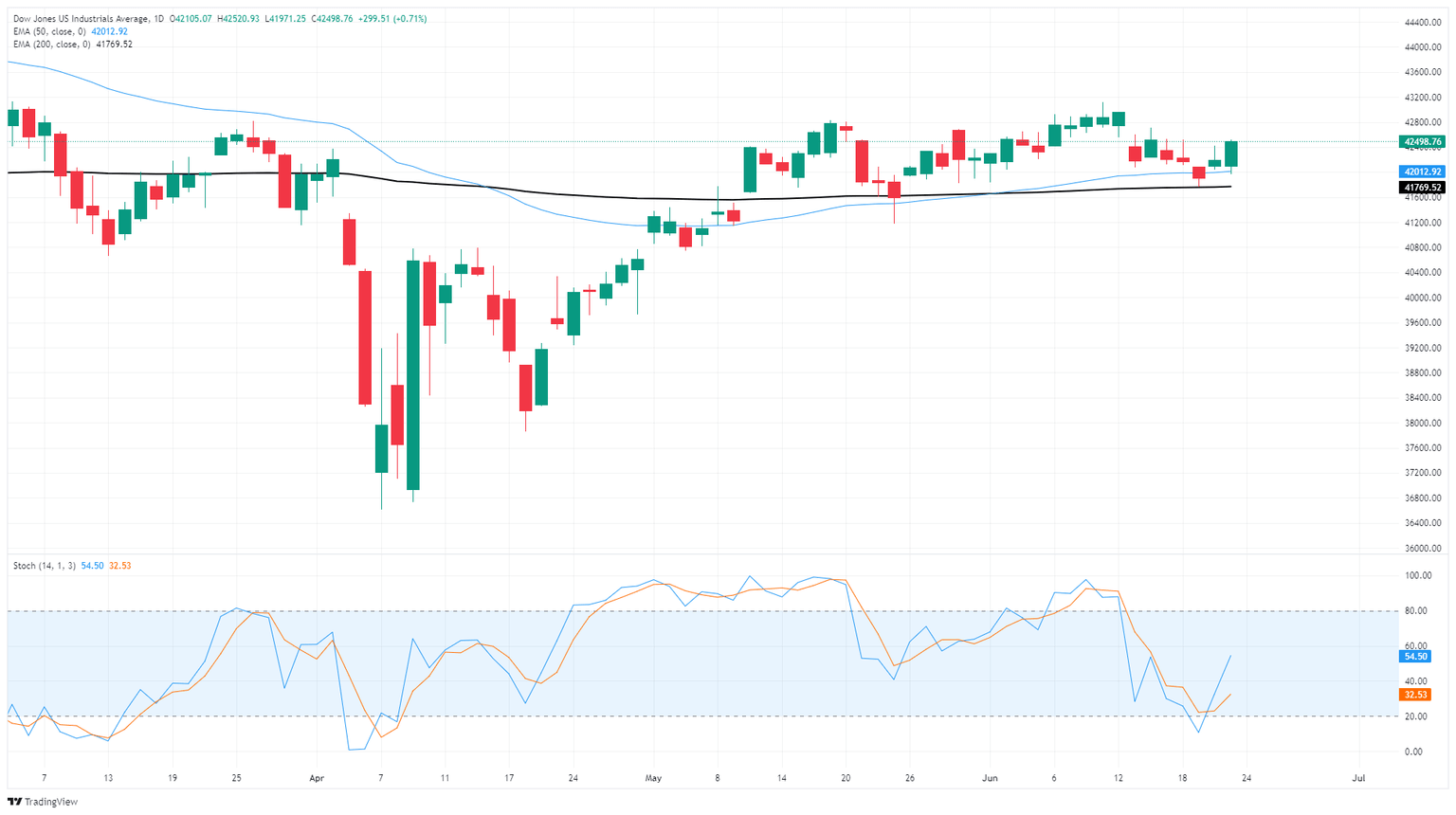

After a rocky start to the trading week, the Dow Jones Industrial Average is pushing back into bullish territory and catching a bullish bounce from the 50-day Exponential Moving Average (EMA) near the 42,000 major price handle. The Dow is clawing back into a near-term congestion zone, climbing around 400 points on Monday. Price action remains capped below 43,000 for the time being, and a sustained push back into the high side will first need to make a firm break of the 42,500 level.

Dow Jones daily chart

Economic Indicator

Fed's Chair Powell testifies

Federal Reserve Chair Jerome Powell testifies before Congress, providing a broad overview of the economy and monetary policy. Powell's prepared remarks are published ahead of the appearance on Capitol Hill.

Read more.Next release: Tue Jun 24, 2025 14:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.