Dow Jones Industrial Average finds thin rebound on Monday

- The Dow Jones shifted higher on Monday, trimming recent losses.

- Equities recovery remains limited as tech stocks trade blows.

- US inflation data due later this week looms large on the horizon.

The Dow Jones Industrial Average (DJIA) recovered some ground on Monday, climbing some 300 points and change at its peak in an effort to claw back some of last week’s losses sparked by an unexpected downturn in consumer confidence figures. Markets are kicking off the new trading week with a bullish tilt, but gains remain limited as tensions hold on the high end and investors remain overall uneasy on multiple fronts.

Consumer sentiment figures from February raised some alarms last week, and now investors will be pivoting to key earnings figures this week from consumer building suppliers Home Depot (HD) and Lowe’s (LOW) to help gauge consumers' spending health. US Personal Consumption Expenditure (PCE) inflation figures due later this week will draw plenty of investor focus as traders hope for signs that January’s uptick in Consumer Price Index (CPI) and Producer Price Index (PPI) inflation, which both came in higher than expected, was just a flash in the pan and not a sign of a new resurgence of inflation pressures.

Dow Jones news

Despite some mixed investor sentiment, most of the Dow Jones is holding on the high side, with over two-thirds of the index’s listed securities gaining ground on Monday. Microsoft (MSFT) is down a full percentage point, falling to $404 per share as the company cuts its spending plans on data centers, reigniting even more fears that the AI trade may be coming to an end.

Dow Jones price forecast

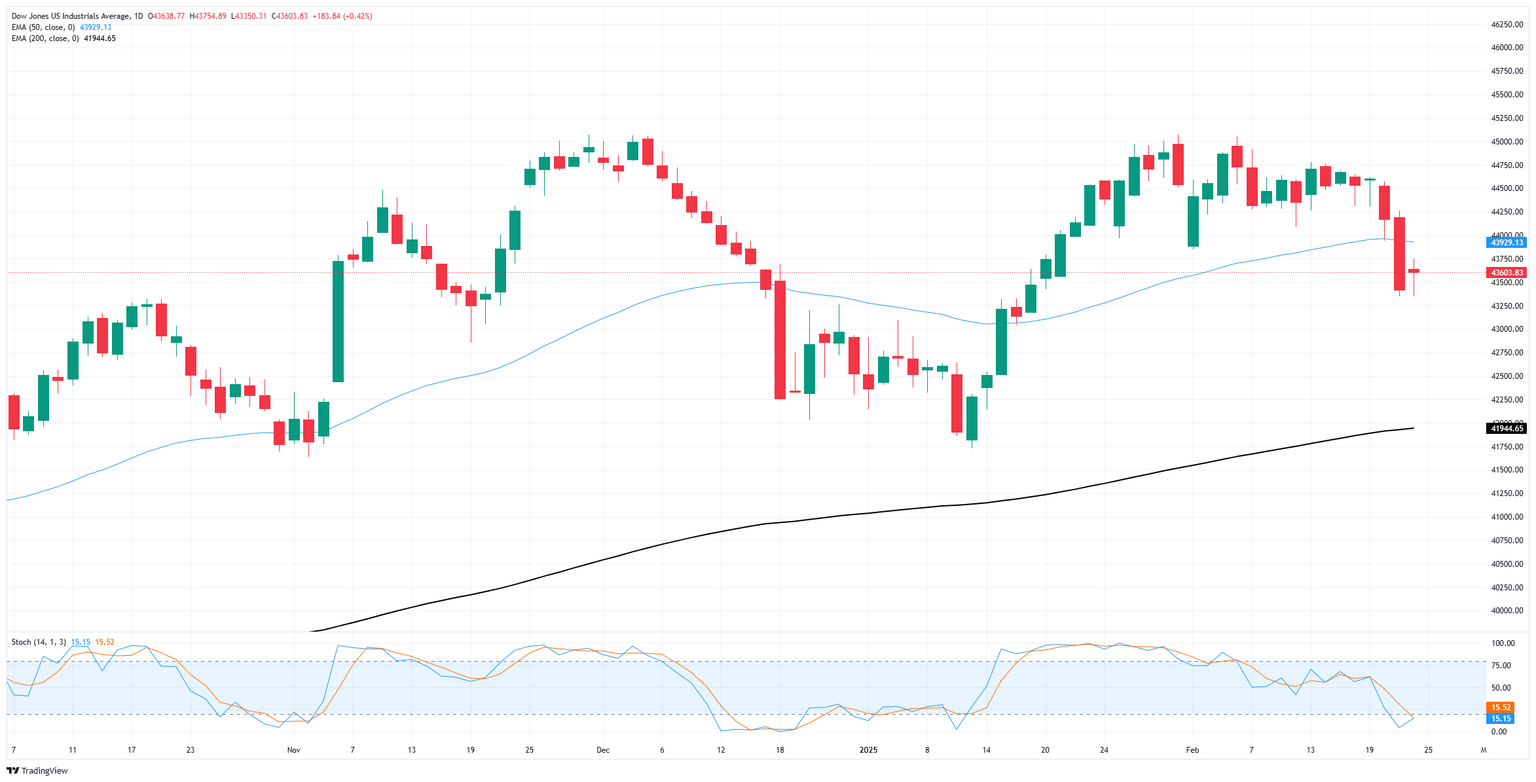

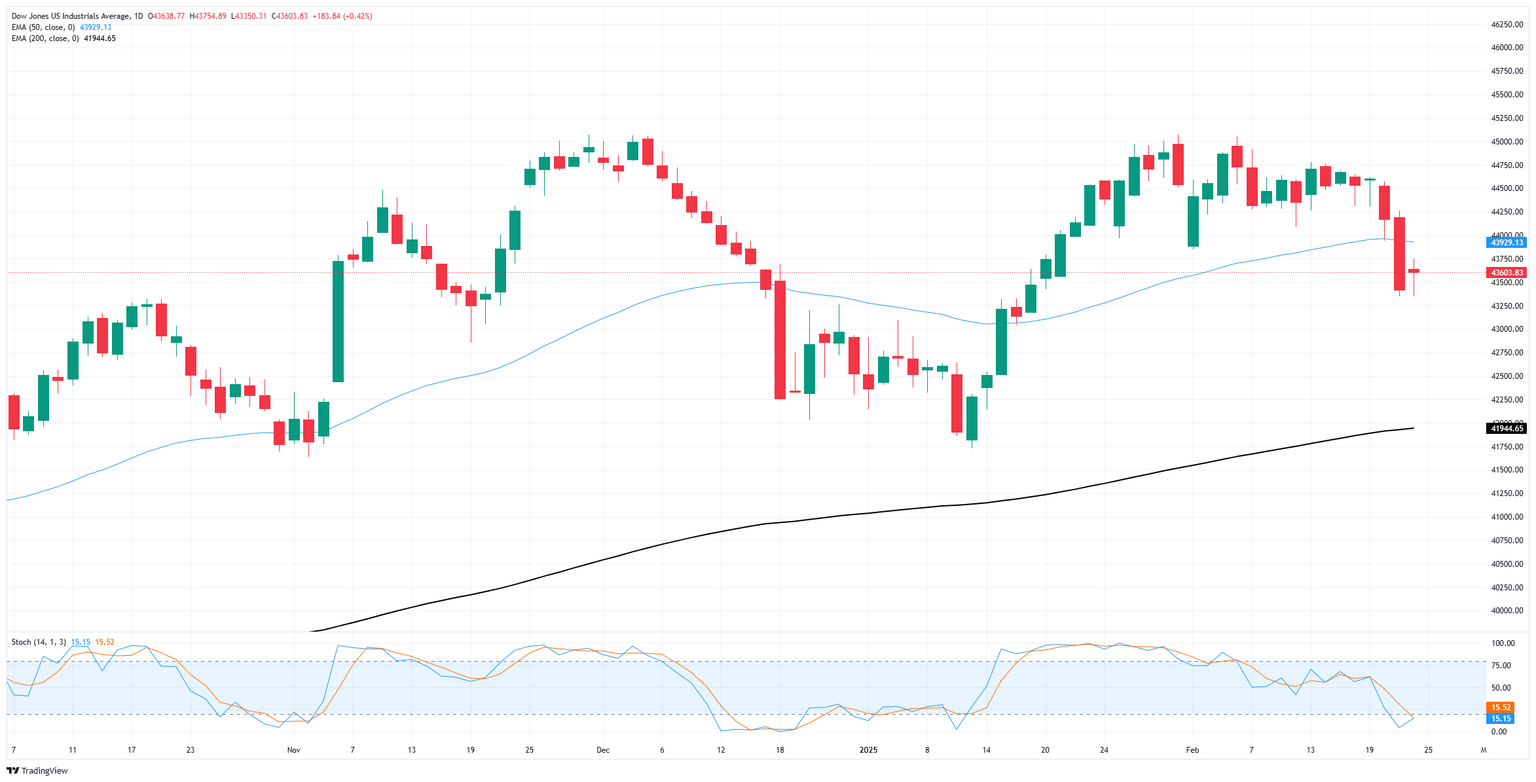

The Dow Jones may be recovering from last week’s last-minute bearish plunge, but the major equity index is still mired in bear country. Price action is stuck on the low side of the 50-day Exponential Moving Average (EMA) near 43,930, and bidders are struggling to develop meaningful legs from their new swing low point.

The Dow Jones shed around 2.75% in a two-day losing streak that took bids from 44,575 to 43,345, but further downside losses are looking unlikely as markets claw back from four-week lows. Price action remains well-supported above the long-term 200-day EMA approaching 42,000.

Dow Jones daily chart

Economic Indicator

Core Personal Consumption Expenditures - Price Index (MoM)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The MoM figure compares the prices of goods in the reference month to the previous month.The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Feb 28, 2025 13:30

Frequency: Monthly

Consensus: 0.3%

Previous: 0.2%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.