Dow Jones Industrial Average trims losses on Tuesday

- The Dow Jones held steady on Tuesday, treading water near 42,000.

- Geopolitical market tensions eased after the US discouraged an Israeli escalation against Iran.

- Investors are now grappling with lower rate cut expectations after last week’s labor print.

The Dow Jones Industrial Average (DJIA) churned on Tuesday, digging in near the 42,000 handle as markets chew on factors pulling investor expectations in multiple directions. Investor concerns about the Israel-Iran ramp-up eased early Tuesday after the US verbally intervened in the still-broiling Middle East conflict. Risk appetite recovered footing on the news, but investor sentiment remains tepid as traders grapple with a muggier outlook on Federal Reserve (Fed) rate cuts for the rest of the year.

US President Joe Biden stepped in to directly warn Israel that a direct retaliatory attack against Iran would be unwise, helping to blow off some of the building pressure and prevent the Middle East conflict from bubbling over into into further neighboring countries. Iran launched a retaliatory strike against Israel this weekend in response to Israel’s invasion of Lebanon.

Rate markets continue to overwhelmingly bet on a single quarter-point rate cut from the Fed in November. According to the CME’s FedWatch Tool, rate markets see nearly 90% odds that the Fed will follow up September’s jumbo 50 bps rate cut with a more modest 25 bps on November 7. Markets were pushed back on hopes for a second double-cut after US labor data printed well above expectations last week. Fed officials widely telegraphed that a weakening in the US labor market would be required to push the Federal Reserve into further outsized rate trims.

Dow Jones news

A little over half of the Dow Jones’ listed stocks are in the green on Tuesday, but overall gains remain thin as higher ground is spread evenly amongst several sectors. Caterpillar (CAT) fell back 2.5% to $388 per share after China failed to announce further construction-supporting subsidies, and Travelers Companies rose 1.75% to $230 per share in a thin recovery from Monday’s -2.4% plunge.

Dow Jones price forecast

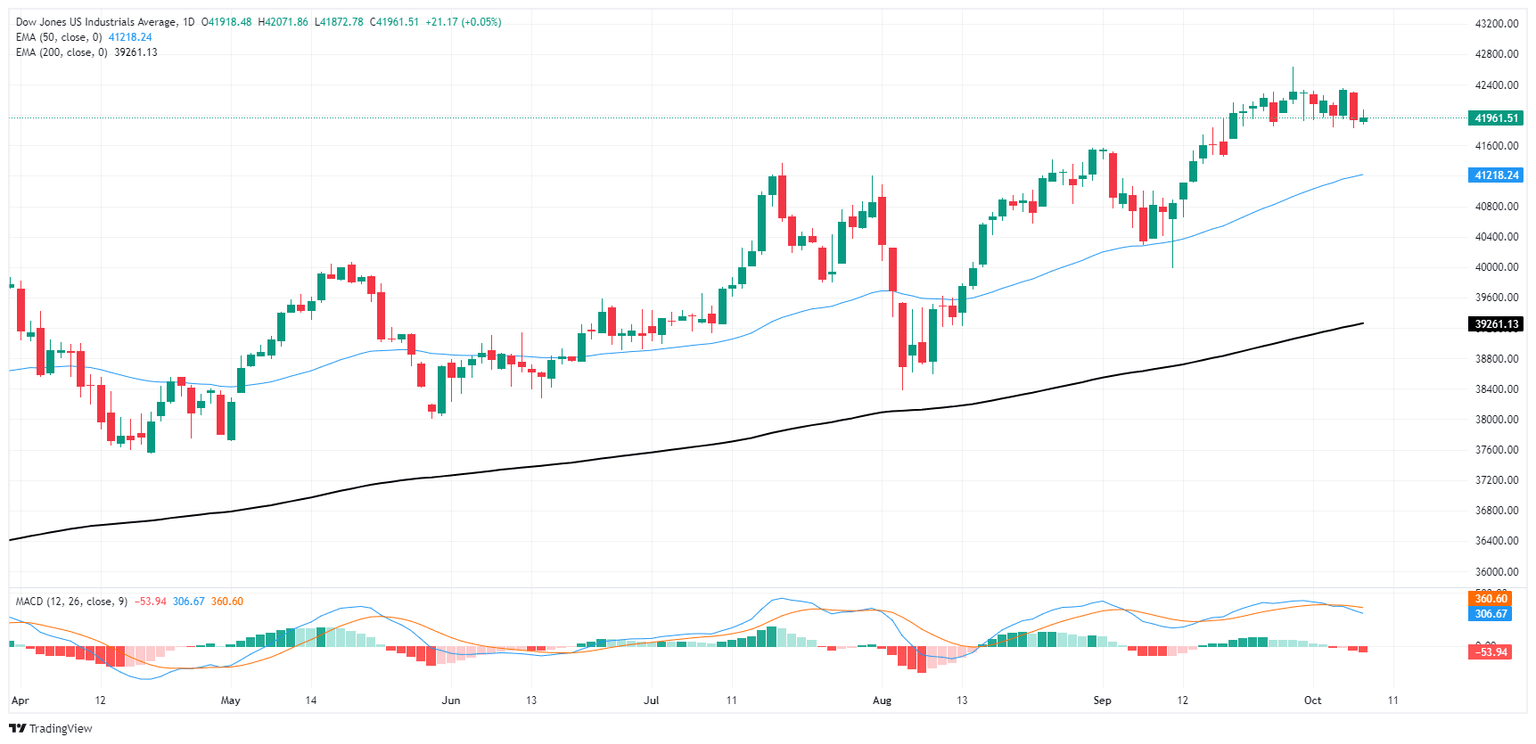

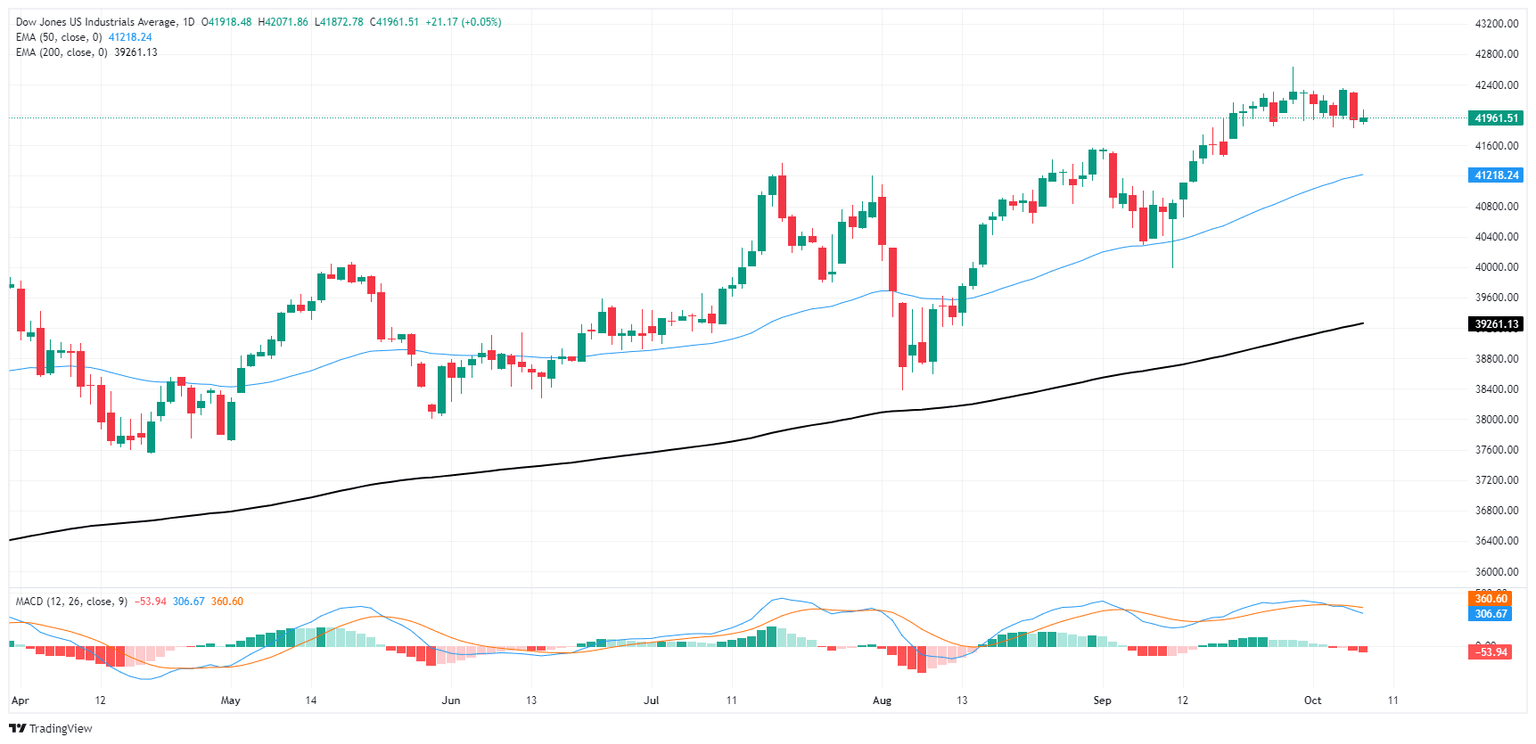

Despite a bearish start to the trading week, the Dow Jones continues to trade north of the 50-day Exponential Moving Average (EMA) near 41,220. The major equity index has bounced off of the 50-day EMA several times in recent months as a bullish uptrend holds steady.

The MACD has been flashing bearish warnings as the Dow Jones trades deep into bull country, but downside momentum remains limited as indexes continue to lean into the high end.

Dow Jones daily chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.