Dow Jones Industrial Average pares intraday losses but renewed tariff threats weigh on investors

- The Dow Jones fell on Friday, shedding 780 points at its lowest.

- Relief from tariff threats is over as the trade policy cycle begins anew.

- Markets pared back downside bets after investors remembered the odds of a tariff walkback remain high.

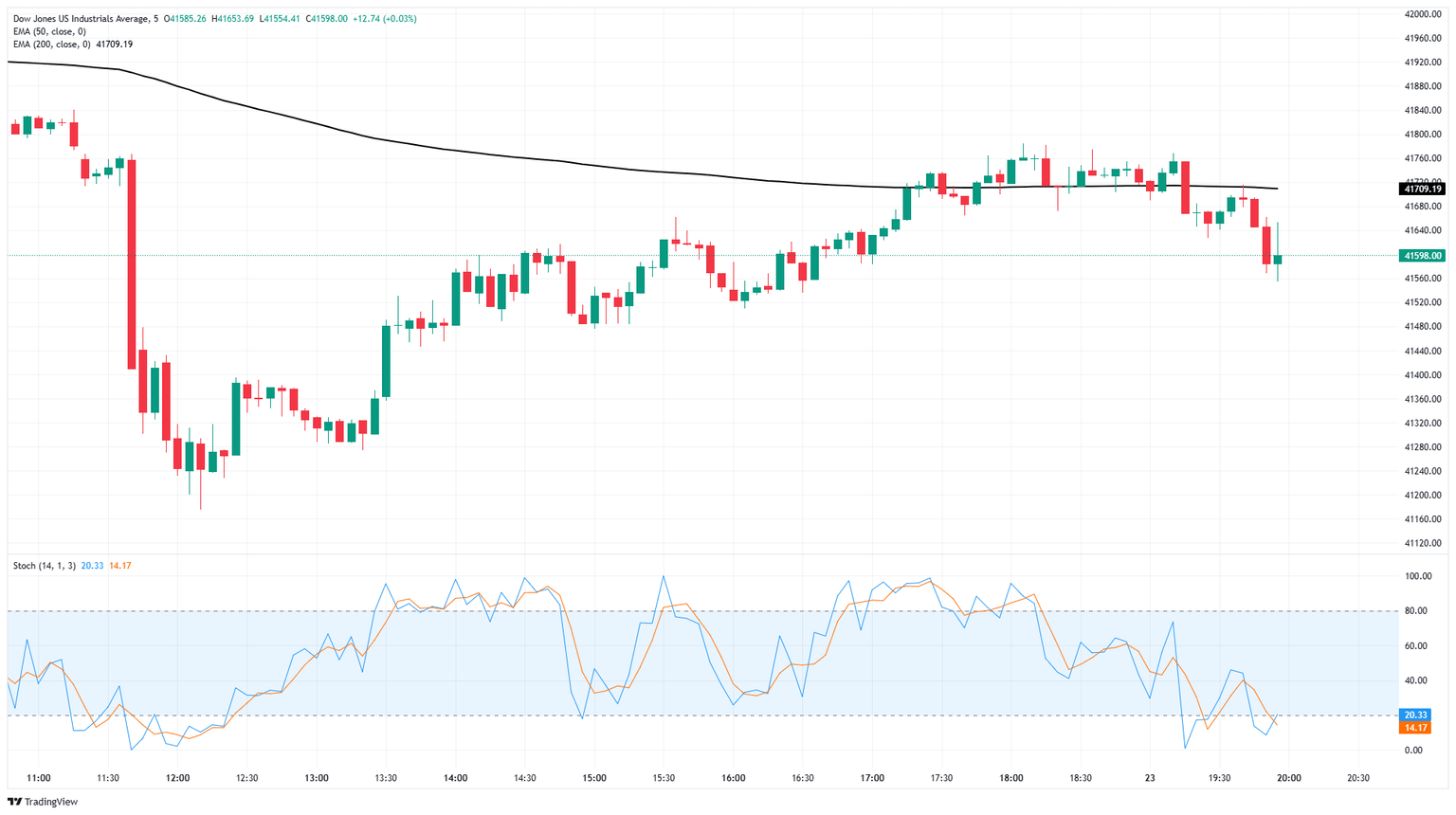

The Dow Jones Industrial Average (DJIA) saw stiff losses during the Friday market session The major equity index declined 780 points top-to-bottom and tapped 41,200 before a slow crawl back to the 41,750 region. United States (US) President Donald Trump sent markets into a backslide after announcing his intent, or at least desire, to impose import taxes on a specific company, the first time the President has targeted a single business entity for tariffs. Donald Trump followed up with a fresh threat of tariffs on European trading partners after his previous bout of walked-back tariff threats against Europe produced little in the way of results.

Trump came out of the gate swinging on Friday, declaring his belief that Apple (AAPL) products should be subject to a 25% tax, and also stating that trade talks with the European Union (EU) are “going nowhere”, and 'recommended' via social media proclamation that the US should impose an across-the-board tariff of 50% on all European goods to begin on June 1. The White House was quick to follow up on President Trump’s social media posting, stating that the President’s direct statements are not necessarily a declaration of official government intent or policy.

Tariff threats and trade ambiguity back on the menu

Policy uncertainty, rather than the tariff threats themselves, is likely the thorn in investors’ side on Friday. As noted by Paul Donovan, chief economist at UBS Global Wealth Management:

“Given the number of times Trump has retreated on these sort of threats, markets are likely to place only a limited amount of weight on this stance; but it is a reminder of the policy uncertainty that persists in the United States at the moment.”

Paul Donovan followed up by noting that the most recent tariff suspension by the Trump administration was only a 90-day temporary fix, and even the threat of a return to high import fees could jostle investor confidence once again. The US’s “reciprocal tariff package” that was announced on April 2 is set to come back into effect on July 1 unless trade deals with key countries are finalized before that date, a feat of diplomacy the Trump administration officials appear unable or unwilling to deliver.

Next week will be a shorter trading week with a US holiday on the cards for Monday. However, a scheduled speech from Federal Reserve (Fed) Chair Jerome Powell on Sunday could set the tone for the first half of the week’s docket before the meeting minutes from the last Fed rate call are released on Wednesday.

Read more stock news: Apple stock sinks after Trump threatens more tariffs

Dow Jones price forecast

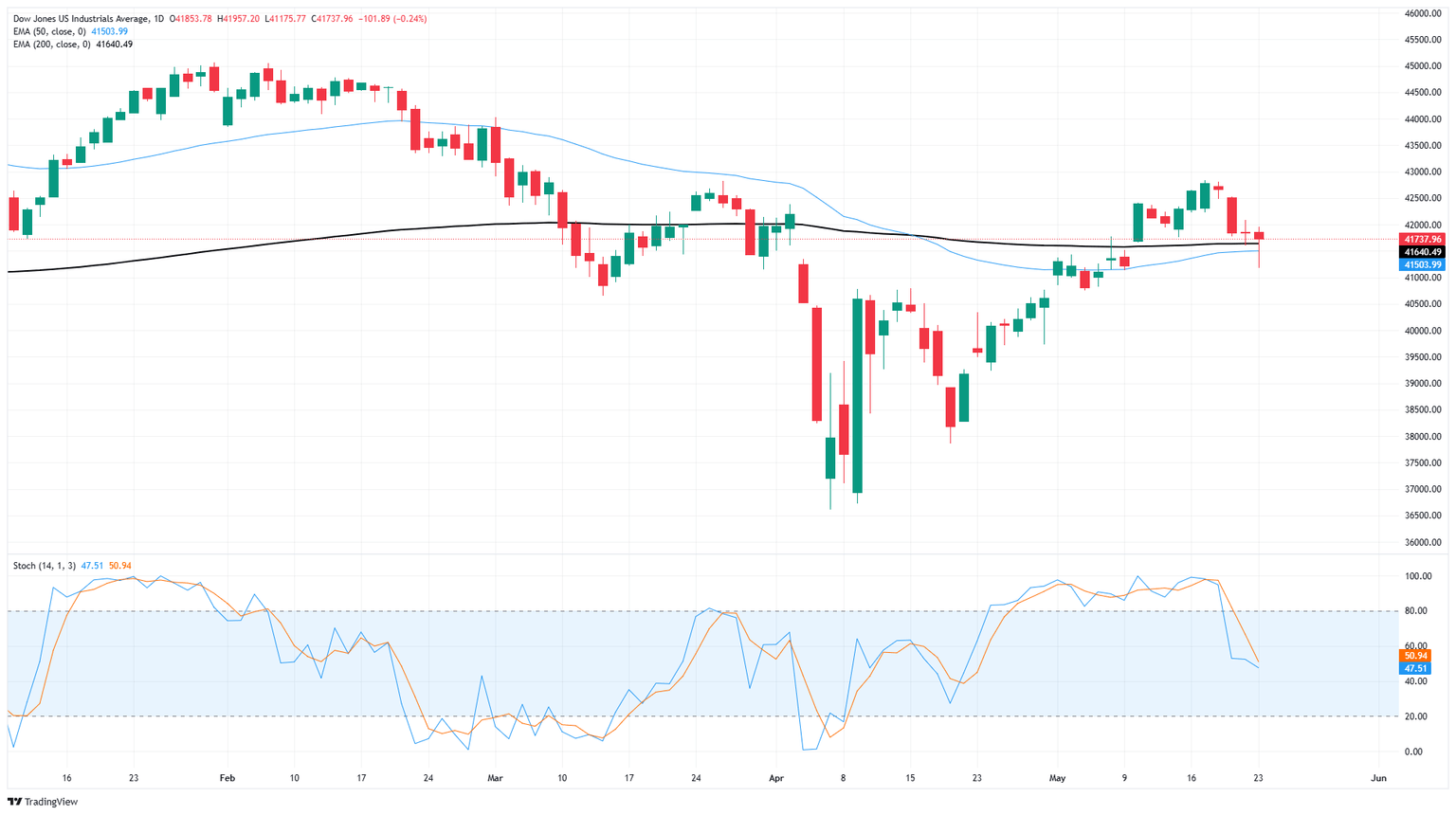

Friday’s fresh bullish plunge has pushed the Dow Jones Industrial Average back into the 200-day Exponential Moving Average (EMA) as the post-tariff suspension recovery looks set to end. The Dow Jones is in the red for not only Friday, but also the week as well as the year, down around 2% from January’s opening bids.

Dow Jones daily chart

Dow Jones 5-minute chart

Economic Indicator

Core Personal Consumption Expenditures - Price Index (YoY)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures." Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri May 30, 2025 12:30

Frequency: Monthly

Consensus: -

Previous: 2.6%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.