Apple stock sinks below $200 after Trump threatens more tariffs

- Trump grows irate at Apple's move into India.

- President claims Apple must produce US-sold iPhone in US or face a 25% tariff.

- US equity futures slip more than 1% in Friday premarket after Trump threatens the EU with a 50% tariff.

- Apple stock gives up 4% in the premarket on Friday.

Apple (AAPL) stock is back in US President Donald Trump's crosshairs on Friday as America's 47th president lambasted the Mac-maker for investing in production capacity in India rather than the United States.

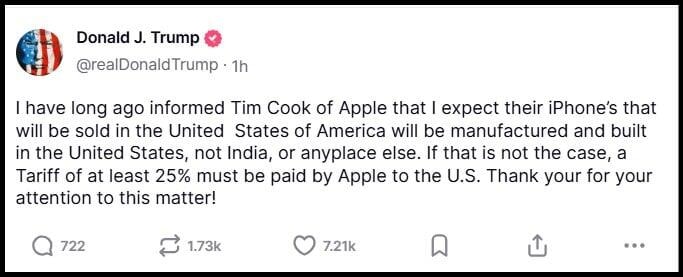

In a post on Truth Social, Trump wrote:

“I have long ago informed [CEO] Tim Cook of Apple that I expect their iPhone’s [sic] that will be sold in the United States of America will be manufactured and built in the United States, not India, or anyplace else. If that is not the case, a Tariff of at least 25% must be paid by Apple to the U.S."

Apple shares sold off some 4% in the premarket on the news. The market figured that Apple was in the clear after the company was able to garner an exemption for its iPhone last month while it moved production from China to India. The company also used private planes to import iPhones itself rather than rely on slower transportation methods.

Apple also announced $500 billion of investment in the US after Trump came into office, something that many thought would soothe Trump's temper.

Politico reported that Cook had an Oval Office meeting with Trump on Tuesday, but both the White House and the company failed to disclose what was discussed.

Trump admitted to reporters on his recent trip to the Middle East last week that he was annoyed by Apple. He told reporters that he “had a little problem with Tim Cook.”

Post from May 23, 2025 on Truth Social

But that wasn't the end of Trump's Friday morning tirade. He then singled out the European Union (EU). Claiming that the monetary union was created to take advantage of the United States, Trump posted that the EU's "Trade Barriers, Vat Taxes, ridiculous Corporate Penalties, Non-Monetary Trade Barriers, Monetary Manipulations, unfair and unjustified lawsuits against Americans Companies, and more" had led to a $235 million trade deficit with the US. In terms of trade, this figure is quite small, and Trump surely meant "billion" instead of "million". The US trade deficit for physical goods with the EU in 2024 was $235.6 billion, according to the Office of the United States Trade Representative.

Trump then said he would be "recommending" a 50% tariff on the EU starting June 1, nine days from now.

Apple stock forecast

Apple stock is now trading beneath the $196 support level that stems from resistance and support during the June to August stretch of 2024. The nearest bit of support comes from the May 7 low at $193.25.

Other levels of support, owing to 2024, come in at $180 and $164. The April 8 plunge arrived in between those levels and just below $170.

AAPL trades below its 50-day and 200-day Simple Moving Averages (SMA), so another move lower is definitely at better than even odds. Dow, S&P 500 and NASDAQ futures are all down between 1.1% and 1.7% in the premarket at the time of writing, so expect bearish sentiment to lead to intraday lows below Apple's premarket levels.

AAPL daily stock chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.