Dow Jones Industrial Average falls after CPI inflation ticks up in June

- The Dow Jones fell on Tuesday, but still remains within recent consolidation.

- Equities backslid after US CPI inflation came in hotter in June, stoking Fed rate concerns.

- Large bank earnings also came in mixed or lower, forcing investor sentiment slightly lower.

The Dow Jones Industrial Average (DJIA) fumbled on Tuesday, losing enough ground to knock the megacap index back below the previous week’s close, but still holding onto near-term consolidation levels. US Consumer Price Index (CPI) inflation showed price pressures are still on the wrong side of Federal Reserve (Fed) targets, knocking investor hopes for a summer rate cut even further back.

Inflation: Back on the menu?

US CPI inflation rose through the tail end of the second quarter. Despite the figures mostly keeping in line with or beating median forecasts, investors are still feeling the pressure from rising price pressures. Annualized headline CPI inflation rose to 2.7% YoY in June, moving in the opposite direction of the Fed policy target range of 2%. With inflation pressures still simmering away in the background, already-thin market hopes for an early rate cut from the Fed have evaporated.

According to the CME’s FedWatch Tool, rate traders have fully priced in a rate hold at the Fed’s July rate meeting. Hopes for a September rate cut also got knocked back post-CPI, with 44% odds of a continued hold on rates on the books. Rate markets are still holding out for two cuts in 2025 despite still-warm inflation measures, with 80% odds of at least a quarter-point rate cut priced in for October.

Tech stocks continue to paper over possible equity market cracks

Elsewhere in the markets, tech rally fans caught an updraft after Nvidia (NVDA) CEO Jensen Huang announced that the Trump administration would grant Nvidia a reprieve from tech restrictions on China, allowing the silicon-punching megagiant to resume selling AI-focused chipsets into the Chinese market. The announcement may come with strings attached, however: the Trump team is gearing up for a large-scale announcement at the end of the month to declare their plans to ensure continued US dominance in the AI tech space. With the Trump administration’s habit of whipsawing on new and old regulations, exemptions, and restrictions alike, there could easily be material changes to Nvidia’s foreign market access long before exports of highly profitable hardware can resume.

Still, things are looking good for Nvidia; the chipstack manufacturer is the first company in history to reach a $4T market cap. Nvidia has climbed around 1,500% from its post-COVID low of $10.81 per share from October of 2022.

Banking stocks also stumbled on Tuesday. Q2 earnings reports overall beat expectations; however, declining income guidance knocked Wells Fargo (WFC) down around 4% on the day. JPMorgan Chase (JPM) also declined slightly despite beating headline earnings expectations, and asset management giant BlackRock (BLK) tumbled 6% after missing revenue forecasts entirely.

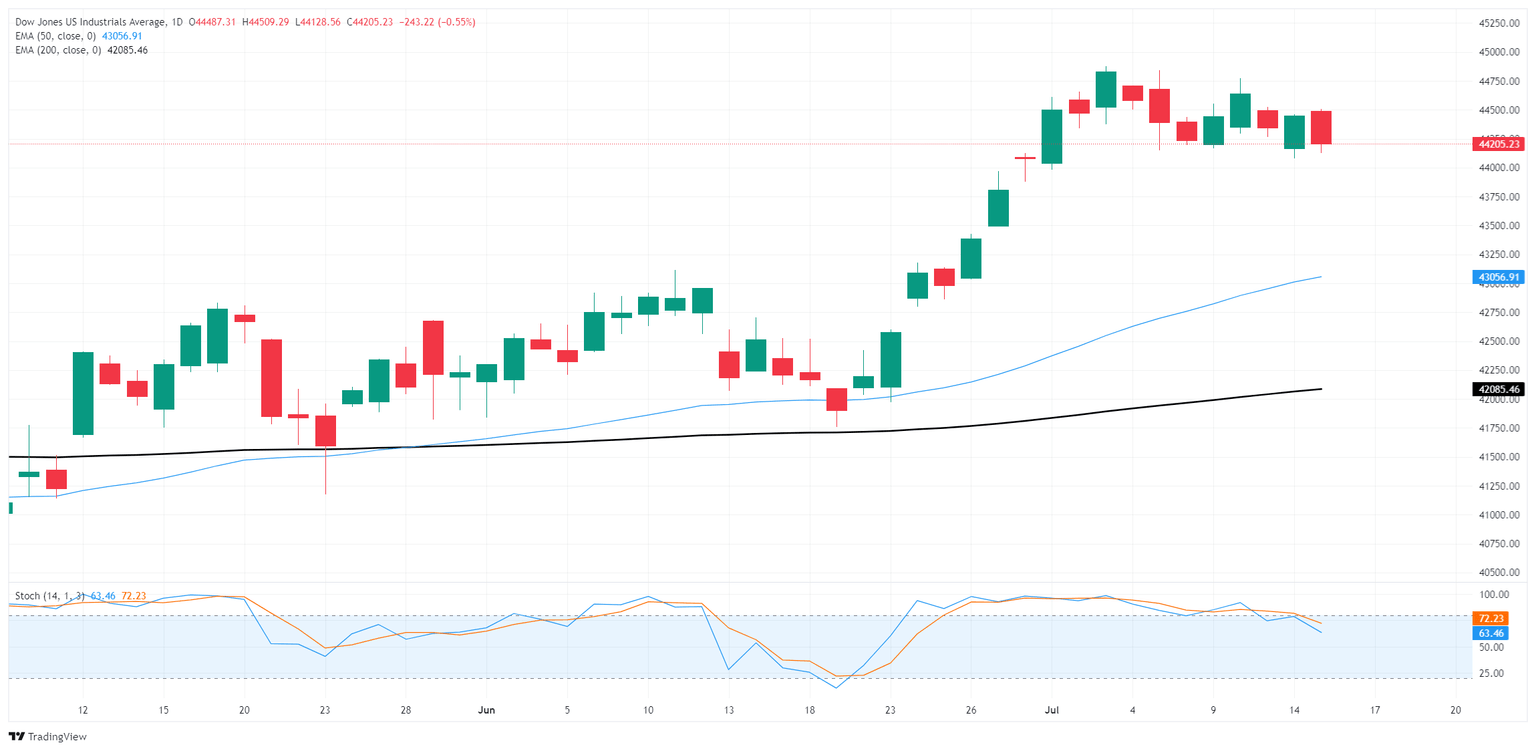

Dow Jones price forecast

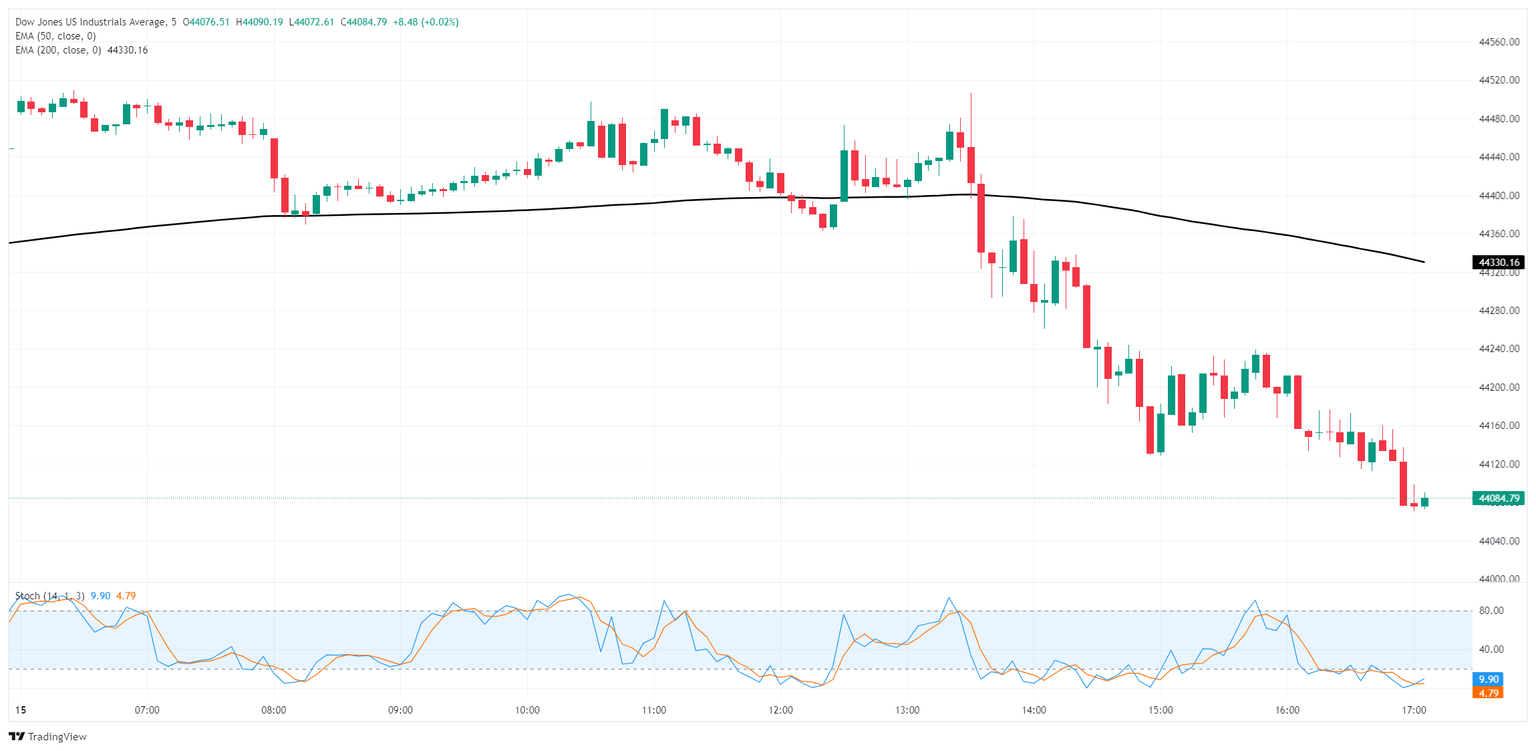

Tech gains notwithstanding, the Dow Jones is in the red on Tuesday, declining by over 0.85% from top to bottom and shedding nearly 400 points at its lowest, as bullish exhaustion gives way to a choppy consolidation phase, testing below 44,200 for the second time this week. Despite recent consolidation, the Dow is still holding firmly on the bullish side, albeit still below all-time highs north of 45,000 as the industry-heavy blue chip index underperforms its tech-biased siblings.

Dow Jones 5-minute chart

Dow Jones daily chart

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Tue Jul 15, 2025 12:30

Frequency: Monthly

Actual: 2.9%

Consensus: 3%

Previous: 2.8%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.