Dow Jones Industrial Average climbs for fourth consecutive day on rate cut bets

- The Dow Jones stepped into a fourth straight day of gains on Thursday.

- Markets are tilting into a firm risk-on stance ahead of the Thanksgiving holiday.

- Investor sentiment is hinged entirely on bets of a December Fed rate cut.

The Dow Jones Industrial Average (DJIA) gained another 300 points on Wednesday, clawing back recent losses and retesting the 47,500 level. The major equity index has stepped into its fourth consecutive day in the green as broader markets tilt into the bullish side ahead of what is now widely expected to be a third straight interest rate cut from the Federal Reserve (Fed).

After a sharp tumble from record highs, the Dow is back on the front foot, climbing 4% from the last swing low into 45,730 despite recent wobbles in the AI-led tech rally. Equities have broadly recovered losses that shook traders heading into mid-November, and high expectations for further Fed interest rate cuts are driving stocks and investor sentiment higher.

Rate cut hopes continue to drive market higher

According to the CME’s FedWatch Tool, rate traders see over 80% odds of a third straight quarter-point rate trim from the Federal Open Market Committee (FOMC) on December 10. Several key FOMC voting members pivoted into a surprisingly dovish stance over the past week, and the Fed’s overall tone on potential interest rate cuts has shifted dramatically from the overly cautious stance from the last rate meeting.

Despite a few hitches and stutters in the AI-led tech rally, equities are set to wrap up an otherwise strong week early. American Thanksgiving will see markets in low-activity mode through Thursday and Friday.

Dow Jones price forecast

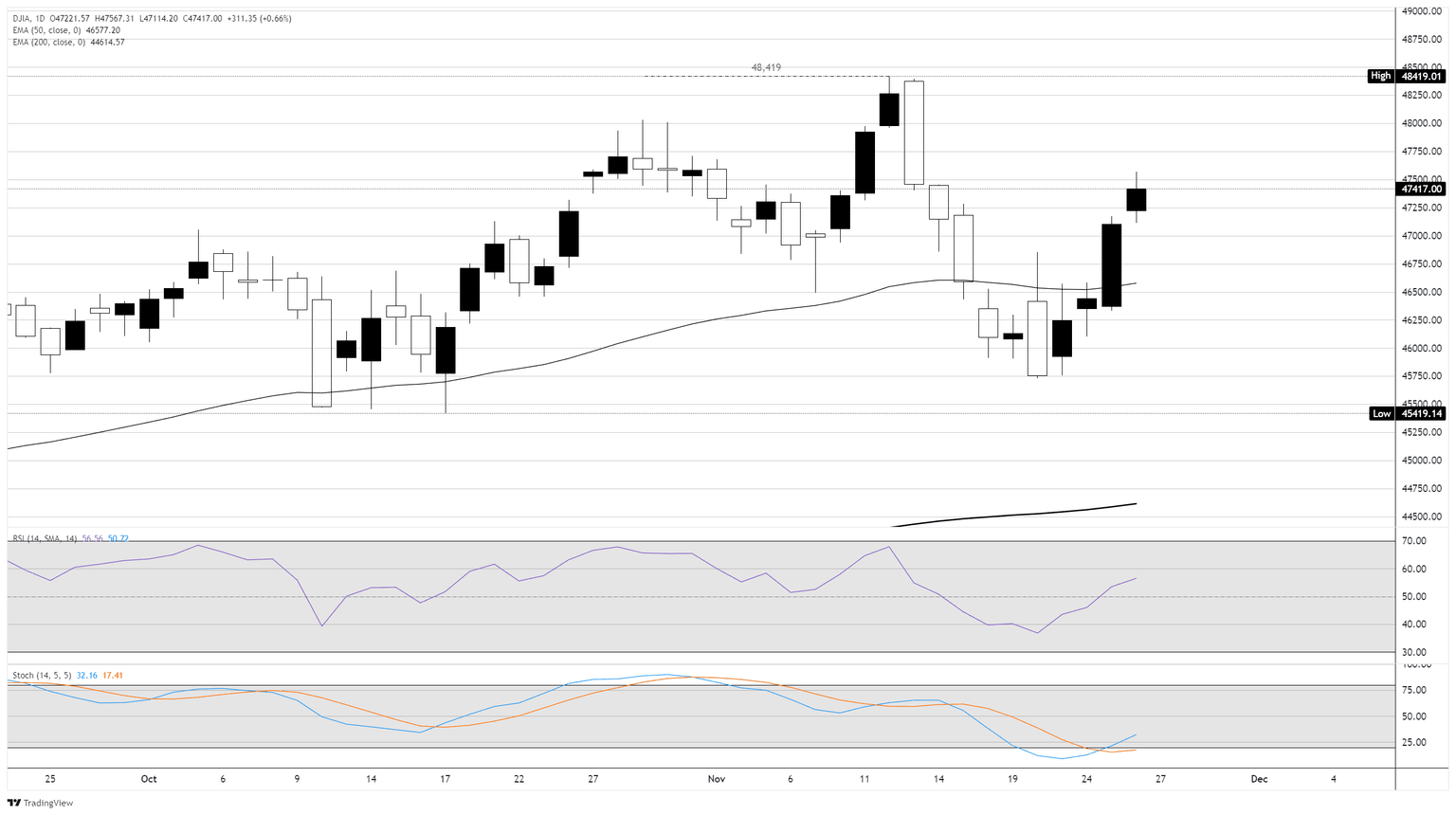

In the daily chart, the Dow is churning near the 47,500 region. Price action remains on the high side of the rising 50-day Exponential Moving Average (EMA) and well above the 200-day EMA, preserving the broader uptrend. The short-term average has turned higher again, reinforcing near-term bidding momentum. The Relative Strength Index (RSI) at 57.63 holds above the midline, confirming improving momentum.

The Stochastic slow oscillator (14,5,5) is turning up from oversold, indicating sellers are losing grip. Holding above the 50-day EMA would keep the focus on the trend-line barrier; a decisive break could extend the advance, while failure there would leave the index vulnerable to a pullback toward the 200-day EMA.

Dow Jones daily chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.