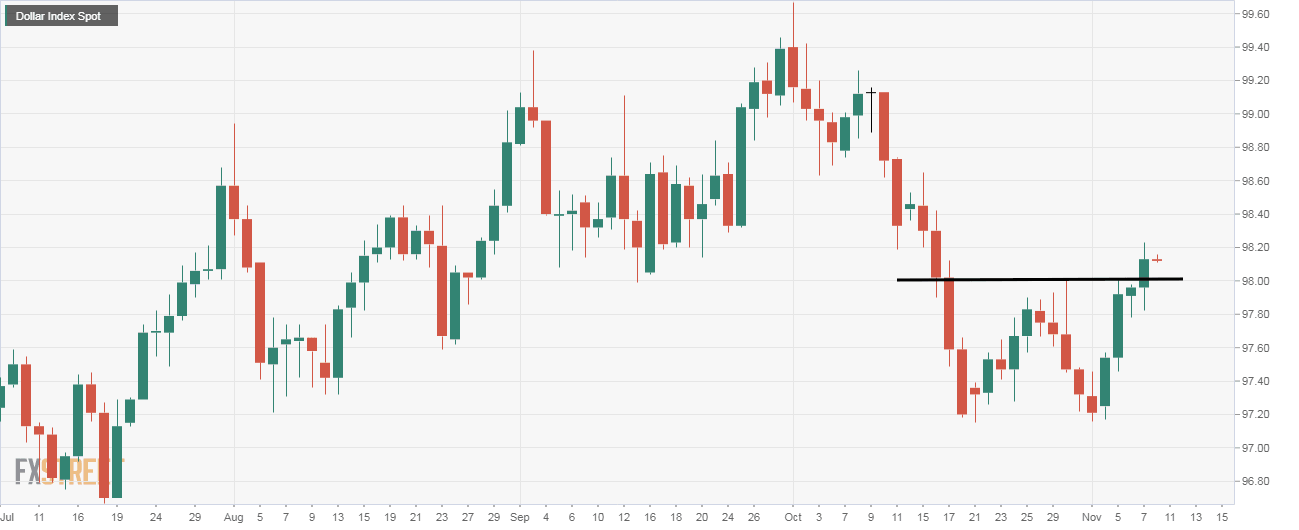

Dollar Index technical analysis: Double bottom breakout

- Dollar Index's daily chart is reporting a double bottom breakout.

- The pattern has created a room for a rally to 98.86.

Dollar Index, which tracks the value of the greenback against majors, closed 0.18% higher on the day at 98.13, confirming a double bottom breakout on the daily chart.

The pattern indicates the sell-off from the Oct. 1 high of 99.67 has ended and the bulls have regained control. The breakout has opened doors for 98.86 (target as per the measured move method).

Treasury yields are rising and could continue to boost demand for the US Dollar. The US 10-year yield rose to 1.97% on Thursday to clock the highest level in over three months.

The bullish case would be invalidated if the index finds acceptance below the former resistance-turned-support of the double top neckline at 98.00.

Currently, the Dollar Index is trading at 98.12.

Daily chart

Trend: Bullish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.