Didi Share Price: DiDi Global Inc extends decline with no end in sight

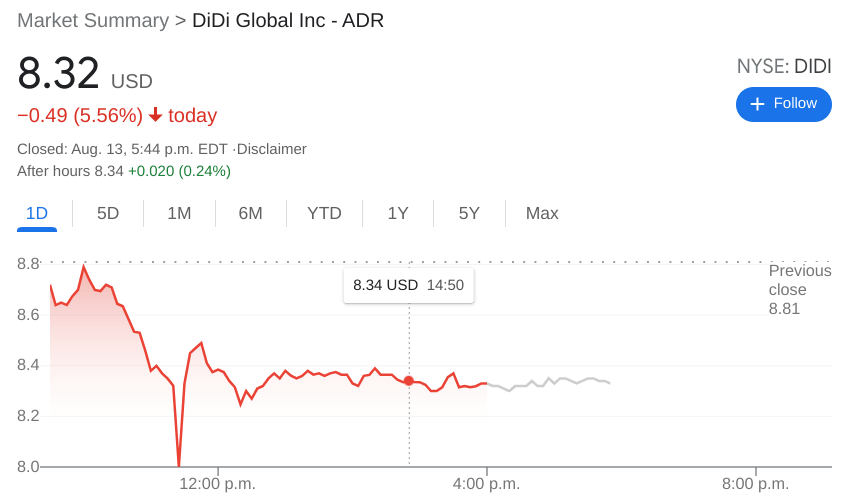

- NYSE:DIDI fell a further 5.56% to close out another tumultuous week.

- Chinese stocks sell off once again as sector weakness continues into the weekend.

- A major U.S. investor initiates a position in Didi after dumping UBER.

NYSE:DIDI continued its downward slide on Friday, and there doesn’t appear to be any end in sight for the beleaguered ride-hailing giant from China. Just when investors think the stock can’t drop anymore, Didi fell a further 5.56% on Friday to close out yet another red week for the recently public stock. The fall lagged the broader markets which saw a relatively flat day to end the week, despite all three major indices finishing in the green with the S&P 500 once again eking out new all-time highs at the close.

Didi wasn’t the only Chinese stock in the red on Friday as China-based companies sold off once again amidst ongoing investigations and cybersecurity probes. AliBaba (NYSE:BABA) fell 1.60%, JD.com (NASDAQ:JD) dipped by 0.95%, and Baidu (NASDAQ:BIDU) continued its decline from Thursday and dropped by a further 4.50%. Will there be an end to the carnage for Chinese ADRs? Next week tech conglomerate Tencent (TCEHY) will report its second quarter earnings, and the week after that PinDuoDuo (NASDAQ:PDD) will as well. It's difficult to see an end to the bearish sentiment for at least as long as the investigation into Didi continues.

NYSE:DIDI News

At least one investor may be seeing a bottom for shares of Didi, as George Soros reportedly initiated a $2.72 million sponsored ADSs of the company. The move comes after Soros’ fund dissolved its position in Didi’s rival Uber (NYSE:UBER). It’s the first sign of any institutional investors showing bullishness towards Didi since the cybersecurity probe into the company began.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet