Crude Oil Futures: Extra gains on the cards

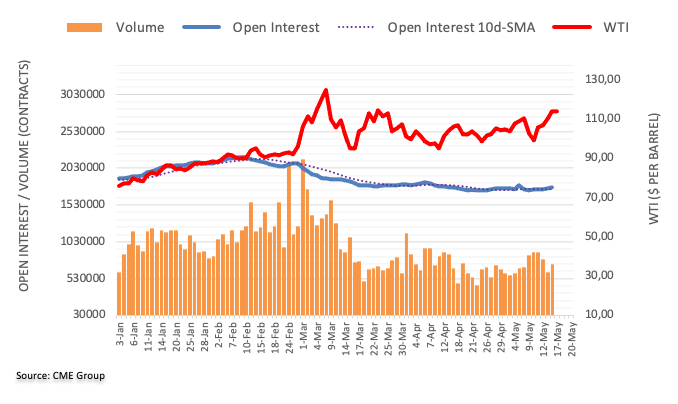

CME Group’s flash data for crude oil futures markets noted traders added around 14.6K contracts to their open interest positions on Monday, reaching the fifth consecutive daily pullback. Volume followed suit and went up by around 114.4K contracts, reversing three daily drops in a row.

WTI: Next on the upside comes $116.60

Prices of the WTI added to the ongoing leg higher on Monday. The move was in tandem with rising open interest and volume and opened the door to the continuation of the uptrend in the very near term. Against that, the next target of note comes at the March 24 high at $116.61.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.