Consumer discretionary ETF $XLY blue box area offers a buying opportunity

In today’s article, we’ll examine the recent performance of Consumer Discretionary ETF ($XLY) through the lens of Elliott Wave Theory. We’ll review how the rally from the August 065 2024, low unfolded as a 5-wave impulse and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock.

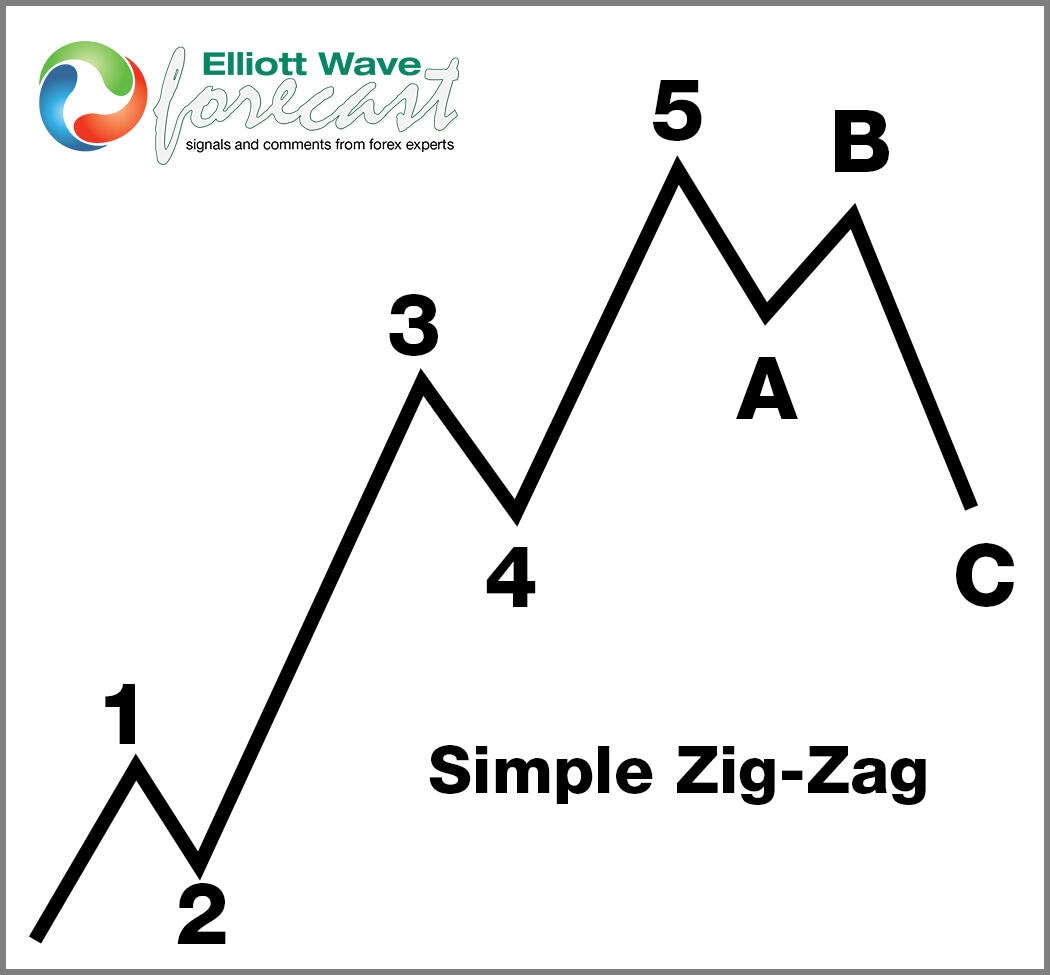

5 Wave Impulse Structure + ABC correction

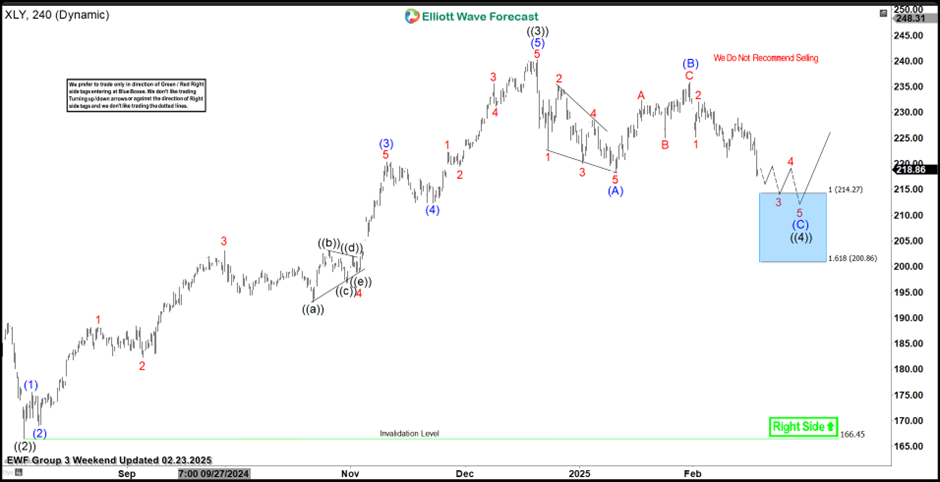

$XLY four-hour Elliott Wave chart 2.23.2025

In the 4H Elliott Wave count from February 23, 2025, we see that $XLY completed a 5-wave impulsive cycle beginning on August 05, 2024, and ending on December 18, 2024, at the black ((3)). As expected, this initial wave prompted a pullback. We anticipated this pullback to unfold in 3 swings first, likely finding buyers in the equal legs area between $214.27 and $200.86.

This setup aligns with a typical Elliott Wave correction pattern (ABC), where the market pauses briefly before resuming the main trend.

$XLY four-hour Elliott Wave chart 3.02.2025

The most recent update, from March 02, 2024, shows that the ETF traded lower as predicted. After the decline from the December peak, the ETF is finding support in the equal legs area, looking for a low.

What’s next for $XLY?

With the current price action, the ETF appears to be positioned for a bounce. Based on the Elliott Wave structure, we expect the ETF to find a low soon and trade higher, targeting the $226 – $229 range before another potential pullback. Therefore, it is essential to keep monitoring this zone as we approach it.

Conclusion

In conclusion, our Elliott Wave analysis of SPDR Consumer Discretionary ETF ($XLY) suggests that it could bounce in the short term. Therefore, traders should monitor the $226 – $229 zone as the next target, keeping an eye out for any corrective pullbacks. By using Elliott Wave Theory, we can identify potential buying areas and enhance risk management in volatile markets.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com