Chinese Caixin Services PMI is the lowest since August, AUD heavy

The Chinese Caixin Services PMI data has been released as follows:

The Caixin/Markit services Purchasing Managers' Index (PMI) dropped to 51.4 in January. This was the lowest since August from 53.1 back in December.

The 50-point mark separates growth from contraction on a monthly basis.

''Activity in China's services sector in January expanded at the slowest pace in five months, as a surge in local COVID-19 cases and containment measures hit new business and consumer sentiment while employment fell, a private survey showed on Monday,'' Reuters reported.

AUD/USD update

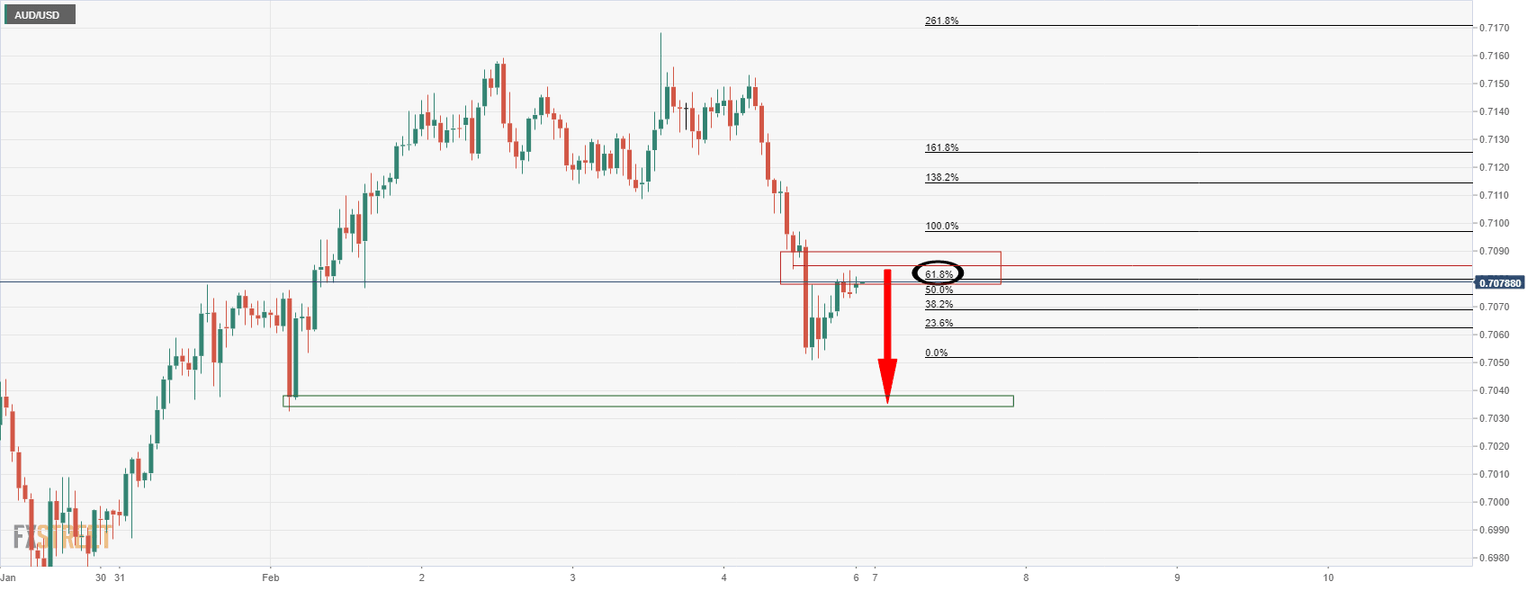

AUD/USD is slighted weighed by the drop in the Composite, but bears need to see a break of 0.7070 as per the following analysis.

Before the Chinese data, which was about the only thing going for the macro forex traders out there on Monday that could move the needle in Asia, AUD/USD was set up for a bearish extension as per the pre-market open analysis:

AUD/USD Price Analysis: Bears sink their teeth into US Nonfarm Payrolls

AUD/USD 15-min chart

Since the data release, the Aussie is being pressured by some 5 pips. A break of 0.7070 will open up the downside for a potetial continuation as illustrated above on the 15-min chart.

About the Caixin Services PM

The Caixin Services PMI™, released by Markit Economics, is based on data compiled from monthly replies to questionnaires sent to purchasing executives in over 400 private service sector companies. The panel has been carefully selected to accurately replicate the true structure of the services economy.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.