AUD/USD Price Analysis: Bears sink their teeth into US Nonfarm Payrolls

- AUD/USD bears are taking back control, seeking a bearish weekly close.

- 0.6991 is a key downside level that bears will be aiming to close below.

AUD/USD was hit hard on Friday after data showed the world's largest economy created far more jobs than expected, raising the chances of a larger Federal Reserve interest rate increase at the March policy meeting. As a consequence, the AUD reversed half the week’s gains on the data that drove a surge in yields.

The US dollar moved its way up the 95 area as measured by the DXY index, crippling the Aussie that fell 0.88% vs the greenback by the close of play. The move translated into a telegraphed price drop from the previous analysis made ahead of Friday's Nonfarm Payrolls event as follows:

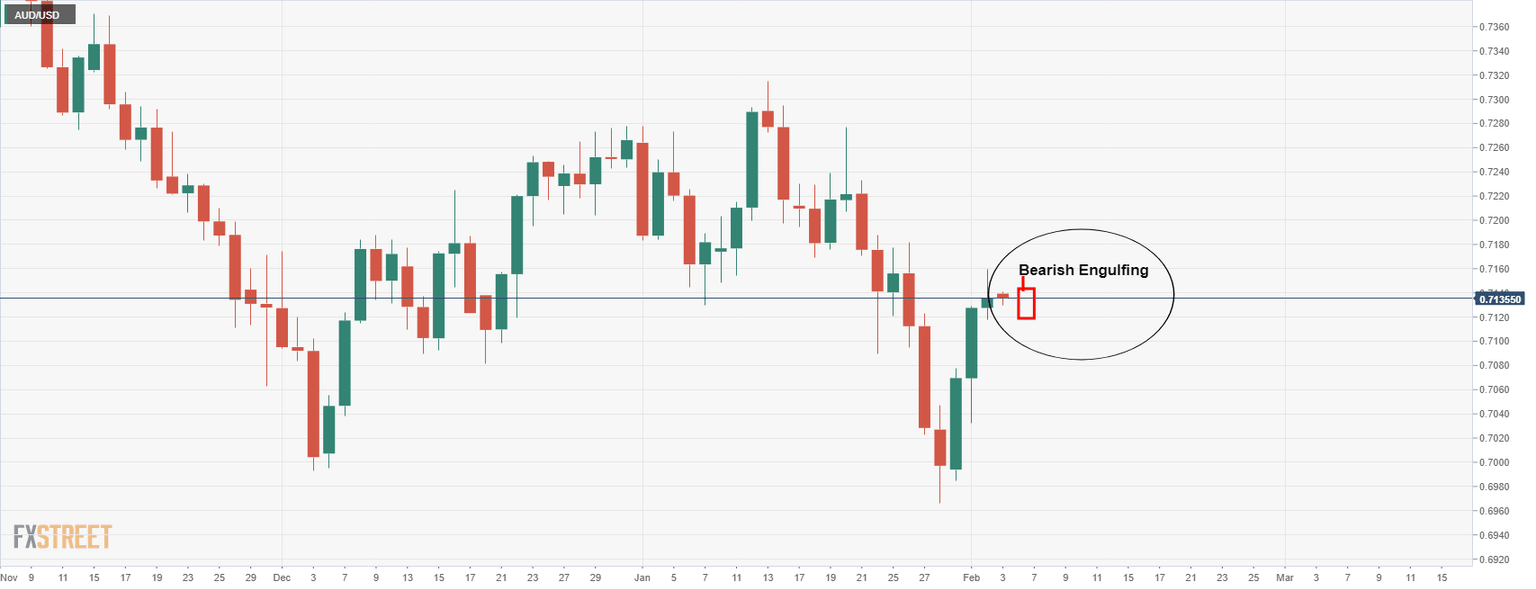

AUD/USD prior analysis

It was stated that the bears were in anticipation of a Dijo close followed by a Bearish Engulfing. While it did not come in the previous daily close, it finally came nonetheless and confirms the bearish bias for the week ahead.

AUD/USD live market, daily chart

As illustrated, the price's last two day's of business engulfed the mid-week Doji, significantly. Bar potential mitigation of the markdown and the imbalance thereof, a break of 0.7050 and then 0.7030 would be key:

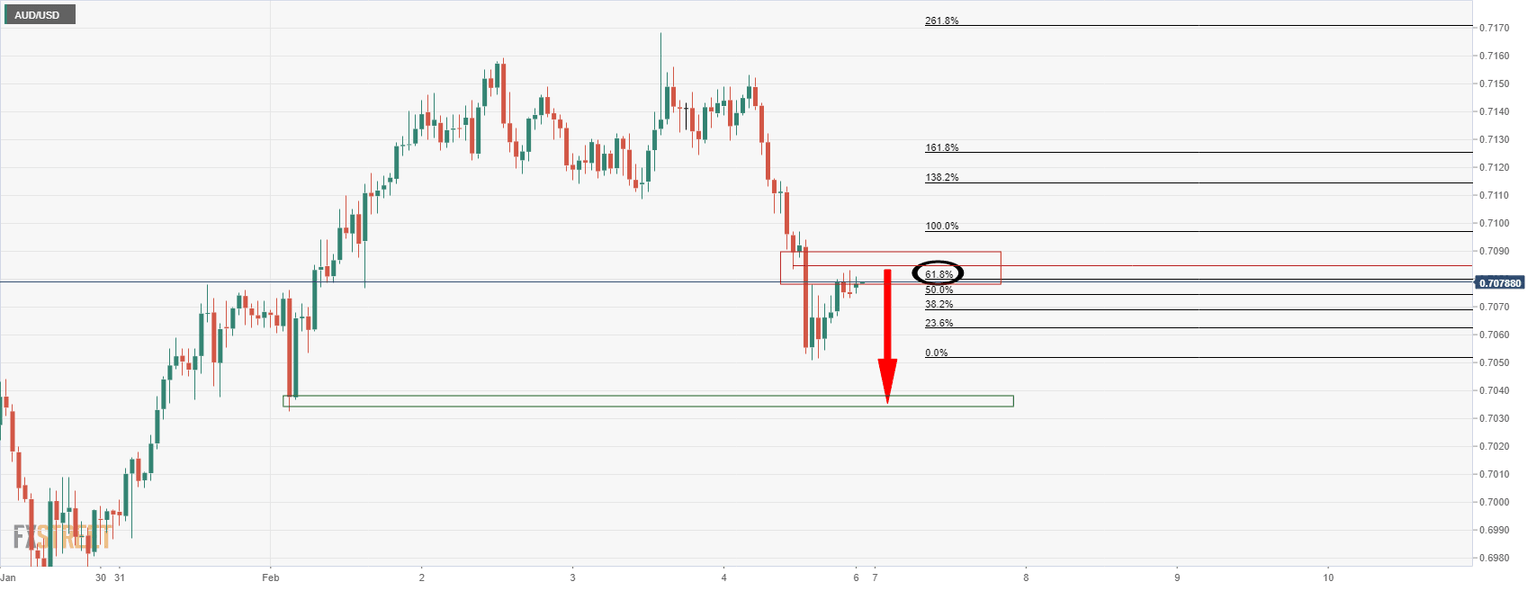

The above scenario includes a bullish open to take on bear's commitments in a 50% mean reversion of the prior two day's of bearish closes at 0.7110.

This could occur in the opening sessions as local rates market play catch up to the US Treasury yields that surged to new cyclical highs after the surprisingly strong Nonfarm Payrolls data.

AUD/USD H1 chart

For the open, the H1 chart is offering a bearish scenario as follows:

AUD/USD weekly chart

Bears are monitoring the M-formation at this juncture and the weekly close below the neckline following the restest of the area leaves a bias to the downside for the week ahead. Bears will want to break the Nov swing lows near 0.6990's confirmation that the longer-term bear trend is intact.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.