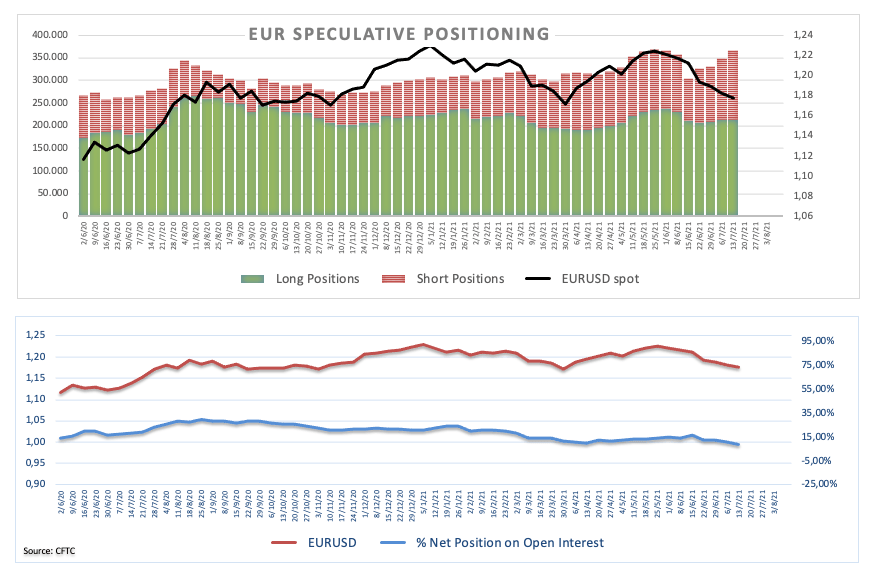

CFTC Positioning Report: EUR net longs at 16-month lows

These are the min highlights of the CFTC Positioning Report for the week ended on July 13th:

- Speculators added gross shorts to their EUR positions for the fourth consecutive week, taking the net longs to levels last seen in mid-March 2020, the onset of the coronavirus pandemic. Traders kept the outflows from the European currency running amidst the firm improvement in the sentiment around the dollar and in response to the potential impact on growth prospects of the increasing cases of the Delta variant of the coronavirus. EUR/USD, in the meantime met a tough barrier in the 1.1880/90 band during the past sessions.

- Net longs in the dollar climbed to levels last seen over a year ago, as investors continued to adjust to the latest hawkish message from the Federal Reserve. The drop of gross shorts noted some optimism in the speculative community ahead of Powell’s testimonies.

- JPY net shorts receded to 3-week lows, as concerns over the fast spread of the Delta variant remain on the rise and threatens to challenge the global growth prospects.

- Net longs in the British pound dropped to levels last recorded in late January, as doubts persist among investors regarding the imminent full re-opening of the UK economy. in addition, the cautious stance from the BoE and the perseverant demand for the greenback kept Cable under pressure in past sessions.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.