CCIV Stock Price: Lucid Motors – Churchill Capital IV rallied over 4% on US stimulus optimism

- NASDAQ:LCID gains 4% as Senate passes infrastructure bill.

- President Biden’s bill is set to benefit the EV sector.

- LCID set to pop as retail still follows it closely.

Update August 11: Lucid Motors extended its rebound into the third straight day on Tuesday, recording 4.09% gains on the day. LCID shares closed the day at $24.46, having reached two-week highs of $25.21 earlier in the session. Several factors contributed to the upsurge in the LCID stock price. The passage of the US $1 trillion infrastructure bill lifted the overall market sentiment and drove the stock price higher. Further, chatters about a massive upgrade for rival Fisker (NYSE: FSR) took speculative EV stocks higher, benefiting Lucid motors.

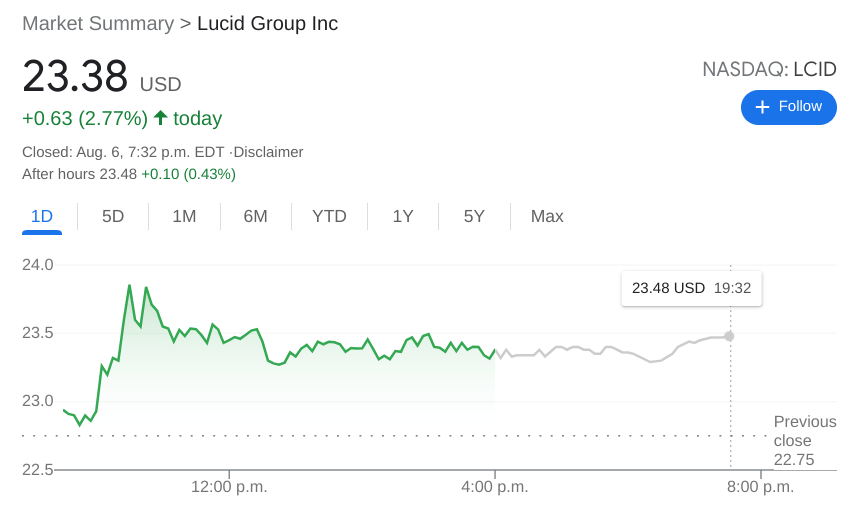

NASDAQ:LCID halted its recent losing streak by surging on Friday and outpaced the electric vehicle sector in general. Shares of LCID jumped 2.77% on Friday, and closed the week at $23.38. The stock still failed to break through the resistance area just below $24.00, and bounced back down after hitting as high as $23.91 in intraday trading. The gain is a nice surprise for Lucid shareholders, who patiently await news from the company about vehicle deliveries for later this year. The stock has traded mostly lower since completing its merger with CCIV, which has caused some investors to lose patience.

Stay up to speed with hot stocks' news!

President Biden’s bipartisan infrastructure plan has Lucid investors feeling even more bullish on the company’s future. While CEO Peter Rawlinson and Lucid were not invited to the summit, the groundwork that was laid down is definitely going to be beneficial in the future. Further government subsidies and incentives will push more consumers towards electric vehicles, and the more people buying, the more chances Lucid makes more sales. The plan also promises to improve charging infrastructure around the country, which benefits all domestic EV makers.

CCIV stock news

Lucid rival Tesla (NASDAQ:TSLA) tumbled to close the week as investors weighed in on President Biden’s White House snub. The United Auto Union was also represented at the summit, which is interesting to note as Tesla factories are non-unionized. Finally, there is an even more outlandish scenario circulating the internet that hints at CEO Elon Musk leaving Tesla altogether in the near future. While obviously that cannot be verified, it was enough to lead some investors to take their profits after Tesla’s recent bull run.

Previous updates

Update 2: Lucid Motors closed over 4% higher on Tuesday as the US Senate passed President Bidens' $1 trillion infrastructure bill. The bill will benefit many indistrial companies but eletric vehicle makers are also set to benefit as the bill paves the way for increasing adoption of electric cars. Lucid certainly has already benefited and is close to breaking back above $25.

Update: LCID shares are trading another 2% higher on Tuesday as the sector is set to receive a boost from the infrastructure plan which is due for a vote before the US Senate on Tuesday. LCID is trading at $23.96 in the firt half hour on Tuesday as investors anticipate good news from the senate.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet