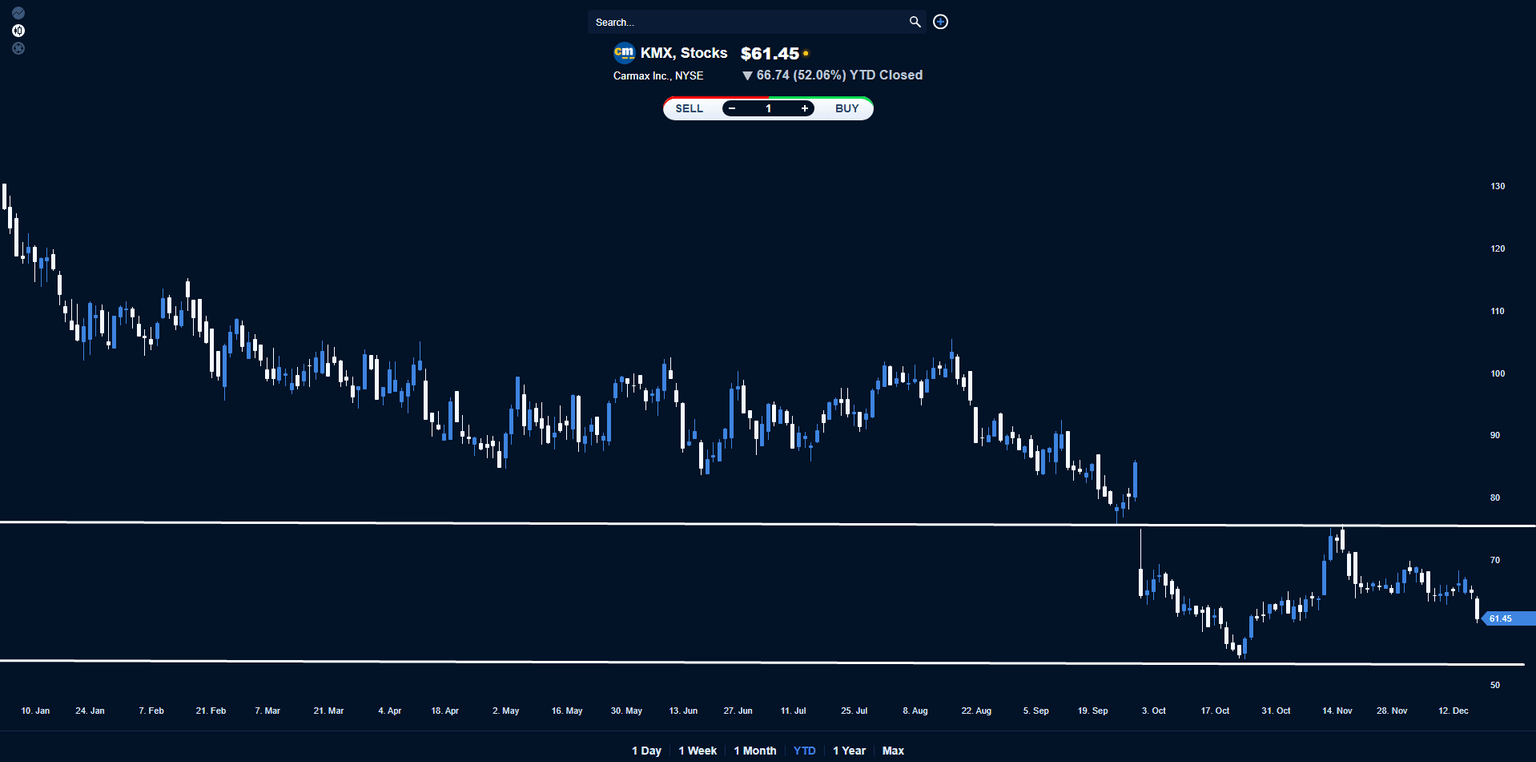

Carmax (KMX Stock) is in a downtrend

Today’s instrument is the Carmax Inc.‘s stock traded in NYSE exchange under the ticker KMX.

Looking at the KMX ‘s chart, we can see that it is in a downtrend, and it was lastly traded at around $61.45.

In the current week, it is announcing its quarterly earnings and if the market’s anticipation is negative, then we should expect it to test its support and 52W low level at around $54.85, otherwise it could test its resistance level at around $74.

Risk warning: Trading is risky. Information presented herein, is not to be constructed as a solicitation or an offer to buy or sell any Financial Instrument or to participate in any particular trading strategy. Carmax’ inc. logo and any associated brand names are Carmax’ inc. trademarks. All other trademarks are property of their respective owners.

Author

AAATrade Team

AAATrade

The AAATrade Team has extensive experience in content writing for the financial industry. Stelios Nikolaou is the lead writer of the team, he currently works at AAATrade to provide research and content writing services.