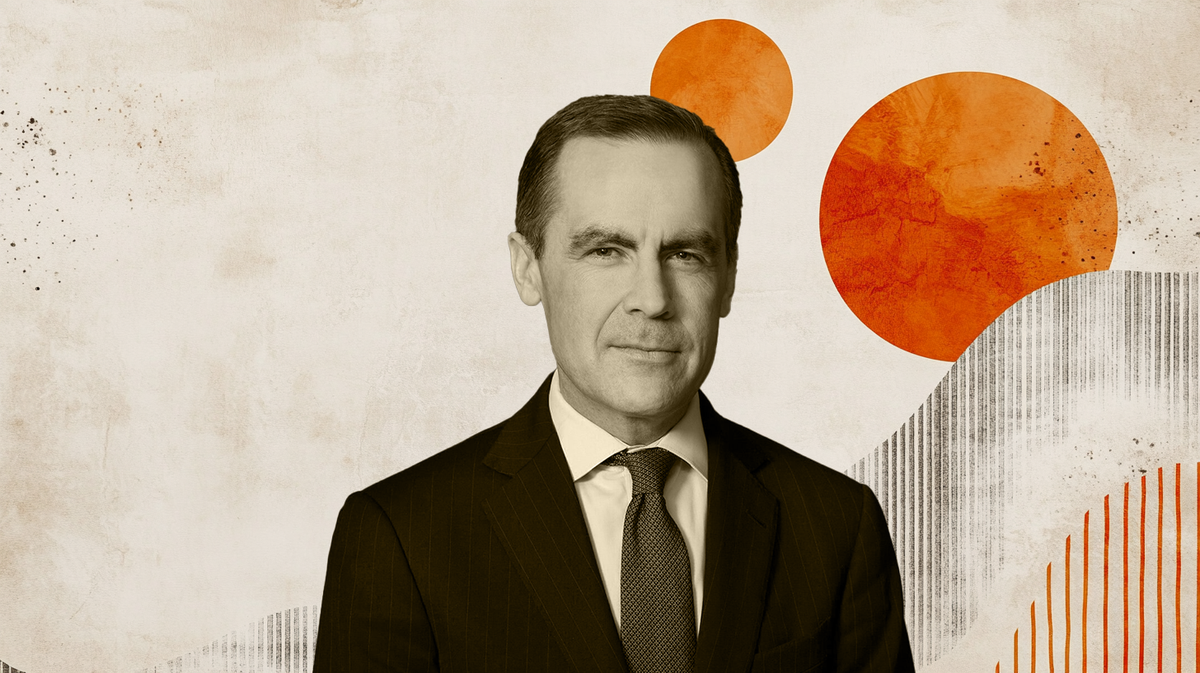

Canadian PM Carney: This is the point at which a serious conversation begins

Following a joint press conference between Canadian Prime Minister Mark Carney and United States (US) President Donald Trump, Canadian PM Carney followed up with a press conference of his own, adding some much-needed clarity to the discussions that have begun between Canada and the US about trade status between the two countries.

Key highlights

The talks were very constructive.

Trump and I agreed to have discussions in the coming weeks and we're meeting at the G7.

I was clear with Trump that Canada will never be for sale.

I think we established a good basis today.

There were no decisions on tariffs today. It’s a very complex situation.

The US and Canada both want to move forward with trade discussions.

We will see how long it takes for the tariffs to be removed.

Progress would not necessarily be evident during negotiations.

I feel better about US-Canada relations in many respects.

We have a lot more work to do, we are fully engaged.

I told Trump that Canada's measures on fentanyl are working.

I asked Trump to stop talking about the 51st state.

This is the point at which a serious discussion begins.

The lesson from this experience would be to ensure that the incentives are aligned and durably so.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.