Canadian Dollar trades steady as Loonie bidding holds firm

- The Canadian Dollar remained pinned into near-term highs on Tuesday.

- Meaningful market moves will come from outside of Canada, putting pressure on CAD traders.

- Canadian economic data is broadly missing from the docket this week.

The Canadian Dollar (CAD) kicked back into recent highs against the US Dollar (USD) on Tuesday, keeping the USD/CAD pair restrained below the 1.3700 handle. Markets are increasingly focused on trade headlines and looming US Consumer Price Index (CPI) inflation data due on Wednesday.

Canada is entirely absent from the economic data docket this week, and that trend will continue until the end of the month, when Canadian inflation figures will be printed. They are not expected to be good, but a lot can change between then and now. US-China trade talks are wrapping up through the overnight session, but market hopes for concise details are unlikely to be fulfilled.

Daily digest market movers: Canadian Dollar at the mercy of US headline and data this week

- The Canadian Dollar pushed back on Greenback gains on Tuesday, keeping USD/CAD pinned near eight-month lows below 1.3700.

- Markets are hoping that US-China trade talks will result in cooling tariff pressures and easing trade restrictions, but any firm policy changes are unlikely to come if they haven’t been announced yet.

- US CPI inflation data slated for Wednesday will be the first CPI reference period to include dates after the Trump administration’s global “reciprocal” tariffs, and investors are bracing for early price volatility impacts.

- US CPI is expected to rise on an annualized basis, and a hotter-than-expected print could push market hopes for Federal Reserve (Fed) rate cuts could get pushed even further back.

- At the current cut, rate traders are pricing in a return to Fed interest rate cuts in September.

Canadian Dollar price forecast

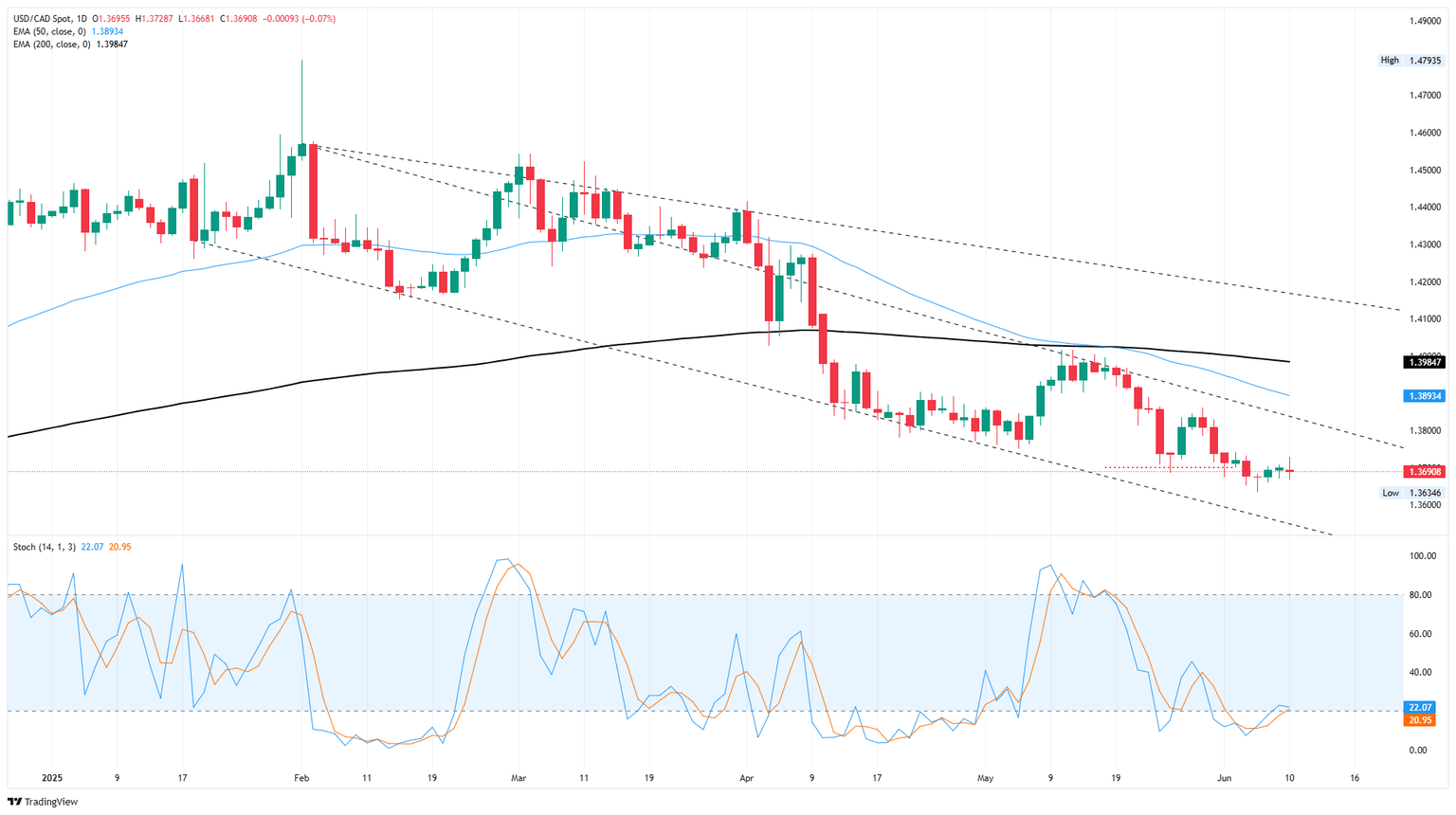

The Canadian Dollar remains steady, close to its eight-month highs against the US Dollar. The recent weakness of the US Dollar, alongside interest rate holds from the Bank of Canada, has kept the USD/CAD pair below the 1.3700 level.

There is a consistent downward trend since February’s highs. That said, technical oscillators are firmly in oversold territory. While this rebound may not be strong enough to disrupt the existing trend, it might indicate an upcoming exhaustion pullback.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.