Canadian Dollar cycles on rangebound Monday as BoC looms

Most recent article: Canadian Dollar finds room up top against floundering Greenback after US ISM PMI miss

- Canadian Dollar finds the middle as investor appetite churns.

- Bank of Canada rate call slated for the midweek.

- US NFP expectations to draw attention through the week.

The Canadian Dollar (CAD) is cycling familiar levels on Monday with markets awaiting another rate showing from the Bank of Canada (BoC) and this week’s key US Nonfarm Payrolls (NFP) report due on Friday. The BoC is expected to hold rates at 5% on Wednesday, and investors hopeful for a rate cut from the Federal Reserve (Fed) will be looking for softening economic figures from the US this week.

The data from Canada this week will be the BoC’s rate call, with Friday’s Canadian labor figures due to get eclipsed by the US NFP employment numbers. Canada’s Unemployment Rate is expected to tick higher this week, and current market forecasts call for a pullback in the US NFP print.

Daily digest market movers: Canadian Dollar mostly flat as markets hinge on rate cuts

- Quiet start to the week as markets focus on Fed rate cut odds.

- Softer US data last week leads to an uptick in June rate cut hopes.

- BoC expected to hold steady on rates on Wednesday.

- Tuesday’s US ISM Services Purchasing Managers Index (PMI) for February is forecast to tick down to 53.0 from 53.4.

- Markets will be looking for softer US data prints as investors hope a weakening US economy will boost odds of a Fed rate cut.

- CME FedWatch Tool sees over 70% odds of a Fed rate trim in June at current cut.

- Wednesday’s BoC rate call is forecast to see no moves from BoC Governor Tiff Macklem.

- The US ADP Employment Change for February is slated for Wednesday and is forecast to show an uptick is US employment to 150K for the month, up from the previous month’s 107K.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.13% | -0.24% | 0.16% | 0.28% | 0.27% | 0.17% | 0.17% | |

| EUR | 0.12% | -0.12% | 0.28% | 0.40% | 0.40% | 0.30% | 0.30% | |

| GBP | 0.24% | 0.12% | 0.39% | 0.52% | 0.52% | 0.41% | 0.42% | |

| CAD | -0.16% | -0.27% | -0.39% | 0.13% | 0.11% | 0.01% | 0.02% | |

| AUD | -0.28% | -0.41% | -0.52% | -0.13% | -0.01% | -0.10% | -0.10% | |

| JPY | -0.27% | -0.40% | -0.55% | -0.14% | -0.01% | -0.11% | -0.10% | |

| NZD | -0.17% | -0.30% | -0.41% | -0.01% | 0.11% | 0.10% | 0.00% | |

| CHF | -0.18% | -0.30% | -0.42% | -0.02% | 0.10% | 0.10% | -0.01% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: Canadian Dollar shifts to flat side as market eyes drift

The Canadian Dollar (CAD) is mostly flat on Monday with the Loonie shedding around four-tenths a percent against the Pound Sterling (GBP) to kick off the trading week. The CAD is close to flat against the US Dollar (USD), trading within a tenth of a percent from Monday’s opening bids.

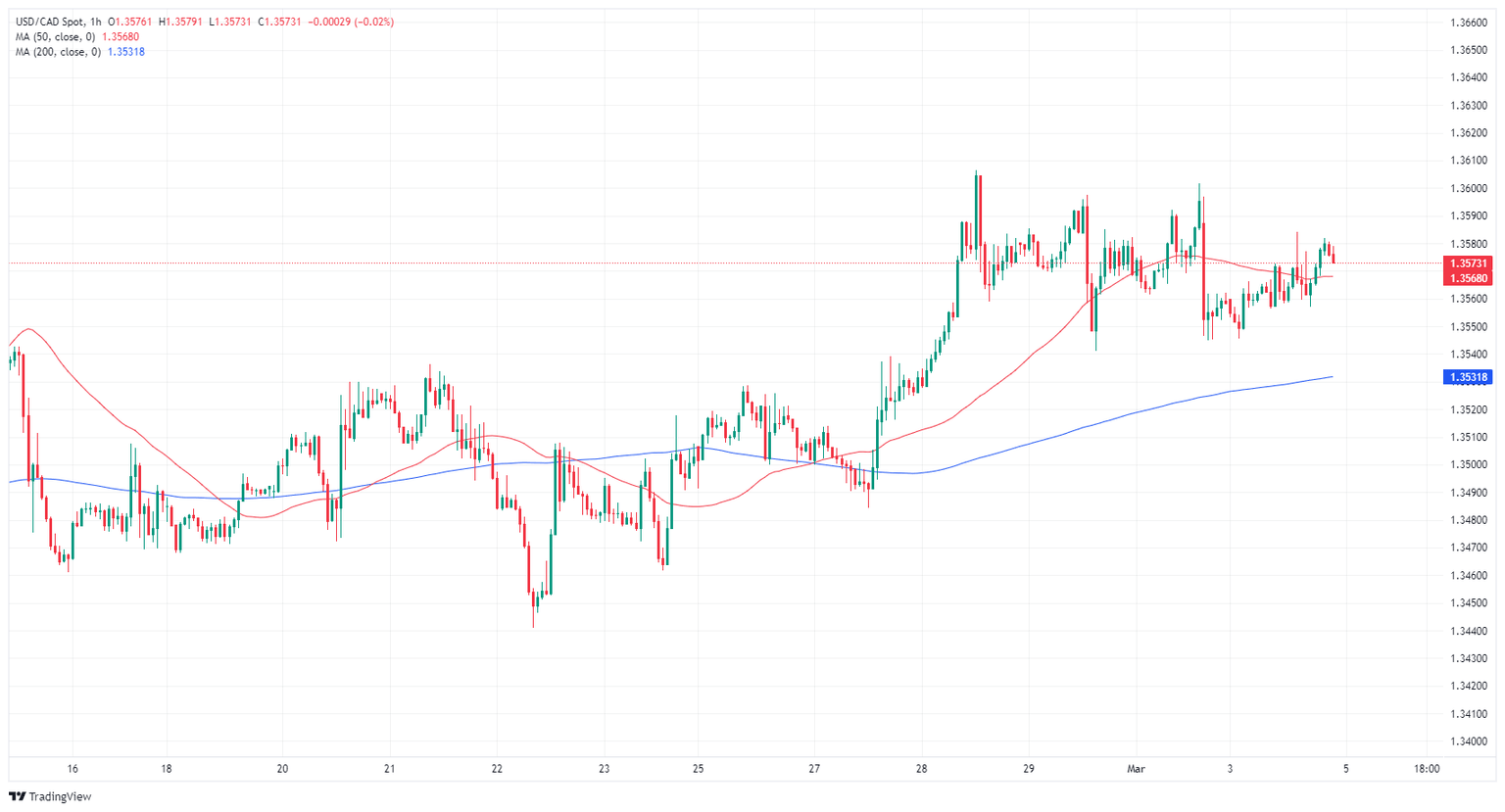

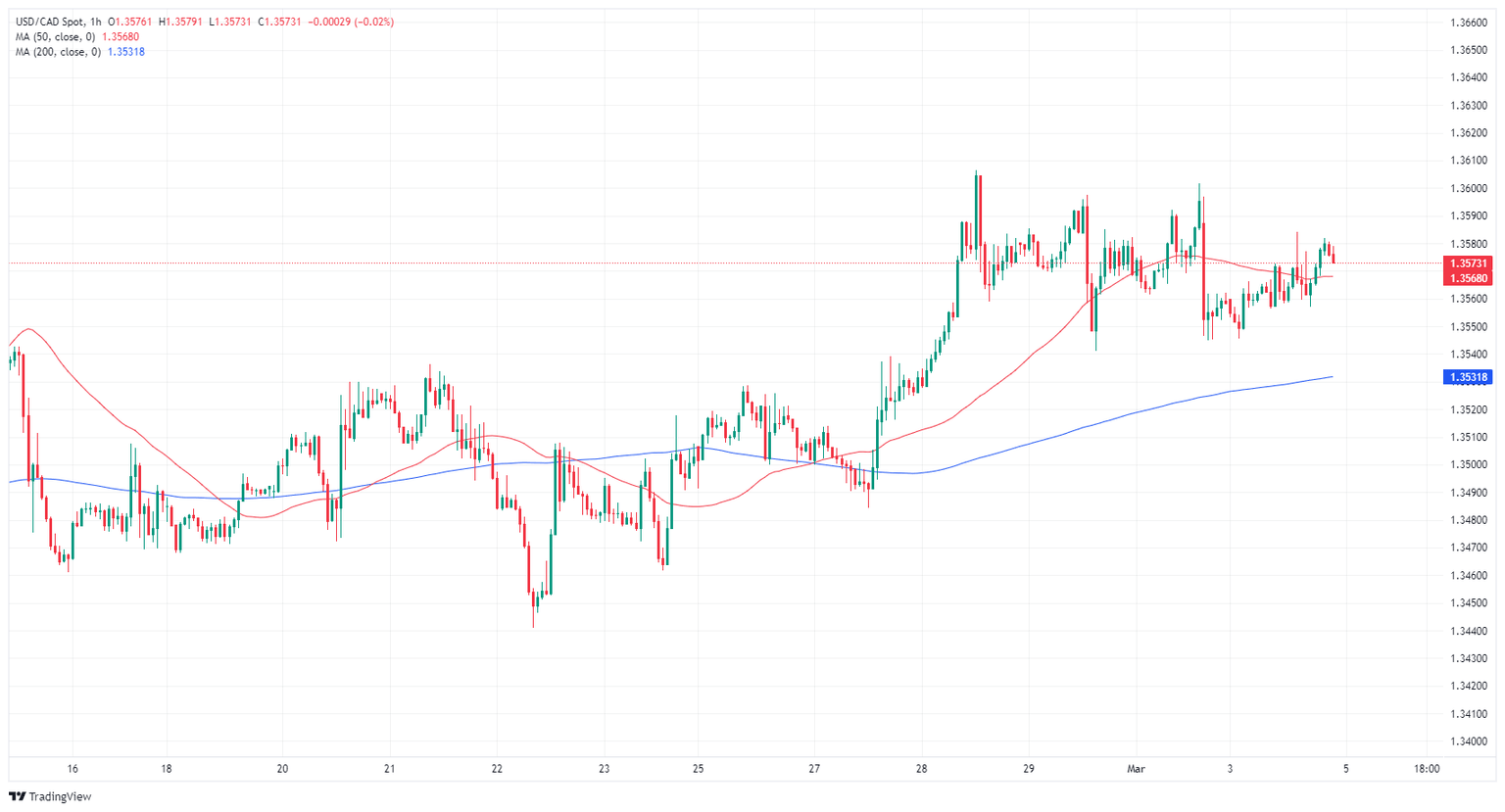

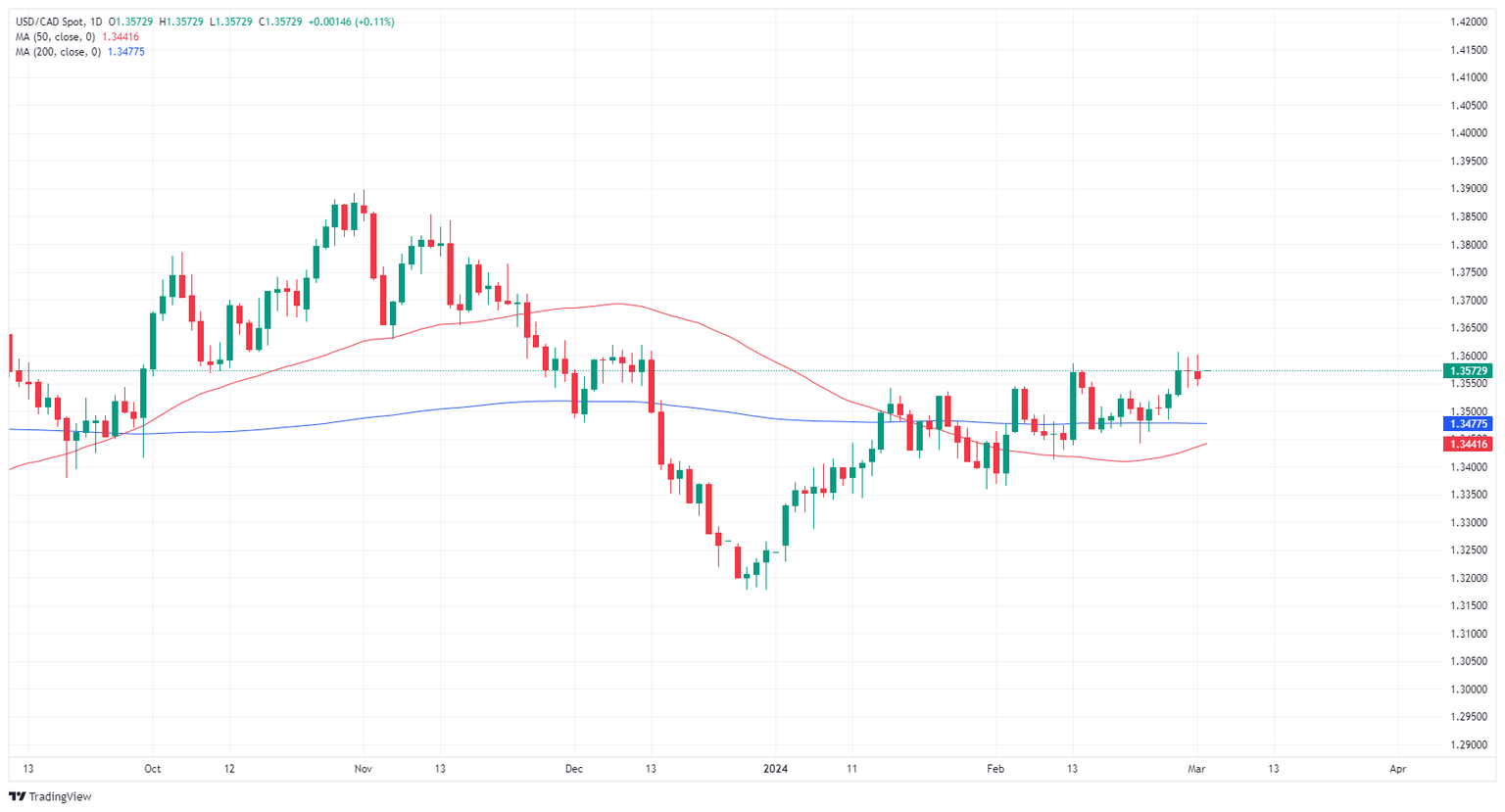

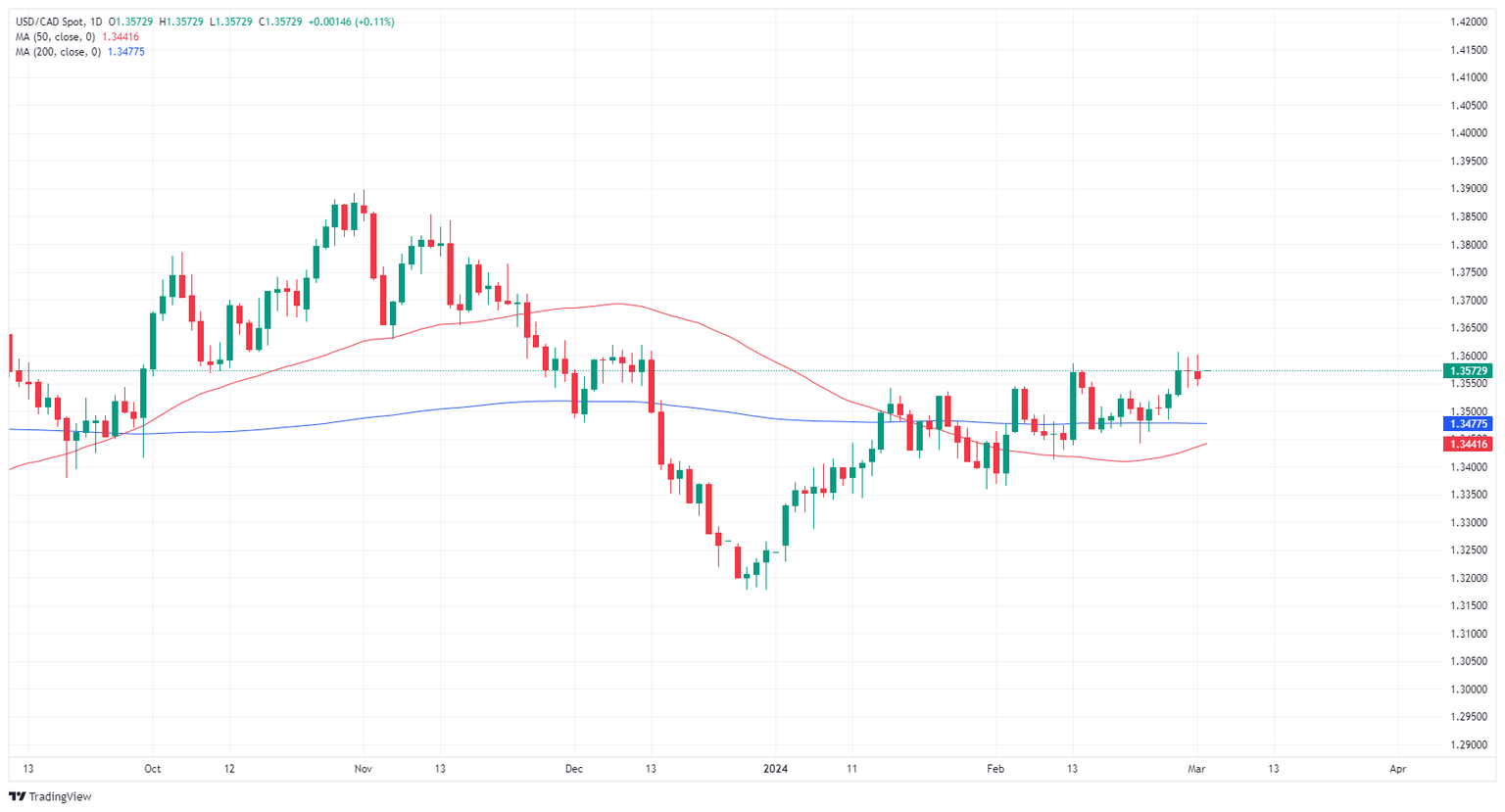

The USD/CAD pair is set to trade into a flat range for a third consecutive trading day. Bids are pushing into the middle and prices are hung up on rangebound figures between 1.3600 and 1.3550. The 1.3600 handle is the immediate near-term technical ceiling, and prices continue to trade on the high side of the 200-day Simple Moving Average (SMA) at 1.3477.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.