Canadian Dollar falls again as tariff threats loom

- The Canadian Dollar lost nearly half of a percent on Monday at its lowest.

- The Loonie has shed weight against the Greenback for seven straight sessions.

- Canadian PMI figures widely missed the mark, signaling risk of recession.

The Canadian Dollar (CAD) turned tail and ran from the Greenback on Monday, backsliding around one-fifth of one percent after plumbing the depths of a seventh straight bearish session. The Loonie is broadly backsliding as fresh threats of a 25% tariff package on all Canadian goods came from the social media of US President Donald Trump.

President Trump issued threats of steep tariff packages on some of the US’ closest trading allies at the start of his presidency, but after kicking the can repeatedly since January Donald Trump looks set to finally make good on his threat to “punish” foreign countries he has decreed as “taking advantage” of the US by steeply taxing his own constituents. Donald Trump’s tariffs exist in a particular quantum state, where they are both meant to change other countries’ trade behaviour, but are also meant to shore up US government finances, which are facing steep deficits if President Trump’s planned tax and government revenue cuts go through, which are poised to add trillions of dollars to the US government deficit in the coming years.

Daily digest market movers: Fresh tariff threats pummel Canadian Dollar

- The Canadian Dollar is poised for a return to multi-year lows as Loonie weakness pushes USD/CAD back into the 1.4500 region.

- President Trump reiterated his intent to begin 25% tariffs on US imports from Canada on Tuesday.

- The Organization of the Petroleum Exporting Countries (OPEC) also tentatively announced a production limit increase in the coming months, further suppressing the Loonie.

- Canadian officials already have retaliatory tariffs and punitive economic actions prepared for US consumers if tariffs go ahead this week.

- According to Donald Trump, further “reciprocal tariffs” are also slated to begin in April.

- Adding insult to injury, Canadian Purchasing Managers Index (PMI) Manufacturing figures for March declined sharply to 47.8, entirely missing the forecast uptick from 51.6 to 51.9. The survey results index has fallen to its lowest level in a little over a year as recession fears loom over businesses in the face of potential steep trade tariffs.

Canadian Dollar price forecast

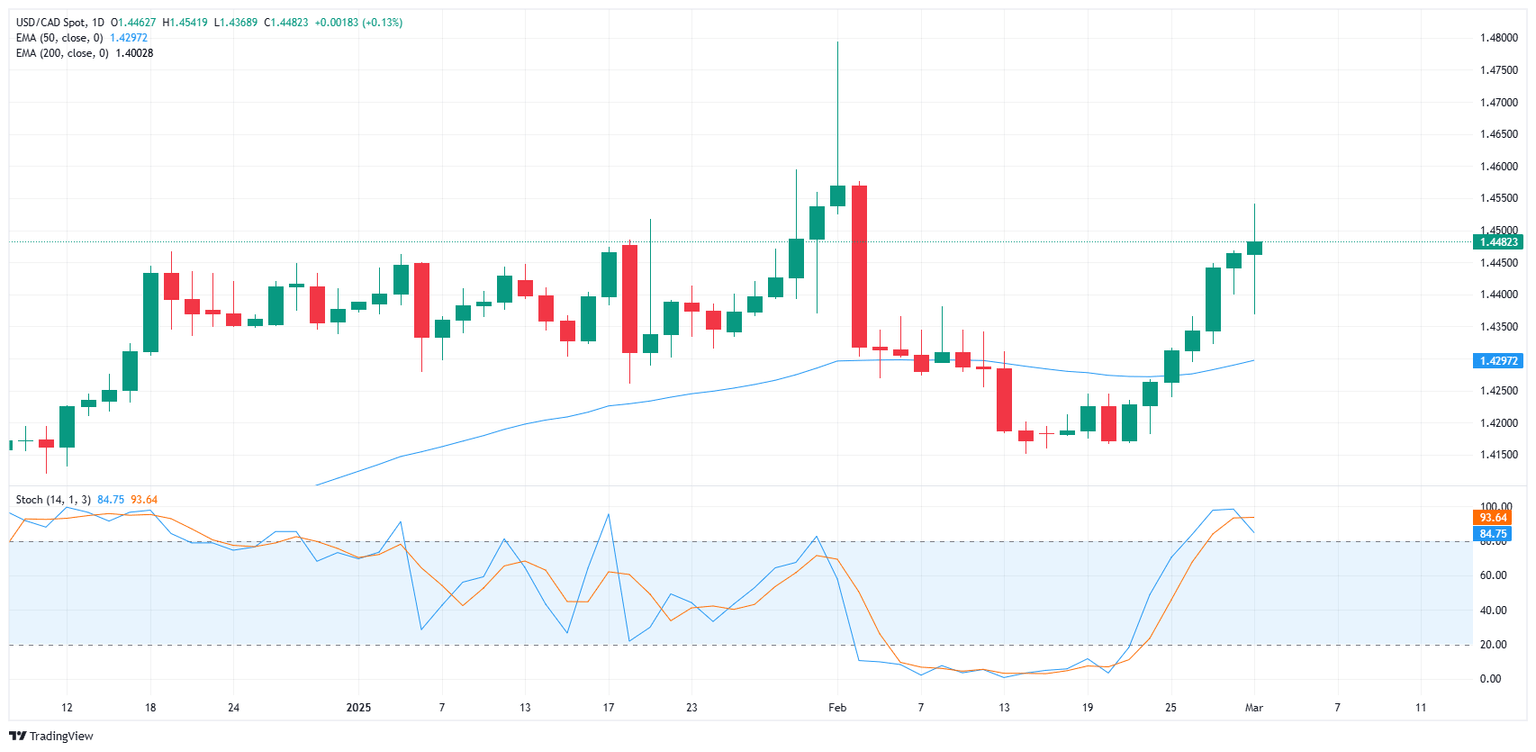

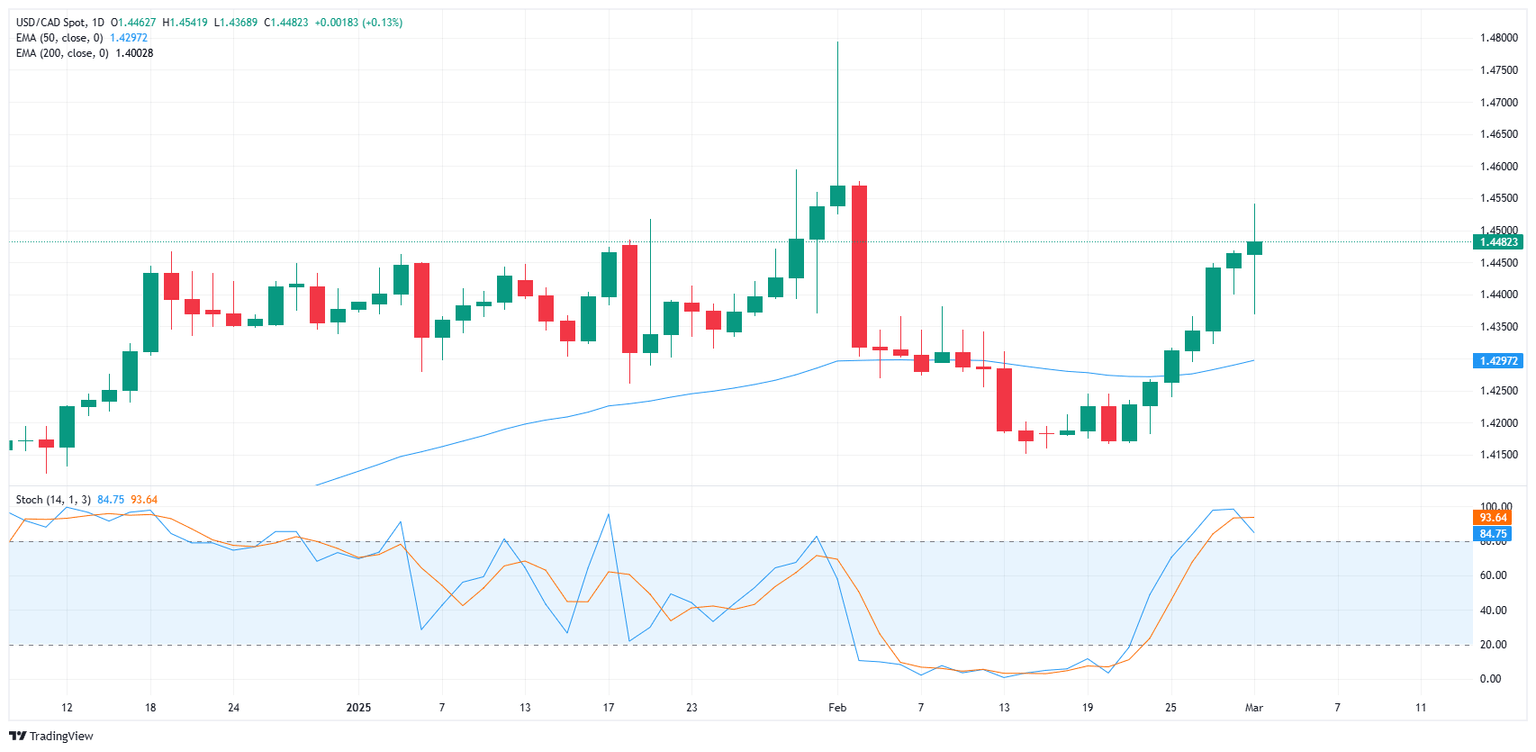

Fresh weakness in the Canadian Dollar has bullied USD/CAD higher, clipping into a seventh straight gaining session as the Greenback climbs against the Loonie. After a brief recovery from multi-year highs in January, the Canadian Dollar has resumed waffling against the US Dollar, dragging USD/CAD back into the 1.4500 handle.

The pair is trending back above the 50-day Exponential Moving Average (EMA) near 1.4300, but technical oscillators are beginning to pivot in overbought territory in a clear signal of potential exhaustion. While it’s unlikely that a fresh bout of bullish momentum behind the Loonie will fundamentally change the ongoing trend, a brief pullback period could be on the cards.

USD/CAD daily chart

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.