Canadian Dollar catches a break from selling pressure on Wednesday

- The Canadian Dollar caught a slight bid after getting pushed into multi-year lows.

- Canada remains absent from the economic calendar until Friday.

- Incoming US Thanksgiving holiday to compress market volumes this week.

The Canadian Dollar (CAD) caught a much-needed bid on Wednesday, clawing back a sliver of recently-lost ground after the Loonie was pushed into multi-year lows by a correlated decline in Crude Oil prices earlier in the week. Investors eased up from broad-market Greenback bidding, taking USD/CAD back down toward the 1.4000 handle.

Canada has been functionally absent from the economic calendar this week, with no meaningful data releases on the radar until Friday’s Canadian quarterly Gross Domestic Product (GDP) update. US data broadly hit expectations on Wednesday, keeping market sentiment roughly on-balance and giving the Canadian Dollar some breathing room as Greenback bidding eases.

Daily digest market movers: Canadian Dollar claws back ground after multi-year plunge

- The Canadian Dollar gained one quarter of one percent on Wednesday, waking back the early week’s fast plunge into 55-month lows.

- Key market drivers on Wednesday were a wide US data dump as markets rush to wrap things up for Thursday’s Thanksgiving holiday.

- Markets will also see limited trading hours on Friday, further crimping market volumes during the latter half of the trading week.

- US core Personal Consumption Expenditures Price Index (PCEPI) inflation rose on an annualized basis, but no more than investors expected, keeping market reactions limited.

- Canada’s Q3 GDP update, slated for Friday, is expected to shrink to 1.0% on an annualized basis compared to the previous 2.1%, while the monthly GDP estimator is forecast to counter-intuitively swing higher to 0.3% from the previous flat print of 0.0%.

Canadian Dollar price forecast

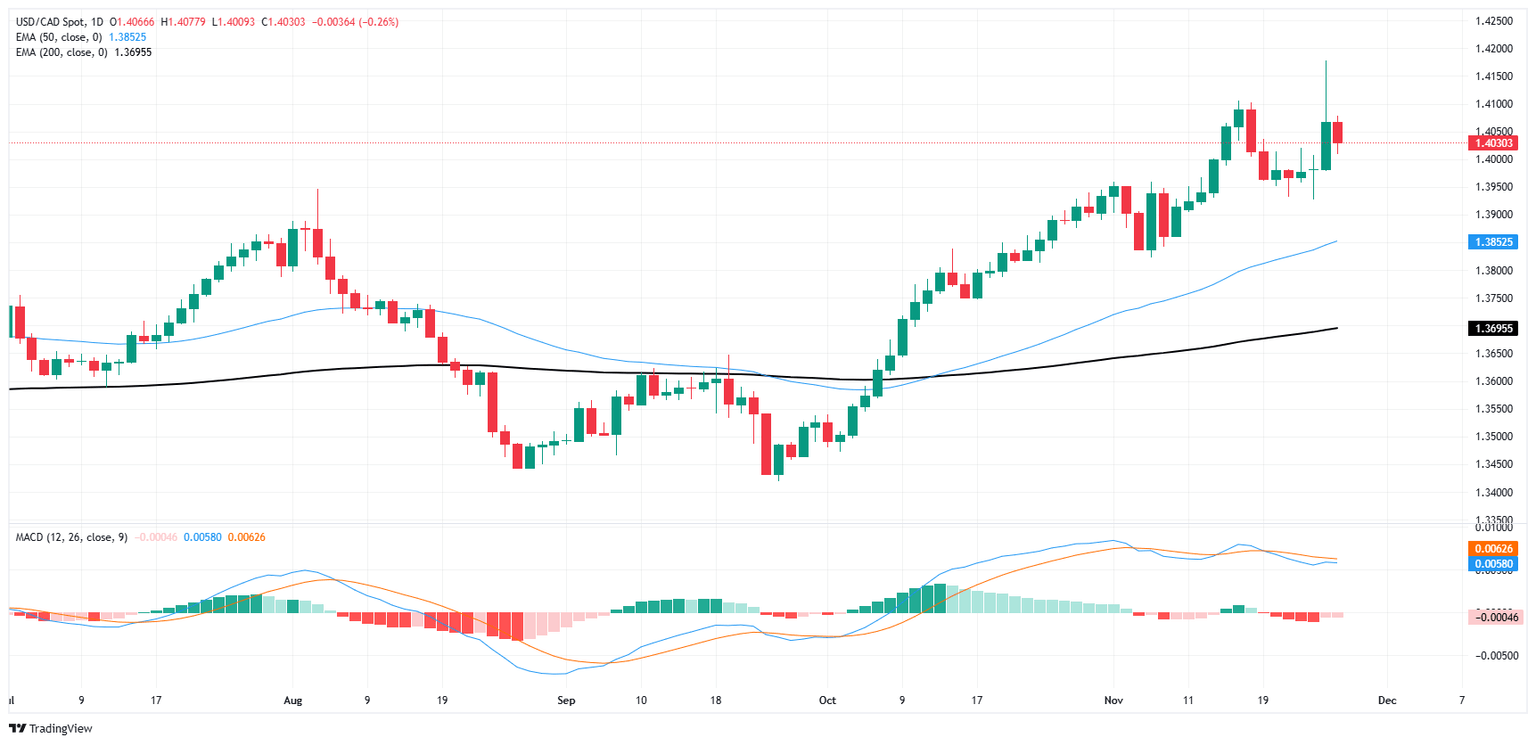

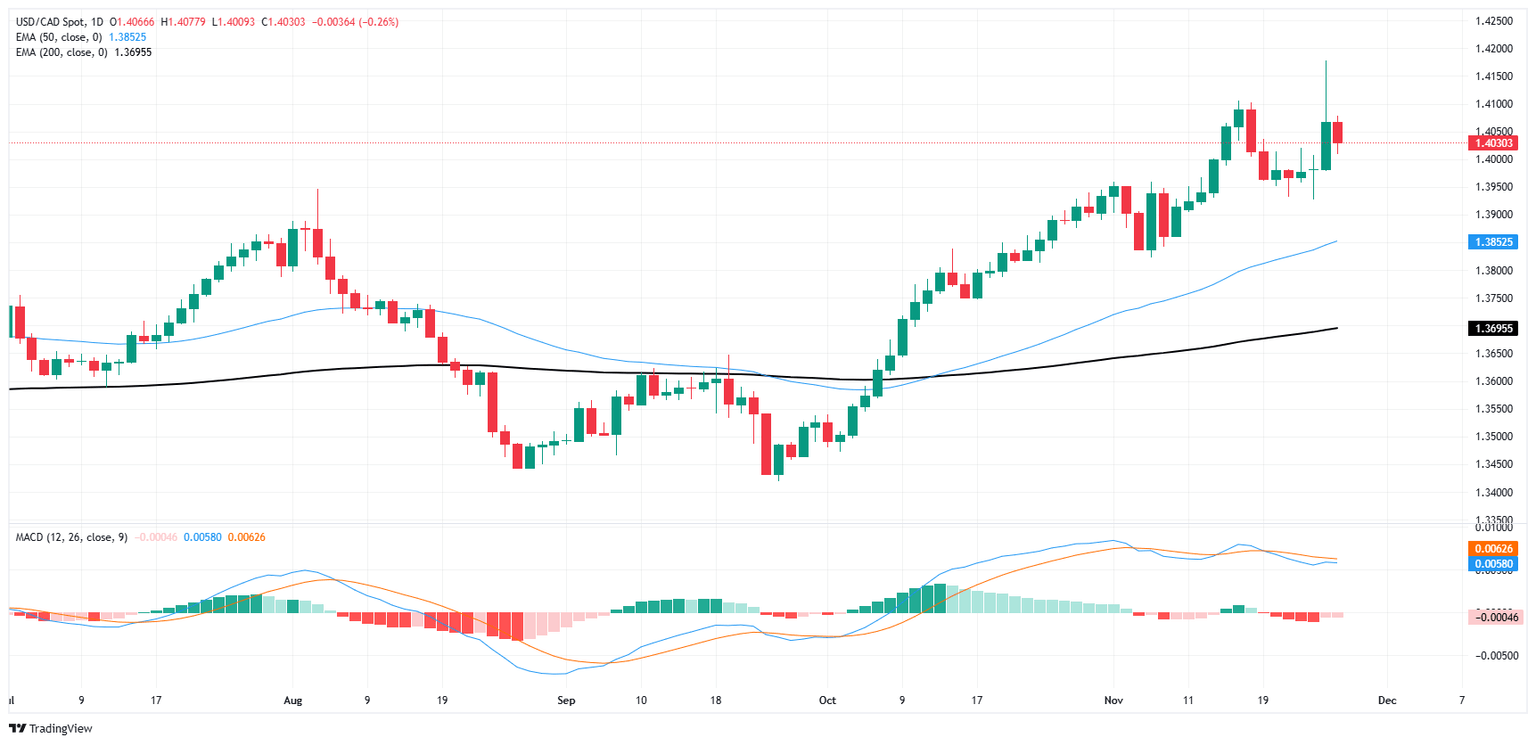

The Canadian Dollar’s (CAD) 55-month low reach this week is seeing a tepid rebound. The CAD has gained an intraday foothold against the US Dollar, dragging the USD/CAD pair back into touch range of the 1.4000 handle. The pair is still caught on the high end following a broad-market bull run in the Greenback, but technical traders will have an increasingly difficult time ignoring the growing potential for a cyclical turnaround in the long-term charts.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.