Cameco (CCJ) breaks out as impulsive strength returns

Cameco is a leading Canadian uranium producer based in Saskatoon. The company operates some of the world’s highest‑grade and lowest‑cost uranium mines. It also maintains a significant presence across the nuclear fuel cycle through refining, conversion, and fuel‑manufacturing assets. In this article, we will look at the long term Elliott Wave path.

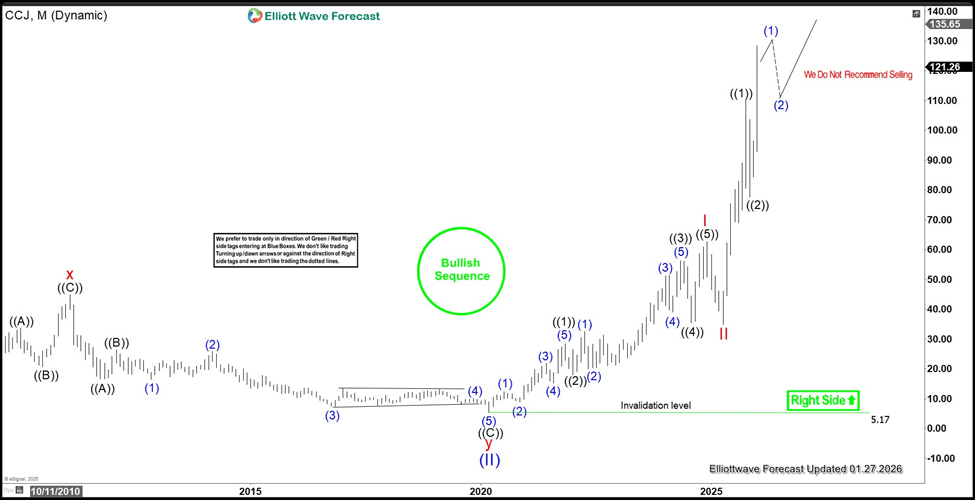

Cameco ($CCJ) monthly Elliott Wave chart

The monthly Elliott Wave chart for Cameco (CCJ) indicates that wave (II) of the Super Cycle ended at $5.17. From there, a powerful impulsive advance in wave (III) followed. From the wave (II) low, wave I completed at $62.55, and the subsequent pullback in wave II finished at $35. The stock then resumed higher in a nesting sequence, with wave ((1)) ending at $110.16 and wave ((2)) pulling back to $77.7. As long as price holds above $5.17, any pullback should find support in a 3‑, 7‑, or 11‑swing structure, with the broader trend favoring further upside.

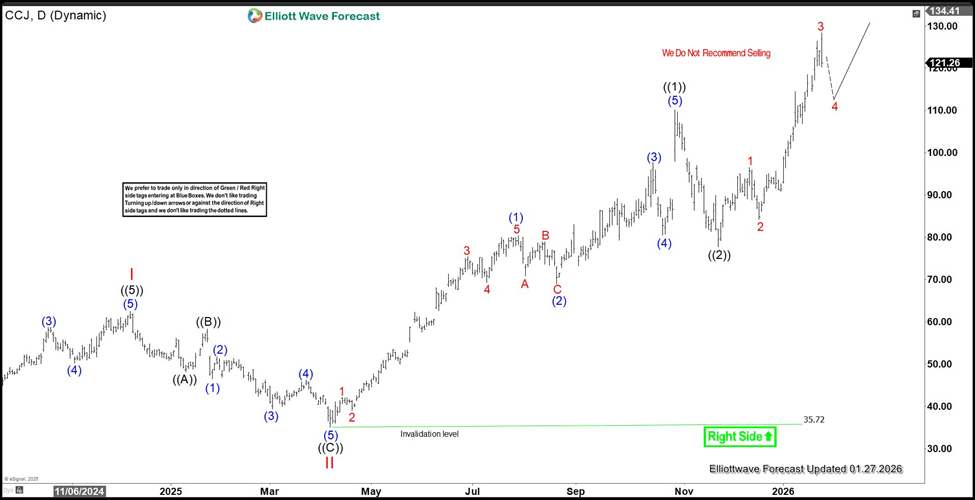

$CCJ daily Elliott Wave chart

The daily Elliott Wave analysis of Cameco (CCJ) shows that wave II completed at $35.72. From that low, the stock resumed higher in wave III, which is unfolding as a five‑wave impulse. Within this advance, wave ((1)) peaked at $110.16, followed by a pullback in wave ((2)) that ended at $77.7. In the near term, as long as the pivot at $35.72 remains intact, any pullback is expected to find support in a 3‑, 7‑, or 11‑swing structure, setting the stage for further upside.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com