Breaking: UK annualized CPI inflation jumps to 10.4% in February vs. 9.8% expected

- UK CPI rises to 10.4% YoY in February vs. 9.8% expected.

- Monthly UK CPI arrives at 1.1% in February vs. 0.6% expected.

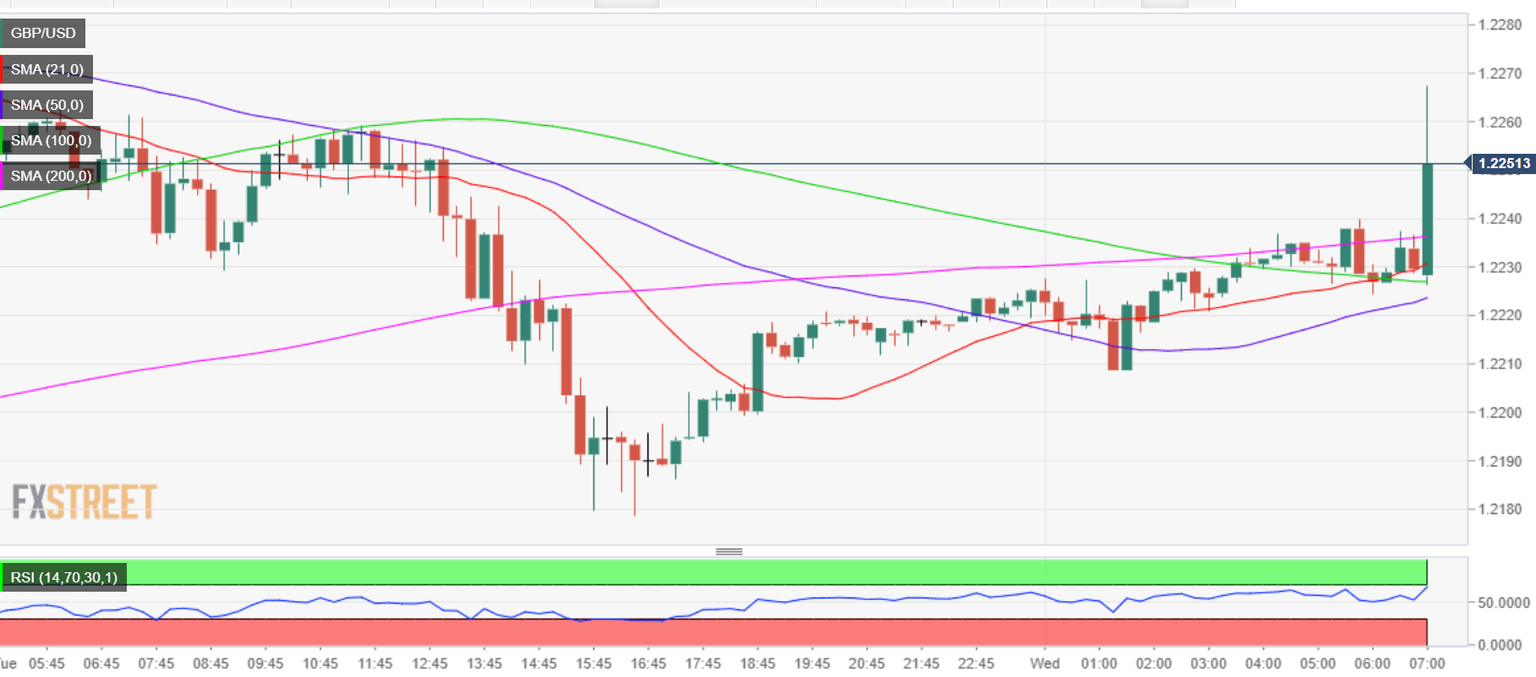

- GBP/USD jumps above 1.2250 on upbeat UK CPIs.

According to the latest data published by the UK Office for National Statistics (ONS) on Wednesday, Britain’s annualized Consumer Prices Index (CPI) jumped to 10.4% in February against the 10.1% increase recorded in January while missing estimates of a 9.8% clip.

Meanwhile, the Core CPI gauge (excluding volatile food and energy items) increased to 6.2% YoY last month versus 5.8% seen in January. The market expectations are for a 5.8% figure.

The monthly figures showed that the UK consumer prices rose to 1.1% in February vs. 0.6% expectations and -0.6% last.

The UK Retail Price Index for February stood at 1.2% MoM and 13.8% YoY, beating expectations across the time horizon.

Additional takeaways (via ONS)

“The largest upward contributions to the annual CPIH inflation rate in February 2023 came from housing and household services (principally from electricity, gas, and other fuels), and food and non-alcoholic beverages.”

“The largest upward contributions to the monthly change in both the CPIH and CPI rates came from restaurants and cafes, food, and clothing, partially offset by downward contributions from recreational and cultural goods and services (particularly recording media), and motor fuels.”

FX implications

In an initial reaction to the UK CPI numbers, the GBP/USD pair jumped to session highs of 1.2264 before retreating to 1.2245, where it now wavers. The pair is up 0.29% on the day.

GBP/USD: 15-minutes chart

Why does UK inflation matter to traders?

The Bank of England (BOE) is tasked with keeping inflation, as measured by the headline Consumer Price Index (CPI) at around 2%, giving the monthly release its importance. An increase in inflation implies a quicker and sooner increase in interest rates or the reduction of bond-buying by the BOE, which means squeezing the supply of pounds. Conversely, a drop in the pace of price rises indicates looser monetary policy. A higher-than-expected result tends to be GBP bullish.

Author

FXStreet Team

FXStreet