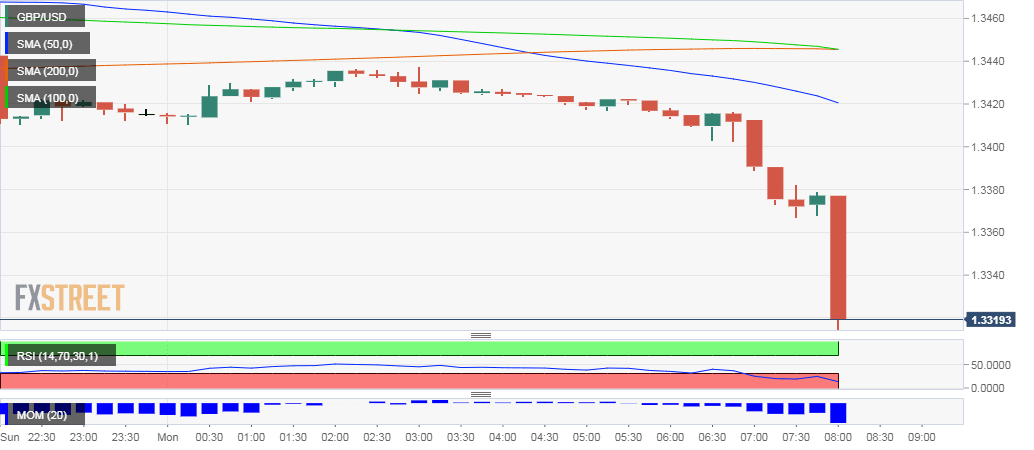

Breaking: GBP/USD collapses below 1.33 as Johnson reportedly ready to ditch Brexit talks

The Sun has reported that UK Prime Minister Boris Johnson is "ready to pull out of Brexit talks within hours" in response to new EU demands. Earlier, both Brussels and London denied speculation that both sides had reached an agreement on fisheries, one of three contentious topics. The other two issues are governance and a level playing field.

An unnamed senior EU official said that is it impossible to say if there will be a deal. The bloc is aggravated by Johnson's Internal Market Bill, which violates the 2019 Withdrawal Agreement preceding the current negotiations.

A breakdown in talks would put Britain on course to revert to World Trade Organization terms, an unfavorable scenario for markets. The latest report could be the "darkest before dawn" – a last-minute row ahead of an agreement.

See Three reasons to expect a sustained Santa rally for sterling

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.