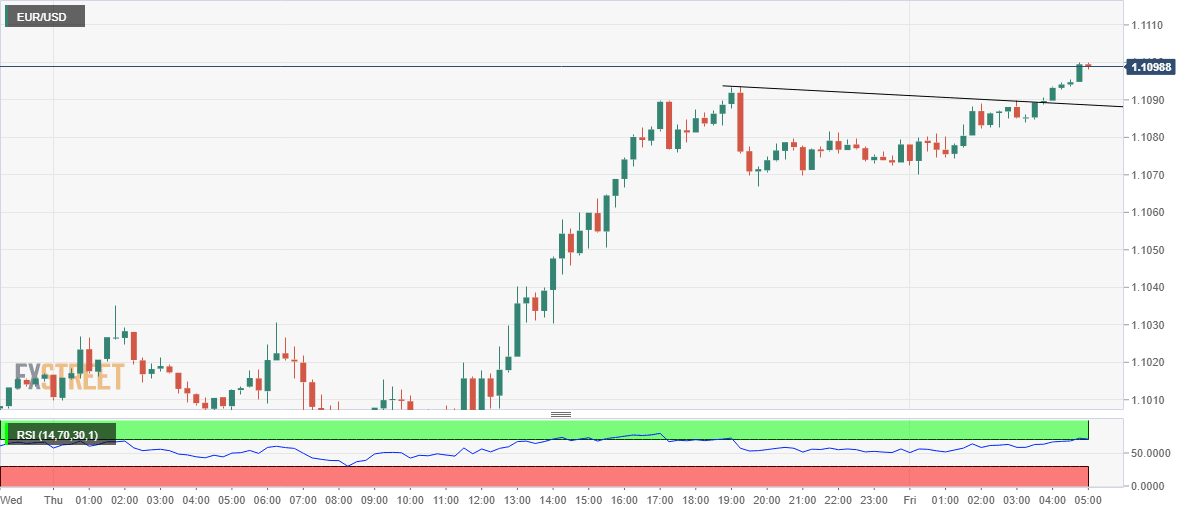

Breaking: EUR/USD breaks above 1.1100, first time since end-March

- EUR/USD catches fresh bids, takes-out 1.1100

- EU Recovery Fund optimism and economic re-opening boost the EUR.

- Focus on Eurozone CPI, US data and Trump’s response.

Following a brief consolidative stint in early Asia, EUR/USD is breaking higher heading into European trading this Friday.

The spot conquers the 1.11 handle for the first time since March 30 despite the risk-off market environment, in light of the escalating US-China tensions.

The optimism around the European Union's (EU) bigger-than-expected fiscal stimulus proposal of 750 billion euros continues to underpin the sentiment around the shared currency.

Further, expectations of the European Central Bank (ECB) expanding its bond-buying next week, in an effort to boost the economic recovery, also add to the strength in the spot.

Additionally, the major benefits from the month-end liquidation in the US dollar positions and nervousness ahead of US President Donald Trump’s response to the Hong Kong security issues.

With the move higher, “EUR/USD appears on track to end May on a positive note. This will be the first monthly gain since December when the exchange rate had appreciated by 1.88%,” as explained by FXStreet’s Analyst, Omkar Godbole.

Looking ahead, the immediate focus remains on the Eurozone Preliminary CPI data and US Core PCE Price Index for fresh trading impetus.

Related articles

- EUR/USD options market bias has flipped bullish, risk reversals show

- EUR/USD looks firmer, now targets 1.1145 – UOB

EUR/USD 15-minutes chart

EUR/USD levels to watch

Author

FXStreet Team

FXStreet