Breaking: Australia’s Unemployment Rate steadies at 4.3% in November vs. 4.4% expected

Australia’s Unemployment Rate steadied at 4.3% in November, according to the official data released by the Australian Bureau of Statistics (ABS) on Thursday. The figure came in below the market consensus of 4.4%.

Furthermore, the Australian Employment Change arrived at -21.3K in November from 41.1K in October (revised from 42.2K), compared with the consensus forecast of 20K.

The participation rate in Australia decreased to 66.7% in November, compared to 66.9% in October (revised from 67%). Meanwhile, Full-Time Employment decreased by 56.5K in the same period from a rise of 53.6K in the previous reading (revised from 55.3K). The Part-Time Employment increased by 35.2K in November versus a decline of 12.5K prior. (revised from -13.1K)

Sean Crick, ABS head of labour statistics, said with the key highlights noted below

Both the number of unemployed and employed people fell in November, by 2,000 and by 21,000 respectively.

Full-time employment fell by 57,000 people, with males falling by 40,000 and females by 16,000 people.

The employment-to-population ratio fell by 0.2 percentage points to 63.8 per cent this month.

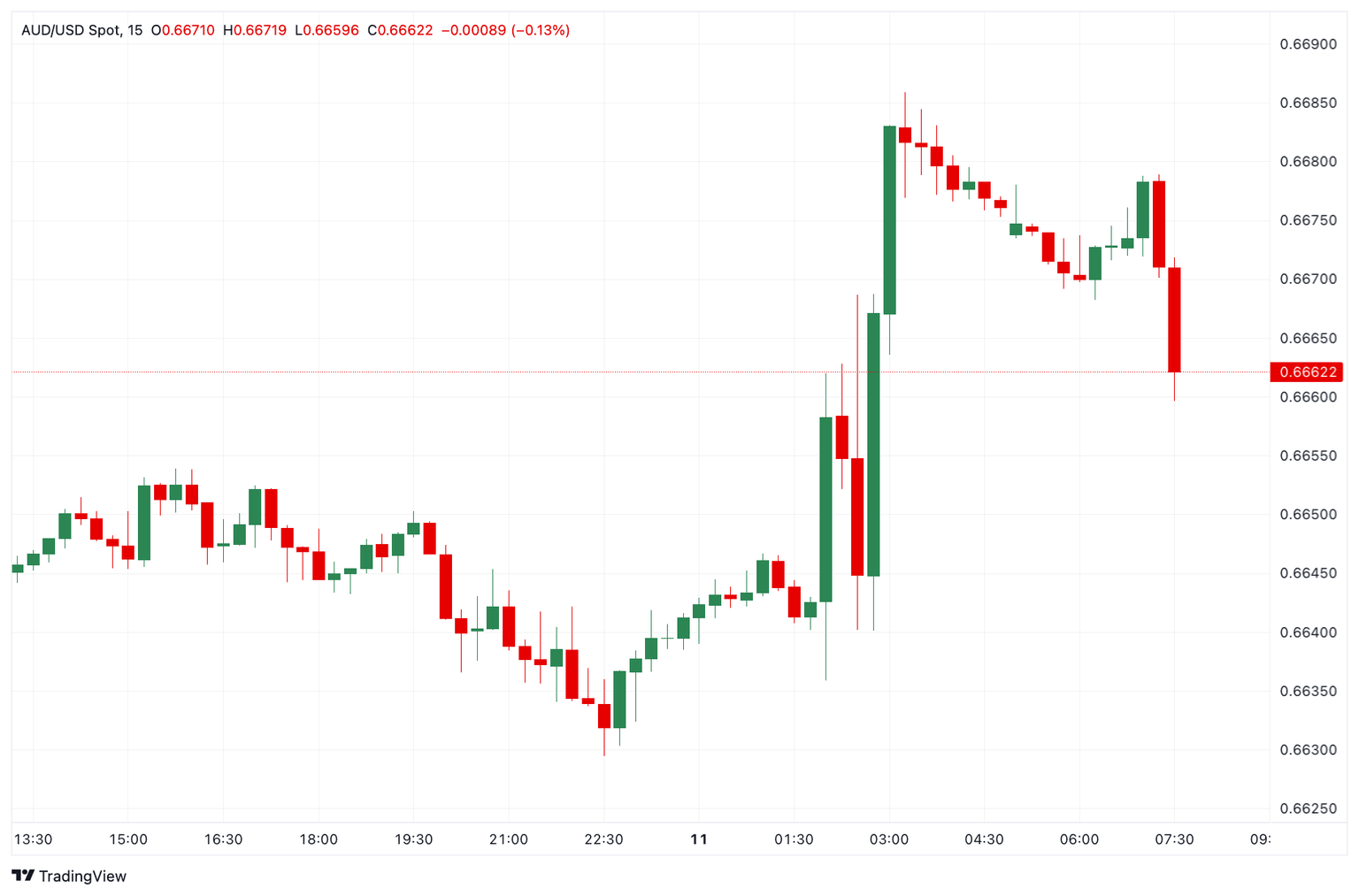

Market reaction to the Australia’s employment data

The Australian Dollar (AUD) attracts some sellers following the employment data. At the time of writing, the AUD/USD pair is trading 0.26% lower on the day to trade at 0.6662.

Australian Dollar Price Last 7 Days

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies last 7 days. Australian Dollar was the weakest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.29% | -0.28% | 0.28% | -1.14% | -0.98% | -0.73% | -0.05% | |

| EUR | 0.29% | 0.00% | 0.55% | -0.87% | -0.69% | -0.44% | 0.24% | |

| GBP | 0.28% | -0.01% | 0.58% | -0.86% | -0.70% | -0.45% | 0.23% | |

| JPY | -0.28% | -0.55% | -0.58% | -1.42% | -1.26% | -1.04% | -0.33% | |

| CAD | 1.14% | 0.87% | 0.86% | 1.42% | 0.17% | 0.42% | 1.09% | |

| AUD | 0.98% | 0.69% | 0.70% | 1.26% | -0.17% | 0.25% | 0.94% | |

| NZD | 0.73% | 0.44% | 0.45% | 1.04% | -0.42% | -0.25% | 0.68% | |

| CHF | 0.05% | -0.24% | -0.23% | 0.33% | -1.09% | -0.94% | -0.68% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.