BoJ’s Ueda: Many trade negotiations with US still going on, uncertainty remains high

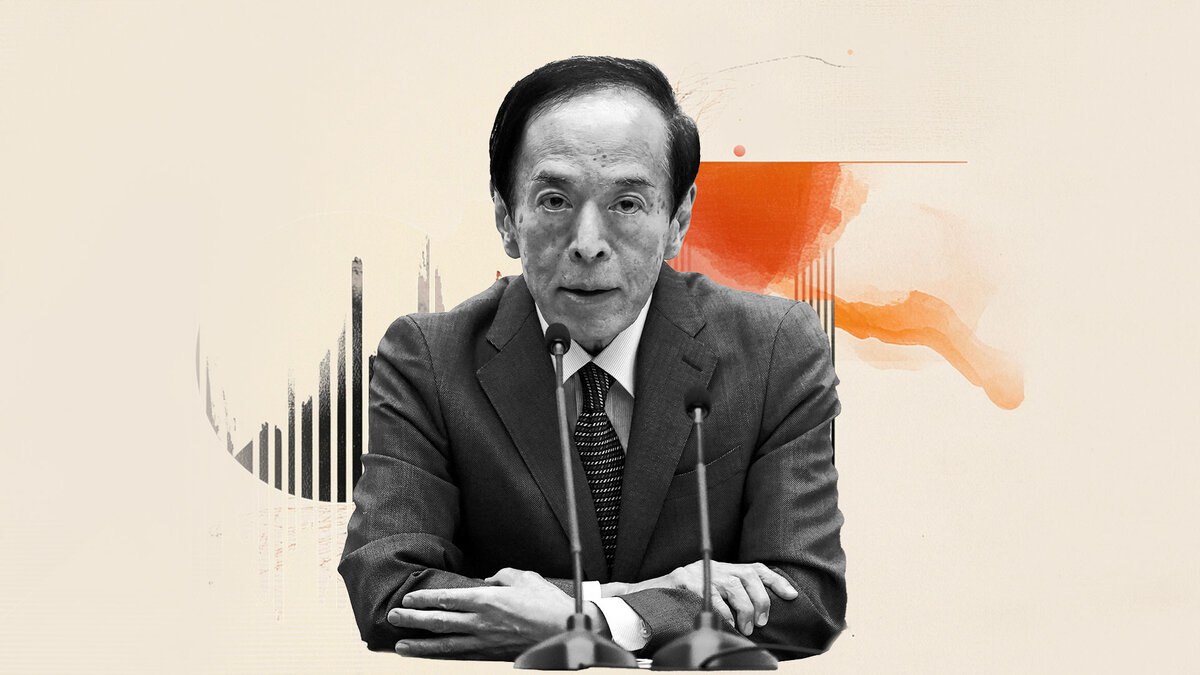

Bank of Japan (BoJ) Governor Kazuo Ueda is back on the wires, via Reuters, commenitng on the impact of US tariffs on the economic and inflation outlook.

Key quotes

Economic, price environment is becoming more complex.

Economic developments have changed sharply since Trump's tariffs in April.

Tariffs could hurt demand via heightened uncertainty, which could weigh on the economy.

Firms could swallow rising costs from tariffs but this will worsen corporate profits.

In turn, that will have negative impact on wages.

Tariffs could affect Japan's economy via financial, FX market moves also.

Still expect prices to gradually rise and withstand downwards pressure from tariffs.

Corporate profits also stay elevated despite tariffs impact.

Underlying inflation in Japan is rising moderately.

Even as economy slows, Japan likely to maintain mechanism in which wages and prices rise in tandem.

No change to our view that underlying inflation is to gradually head towards 2% target.

BoJ expected to continue hiking rates if underlying inflation accelerates to 2% as projected.

We will judge without preconception whether economic, price forecasts will materialise.

Japanese firms' wage and price-setting behaviour could change significantly due to tariffs impact.

BoJ bond buying is exerting intended effect on improving bond market functionality.

Many bond market players in recent meeting shared BoJ view on that.

BoJ must continue to balance predictability and flexibility with regards to bond taper plan in April 2026.

See no need now to change our baseline view on Japan's economy.

See no change to big picture of Japan's economy, price developments since we released our outlook report on May 1.

Many trade negotiations with US still going on, uncertainty remains high.

Whether to raise interest rates and likely timing of such a move will depend on Japan's economic, price developments.

Won't comment on short-term moves in bond yields.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.