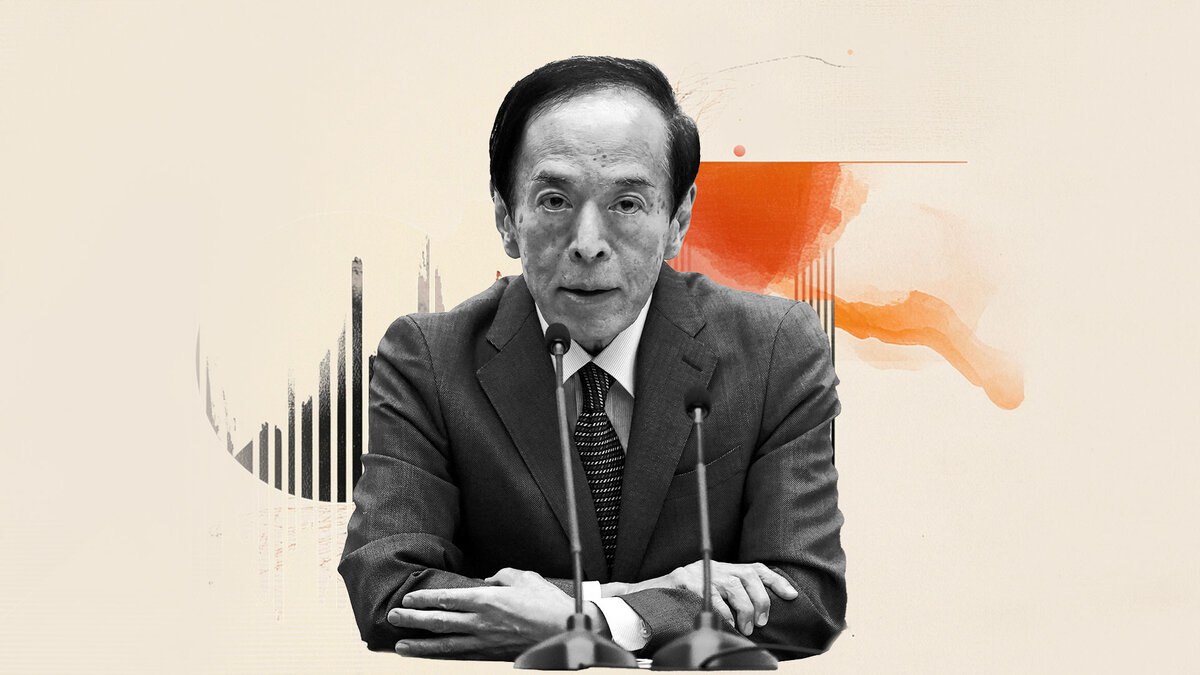

BoJ’s Ueda: Japan's economy moderately recovering

Bank of Japan (BoJ) Governor Kazuo Ueda said on Tuesday that the Japanese economy is modestly recovering despite some weakness.

Key quotes

Japanese economy modestly recovering despite some weakness seen.

Corporate profits are improving, with business sentiment solid.

As the slowdown in the overseas economy pressures corporate profits, the pace of economic growth is expected to slow down.

Import prices pushing up inflation are expected to wane.

Uncertainties over overseas trade policies and economic, price situations remain extremely high.

Will continue to raise interest rates if the economy, and prices move in line with forecasts.

Important to make judgment without any preset ideas.

Have said in outlook report that our baseline scenario could change significantly.

Will closely communicate with the government.

Will closely monitor financing situations at companies through BoJ’s networks.

No preset plan for rate hikes, will raise interest rates only if economy, prices turn up again, outlooks likely to be realized.

Vigilantly seeing uncertainties over how tariff rates would affect the economy.

Uncertainties over developments in each country's tariff policies are extremely high.

Will review bond taper plans at the next policy meeting taking into account opinions of bond market participants.

Aware of market view some investors' appetite for super-long JGBs have declined.

From long-term perspective, domestic investors remain key buyers of super-long JGBs.

Moves of short, medium-term JGB yields tend to have bigger impact on economy than those of super-long yields.

Volatility in super-long yields could affect short-, medium-term yields so watching market developments and their impact on the economy closely.

Minutes of BoJ’s meeting with bond market players showed there were only few who wanted tweak to existing bond-taper plan.

Minutes of BoJ’s meeting with bond market players showed many thought it was important for the BoJ to continue tapering bond buying while striking balance between flexibility and predictability.

Minutes of BoJ’s meeting with bond market players showed there were various opinions on the desirable pace of BoJ’s bond taper beyond April 2026.

Market reaction

As of writing, the USD/JPY pair was up 0.10% on the day at 142.85.

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan embarked in an ultra-loose monetary policy in 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds. In March 2024, the BoJ lifted interest rates, effectively retreating from the ultra-loose monetary policy stance.

The Bank’s massive stimulus caused the Yen to depreciate against its main currency peers. This process exacerbated in 2022 and 2023 due to an increasing policy divergence between the Bank of Japan and other main central banks, which opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy led to a widening differential with other currencies, dragging down the value of the Yen. This trend partly reversed in 2024, when the BoJ decided to abandon its ultra-loose policy stance.

A weaker Yen and the spike in global energy prices led to an increase in Japanese inflation, which exceeded the BoJ’s 2% target. The prospect of rising salaries in the country – a key element fuelling inflation – also contributed to the move.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.