Bitfarms Ltd. ($BITF) soars 400% from the blue box area – What’s next?

In today’s update, we’ll revisit the Elliott Wave structure of Bitfarms Ltd. ($BITF) and provide insights into the next phase of its price action. You can check the last article here. As anticipated, the 5-wave impulsive cycle from April 2025 has concluded, and a corrective pullback has begun. This pullback presents a potential buying opportunity in the coming weeks. Let’s break it down.

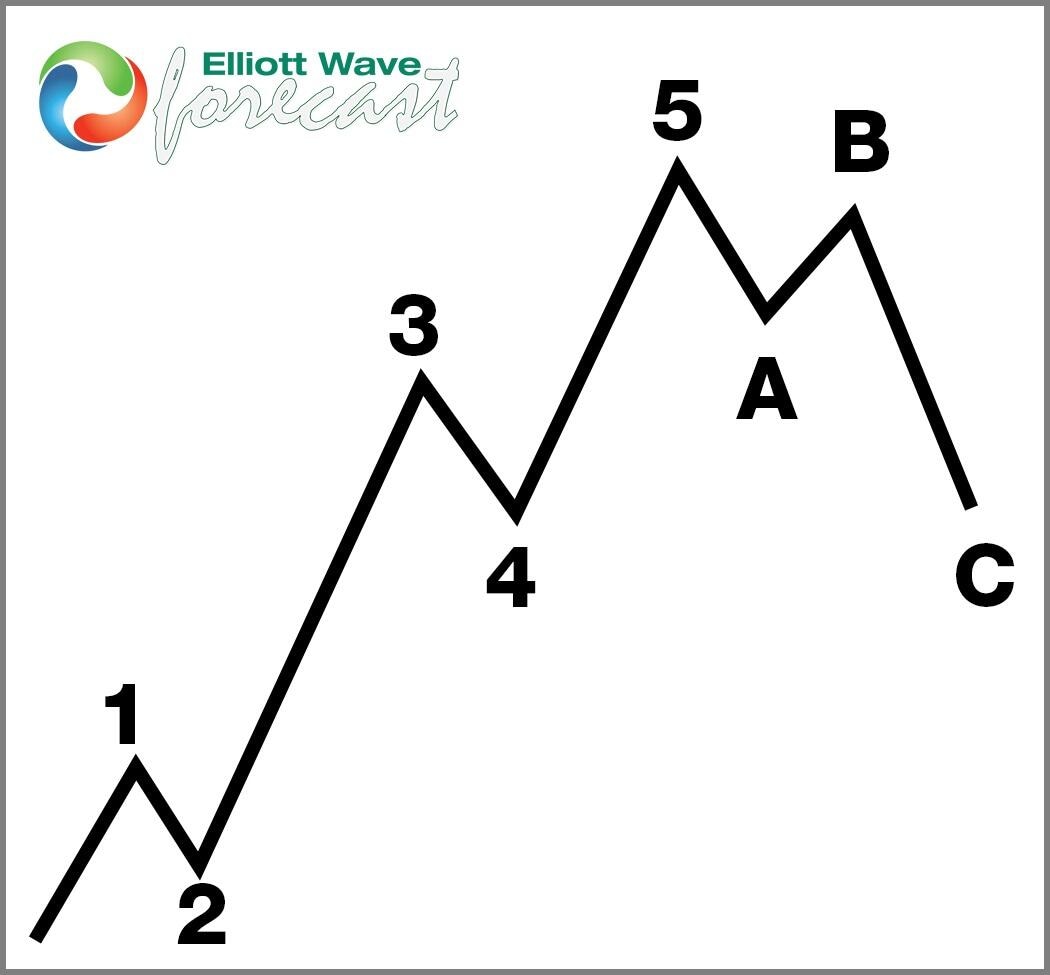

Five wave impulse structure + ABC correction

$BITF daily Elliott Wave view August 19th 2025

$BITF daily Elliott Wave view October 28th 2025

Since our last update, $BITF has rallied and confirmed the completion of wave (5) within wave ((1)). The stock has now entered a corrective phase, consistent with Elliott Wave Theory. Here’s how the structure is unfolding so far:

- The first leg lower, labeled wave (A), has already formed, marking the initial phase of the pullback.

- This was followed by a bounce in wave (B), which appears to be taking place.

- The stock will soon enter wave (C) of the larger wave ((2)) correction, which should target the area at $3.63–$2.93.

Blue box area: A key buying opportunity

The Blue Box area represents a high-probability reversal zone where buyers could re-enter for the next bullish cycle. This correction, which follows the 5-wave impulse, allows the market to reset and create new opportunities for traders.

§ Wave Structure: Corrections typically unfold in 3 swings (ABC), with wave (C) often extending into the Blue Box.

As $BITF approaches this zone, traders should closely monitor price action for signs of reversal and a resumption of the larger uptrend.

What’s next for $BITF?

Once wave ((2)) completes in the Blue Box area, we expect $BITF to resume its bullish trend with a rally in wave ((3)). This next impulsive move could take the stock to new highs, continuing its uptrend.

Conclusion

The current correction in Bitfarms Ltd. ($BITF) aligns with our Elliott Wave analysis and offers a strategic buying opportunity. As the stock approaches the $3.63–$2.93 area, traders should prepare to capitalize on the next leg of the uptrend. Stay patient, focus on risk management, and let the Elliott Wave structure guide your decisions.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com