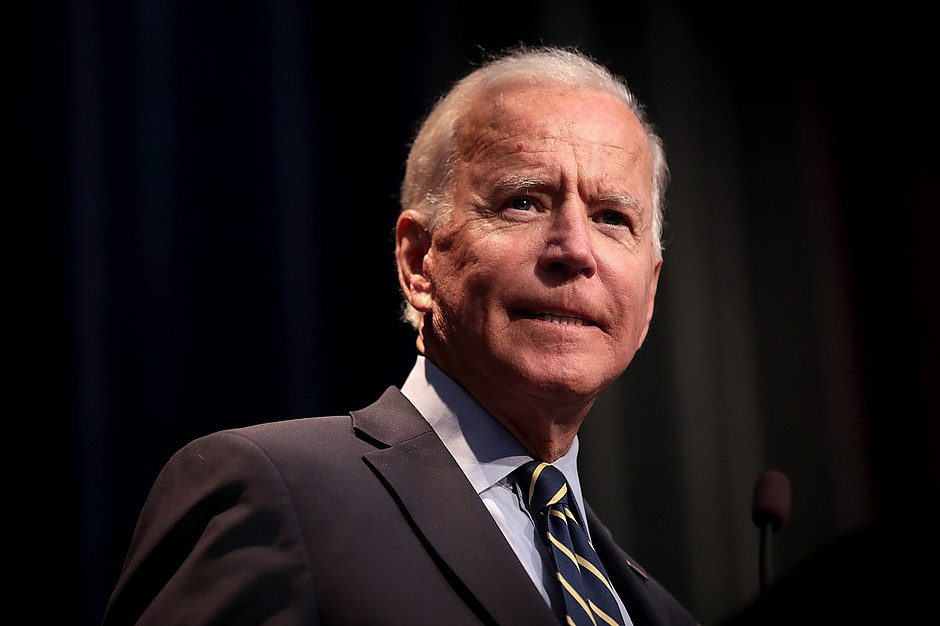

Biden: 'Armageddon' risk at highest level since Cuban Missile Crisis

US President Joe Biden at a Democrats fundraiser tonight said, “we have not faced the prospect of Armageddon since Kennedy and the Cuban missile crisis.”

He says Putin is “not joking when he talks about the potential use of tactical,” nuclear or biological weapons because his military is underperforming.

President Vladimir Putin, who rules the world's biggest nuclear power, has repeatedly cautioned the West that any attack on Russia could provoke a nuclear response.

In other news, Putin said he expected sanctions pressure on the Russian economy to intensify, in televised remarks from a meeting with government officials.

Reuters also reports that the Kremlin denied reports that 700,000 Russians have fled the country since Moscow announced a mobilisation drive to call

up hundreds of thousands to fight in Ukraine.

Meanwhile, US intelligence agencies believe parts of the Ukrainian government authorised a car bomb attack near Moscow in August that killed Darya Dugina, the daughter of a prominent Russian nationalist, the New York Times reported.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.