Bed Bath & Beyond Earnings News: BBBY Stock falls sharply on disappointing earnings

- BBBY stock is set to release Q4 earnings before the open on Wednesday.

- BBBY stock is a noted favorite amongst retail traders.

- BBBY stock counts GME savior Ryan Cohen as a large shareholder.

Update: BBBY stock is down 10% on Wednesday aster the company reported disappointing earnings. EPS came in at -$0.92 versus $0.03 expected. Revenue totaled $2.05 billion also missing estimates for $2.08 billion. Margin also declined worse than thought as inventory problems hit BBBY stock. BBBY CEO says on hte conference call that industry trends have worsened according to Reuters. No update on Buy Buy baby.

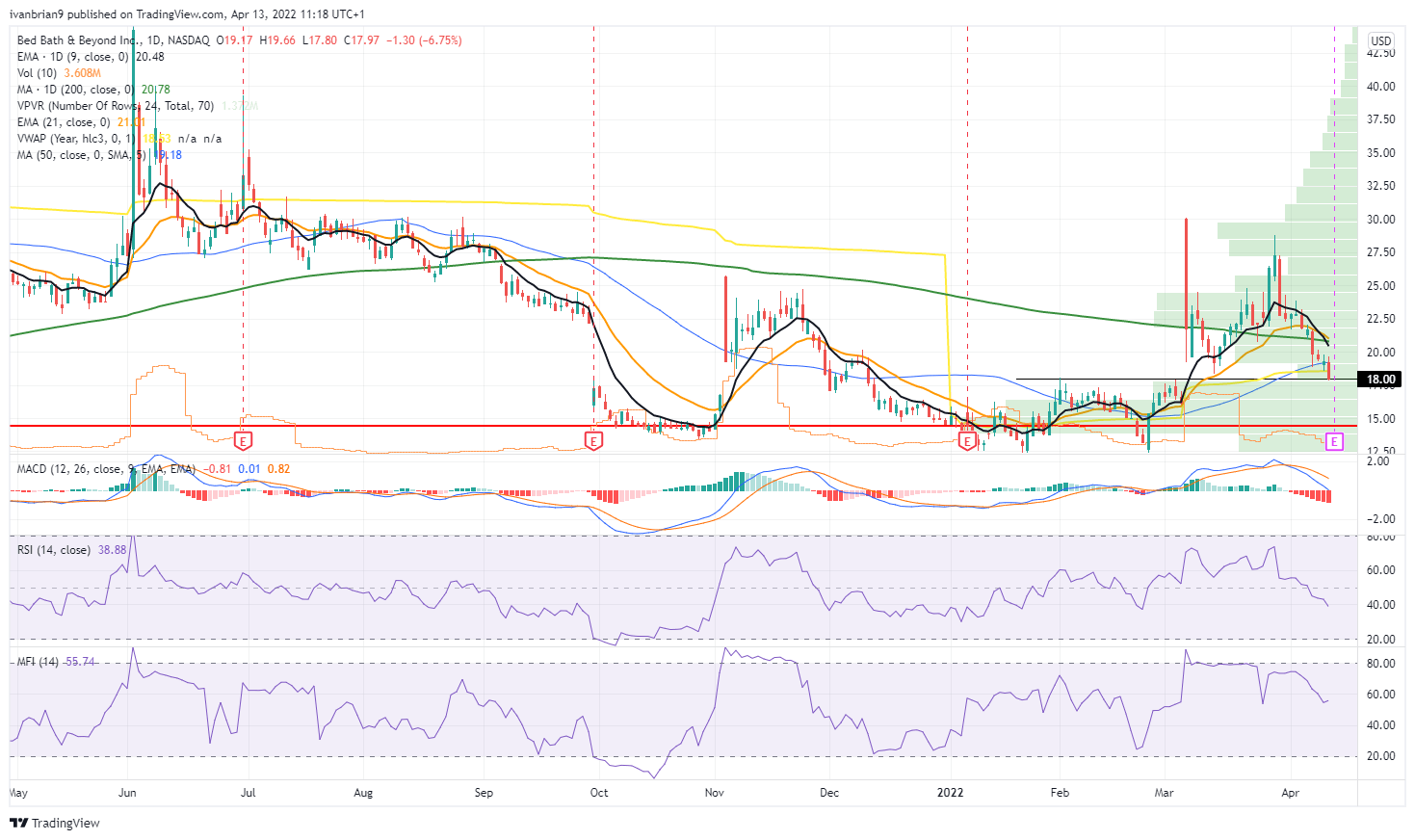

Bed Bath and Beyond Inc (BBBY) reports its Q4 earnings today before the open. Investors and retail traders will be tuning in to see what GameStop supremo Ryan Cohen can do with the company he recently invested in. BBBY stock spiked over 30% in early March when news broke that Ryan Cohen had taken a 9.8% stake in BBBY stock. This saw a frenzy of activity with BBBY stock opening March 7 at $30 before falling off to close at $21.71. That was a gain of 34% though even with the fall from earlier intraday highs. Since then BBBY has given back nearly all those gains and closed Tuesday at $17.97.

Bed Bath & Beyond (BBBY) stock news: What to expect from BBBY earnings?

Q4 earnings per share are expected to reach a modest $0.04 versus -$0.25 for the prior quarter. Revenue is slated to come in at $2.08 billion for the fourth quarter, versus $1.878 for Q3. BBBY stock has produced very volatile results over the last number of years with multiple misses on the top and bottom lines. As ever forward guidance nearly carries more importance than the historical earnings and this is especially relevant in the current inflationary environment with multiple headwinds from supply chain issues. So investors will look for certainty.

BBBY stock forecast

Generally, a breakout needs to consolidate in order to continue the trend in the direction of the initial breakout. BBBY has failed to do that and $18 is the breakout level. So this really needs to hold. Break and BBBY will target a move to $15 and below where there is strong volume-based support. Given this has a large retail base, volatility is virtually guaranteed after the earnings release. This means buying options is currently expensive.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.