Bearish US dollar index (DXY) bets near decade high as 2020 draws to an end – Bloomberg

Early Tuesday, Bloomberg came out with any analysis, based on non-commercial positions in futures linked to the Intercontinental Exchange (ICE), portraying the US dollar’s broad weakness.

The analytical piece initially cites data from the Commodity Futures Trading Commission (CFTC) to confirm that the net short non-commercial positions in futures linked to the ICE US Dollar Index (DXY) have surged to the most since March 2011.

While emphasizing the 6% drop of the greenback’s gauge, the piece quotes analysts from Goldman Sachs as saying, “We see depreciation in the dollar continuing into 2021. Liquidity dynamics and virus news flow may influence the timing of dollar weakness, but not necessarily the medium-term downtrend.”

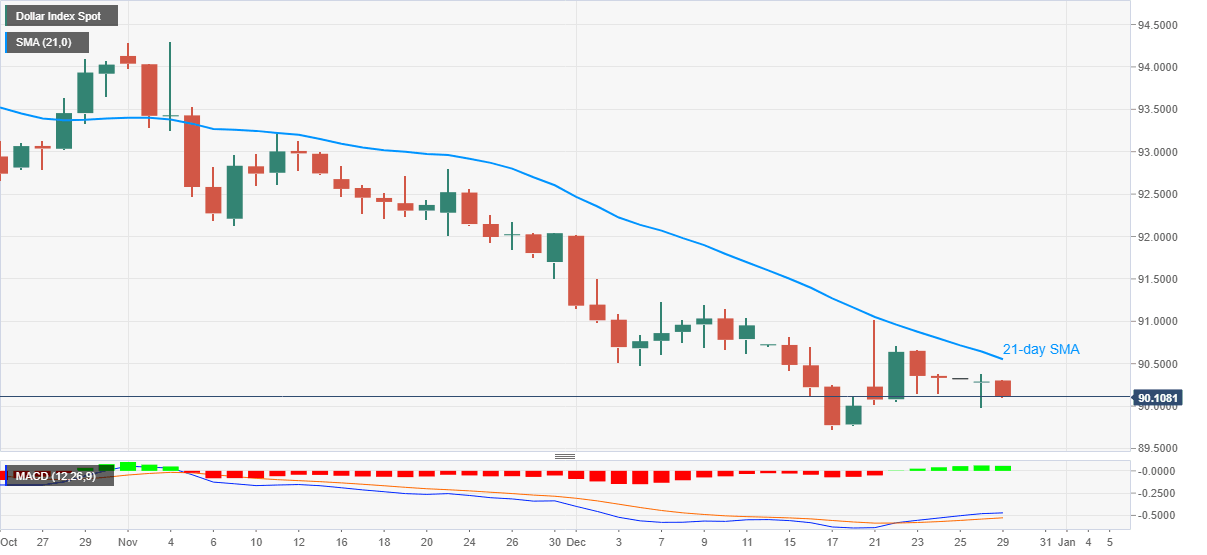

DXY remains pressured…

DXY bears the burden of risk-on sentiment while flashing 0.20% intraday losses to 90.11 by press time. In doing so, the US dollar barometer drops the most after the last Wednesday.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.