BBBY Stock Forecast: Bed Bath & Beyond surges after securing a new loan deal

- NASDAQ:BBBY gained 18.0% during Wednesday’s trading session.

- Bed Bath and Beyond reports that it has secured a new loan deal.

- While BBBY rebounded, GameStop continued to slump lower.

NASDAQ:BBBY shareholders woke up to a surprise on Wednesday as the stock soared higher following the collapse of its short squeeze last week. Shares of BBBY jumped higher by 18.0% and closed the trading session at $10.36. Stocks were on the rise across the board on Wednesday as all three major indices closed the day higher. This comes after a bearish start to the week for investors ahead of the Fed’s annual Jackson Hole Symposium that begins on Thursday. Overall, the Dow Jones added 59 basis points, while the S&P 500 and the NASDAQ rose by 0.29% and 0.41% respectively during the session.

Stay up to speed with hot stocks' news!

What was the reason for Bed Bath and Beyond’s sudden surge? Earlier in the morning, the Wall Street Journal reported that the company had secured a new loan deal to help with its struggling finances. As of the time of this writing, no details had been released on the size of the loan or who the lender was. Bed Bath and Beyond failed to take advantage of the short-lived short squeeze last week, so the company’s liquidation issues are still very much a reality.

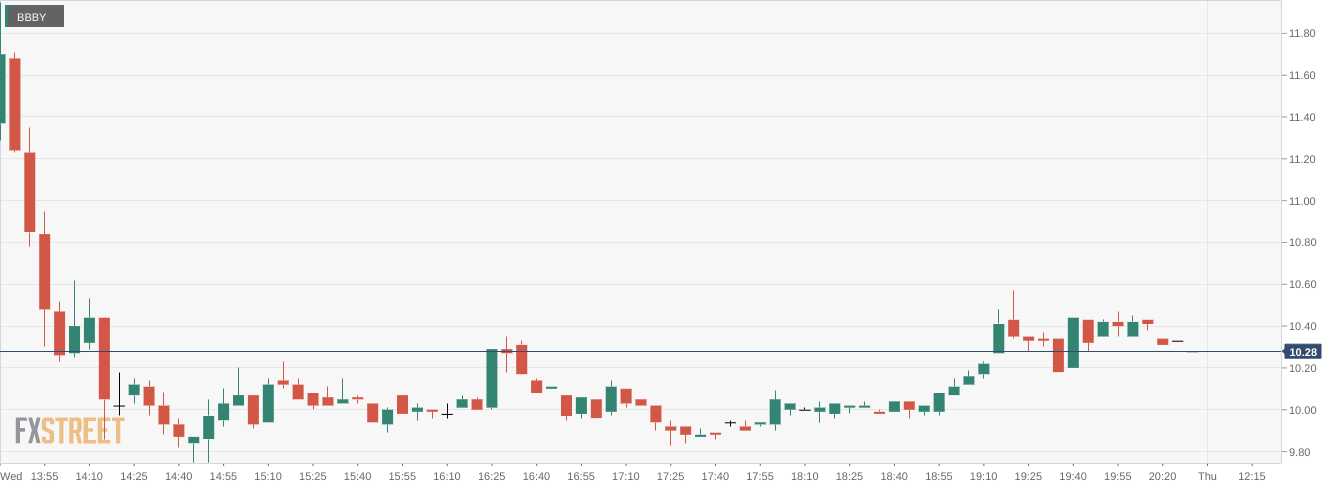

BBBY stock price

While Bed Bath and Beyond rebounded, shares of GameStop (NYSE:GME) continued their descent on Wednesday. Could GameStop’s stock actually be in trouble? It seems as though meme stock traders are certainly still upset with GameStop Chairman Ryan Cohen for selling his stake in Bed Bath and Beyond and causing the collapse of the stock’s short squeeze.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet