BBBY Stock Forecast: Bed Bath & Beyond rises, GameStop and AMC tumble during market sell off

- NASDAQ:BBBY gained 5.94% during Friday’s trading session.

- Daily trading volume surged on Friday as BBBY looks to squeeze again.

- Investors might also be interested in the company’s strategic update next week.

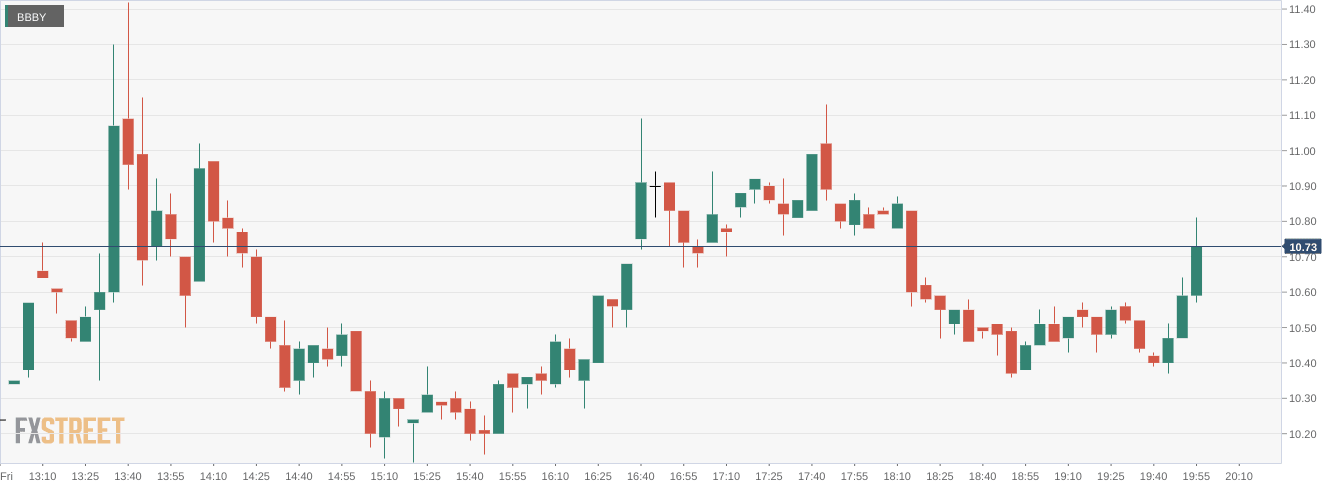

NASDAQ:BBBY pulled off an improbable rise on Friday despite the broader markets tumbling to close the week. Shares of BBBY rose higher by 5.94% and closed the trading week at a price of $10.70. Stocks were hammered on Friday as Fed Chairman Jerome Powell delivered a hawkish speech from Jackson Hole that hinted at more pain ahead for the US economy. The eight-minute speech was short and to the point, and caused an immediate crash on Wall Street. Overall, the Dow Jones sank by 1,008 basis points, the S&P 500 dropped lower by 3.37%, and the NASDAQ tumbled by 3.94% during the session.

Stay up to speed with hot stocks' news!

How did Bed Bath and Beyond manage to eke out a positive day despite the broad market sell off? The daily trading volume soared past the recent average, as more than 56 million shares changed hands on Friday. Intense buying pressure was offset by selling pressure for other meme stocks, including GameStop (NYSE:GME) which continues to fall following Chairman Ryan Cohen selling his stake in BBBY in the middle of the short squeeze. Both AMC (NYSE:AMC) and Ape (NYSE:APE) also sank lower, in what has been a volatile week of trading for meme stocks.

BBBY stock price

There could also be some optimism surrounding Bed Bath and Beyond as the company announced it would deliver a strategic update on August 31st. While the company is far from being in a strong financial state, it is believed that it recently secured a new loan plan in the amount of $375 million. We could continue to see buying pressure for BBBY until the announcement on Wednesday.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet