Banxico lower rates by 25 basis points, signals further easing

- Unanimous decision reflects changed stance since September; further rate cuts may follow as inflation outlook improves.

- Banxico emphasizes continuing economic challenges but sees potential for easing as non-core inflation effects diminish.

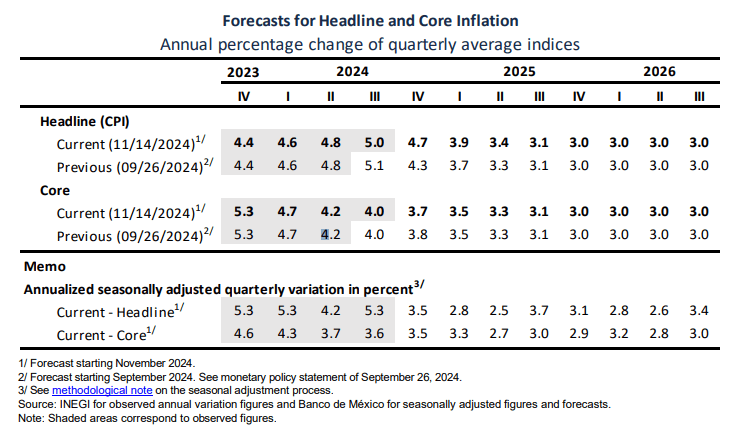

- Inflation expected to reach target by Q4 2025, with updated projections suggesting a gradual disinflationary trend.

The Bank of Mexico cut rates by 25 basis points for the fourth time since March 21, diminishing Mexico’s primary reference rate from 10.50% to 10.25%. It’s worth noting that the decision was unanimous after Deputy Governor Jonathan Heath voted to hold rates unchanged at the September meeting.

Bank of Mexico reduces key rate to 10.25%, citing improving inflation outlook and downside economic risks

In its monetary policy statement, Banxico acknowledged that the balance of risks to economic activity growth is skewed to the downside. They added, “the nature of the shocks that have affected the non-core component and the projection that their effects on headline inflation will dissipate over the next quarters.”

The board added the inflationary scenario “will allow further reference rates adjustments,” and although it requires a restrictive monetary policy stance, the evolution of the disinflation process “implies that it's adequate to reduce the level of monetary policy restriction.”

Banxico updated their forecasts for 2024, 2025 and 2025. The board projects that headline inflation will converge to the bank’s 3% target in Q4 2025.

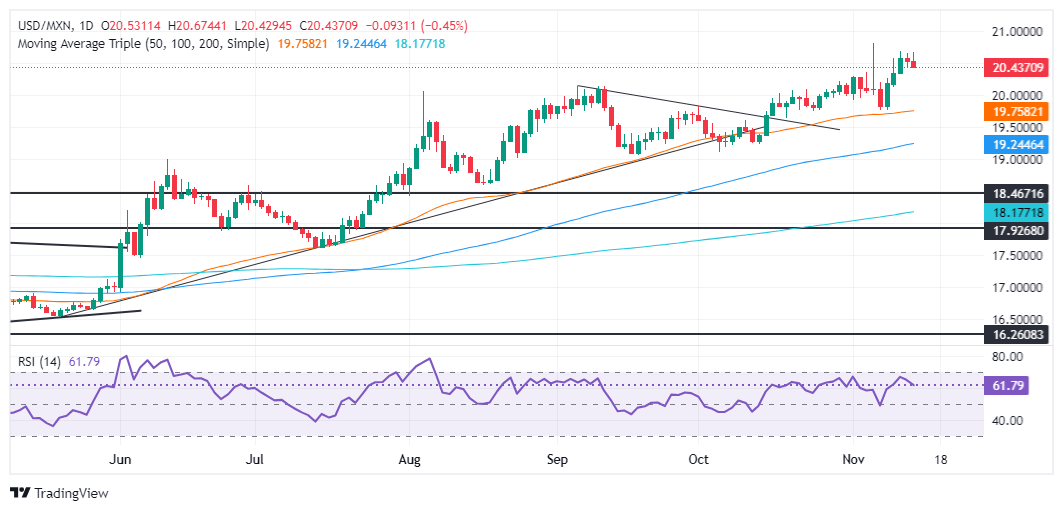

USD/MXN Reaction to Banxico’s decision

The USD/MXN spiked toward 20.55, before printing new daily lows below 20.45. Despite this, the exotic pair bias is tilted to the upside, unless sellers push the exchange rate below 20.00, ahead of testing the 50-day Simple Moving Average (SMA) at 19.74. On the upside, buyers had a clear path to test year-to-date (YTD) highs at 20.80, if they reclaim 20.50.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.