Australian new coronavirus cases, Victoria said to have 439 cases added today

The ABC reports that Victoria will report around 439 new coronavirus cases today. Premier Daniel Andrews is due to give an update at 11am.

Meanwhile, as we await the official numbers, the Guardian reported that Victoria’s stage three restrictions drove down community transmission of coronavirus and potentially saved the lives of hundreds of people, according to new research.

Research from the Burnet Institute, published in the Medical Journal of Australia on Tuesday, found the state’s response to the second wave of COVID-19 averted 9000 to 37,000 cases between July 2 and 30.

Based on the World Health Organisation’s mortality rate of 3.4 per cent, the restrictions potentially saved 1258 lives.

Among stage three restrictions was the lockdown of 12 hotspot postcodes, the complete quarantine of several public housing towers in Flemington and North Melborne and the closure of state borders in early July.

A six-week lockdown was announced for residents of metropolitan Melbourne and Mitchell Shire from July 9, then the compulsory use of masks in public settings was introduced.

Researchers said the reproduction rate of the virus before lockdown was 1.75.

AUD under pressure

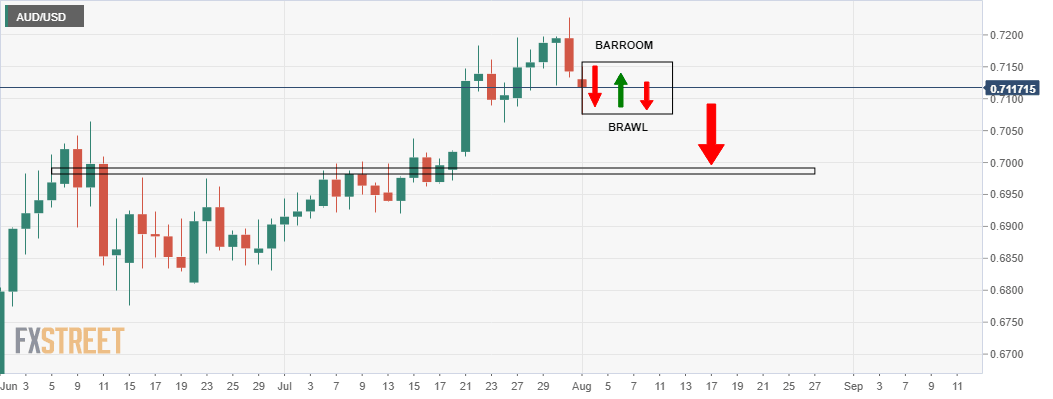

The currency has been under pressure in a barroom brawl at the start of the week as investors begin to question the justification for the value of the currency.

A weight on the currency falls with the surge in virus cases in Victoria.

The chart above was attached in this week's Chart of the Week yesterday to illustrate the prospects for a barroom brawl and construction of a bearish head and shoulder's right-hand shoulder.

This was playing out throughout Europe and New York markets overnight ahead of today's main even in the Reserve Bank of Australia as follows...

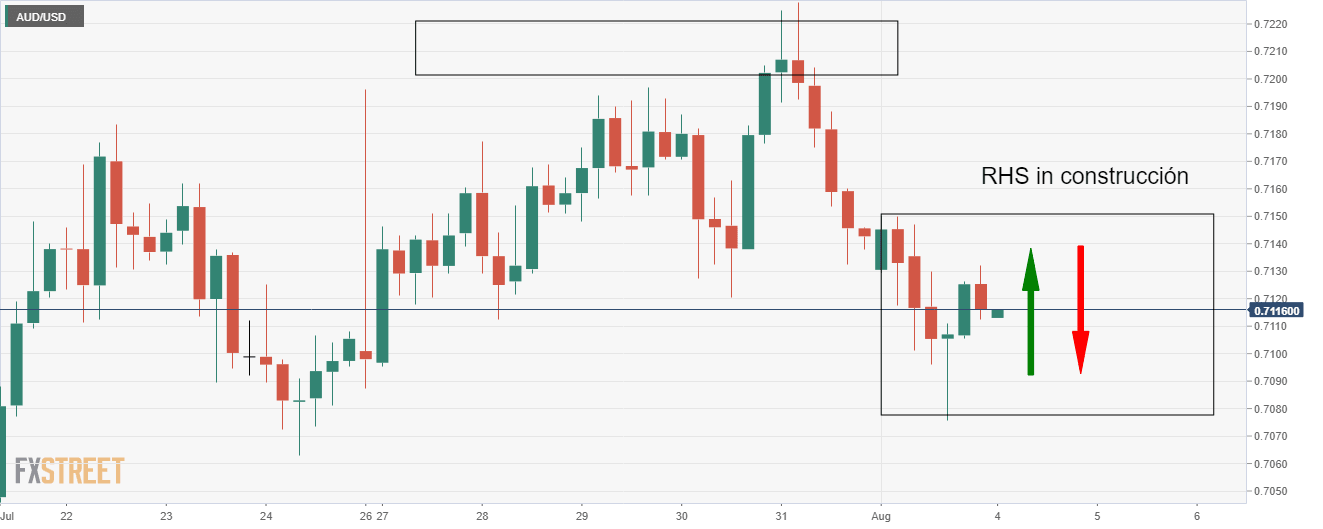

The 4-hour chart shows the formation of the RHS in progress during today's Asia session...

RBA in focus

Meanwhile, looking ahead, no change in the stance of policy is expected at the August RBA meeting.

A full discussion of the outlook and risks will follow on Friday as the RBA releases its latest Statement on Monetary Policy. Recent RBA commentary has indicated scepticism over policy options such as negative interest rates and FX intervention. But Australia’s deteriorating economic outlook means the topic needs to be addressed,

analysts at Westpac explained.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.