Australian Dollar holds steady heading into Tuesday

- The Australian Dollar caught a late boost last week after the Greenback got shredded by bad NFP numbers.

- A mid-tier data schedule awaits Aussie traders this week.

- The RBA’s latest rate call is due next week, and a cut looks likely after CPI inflation eased further.

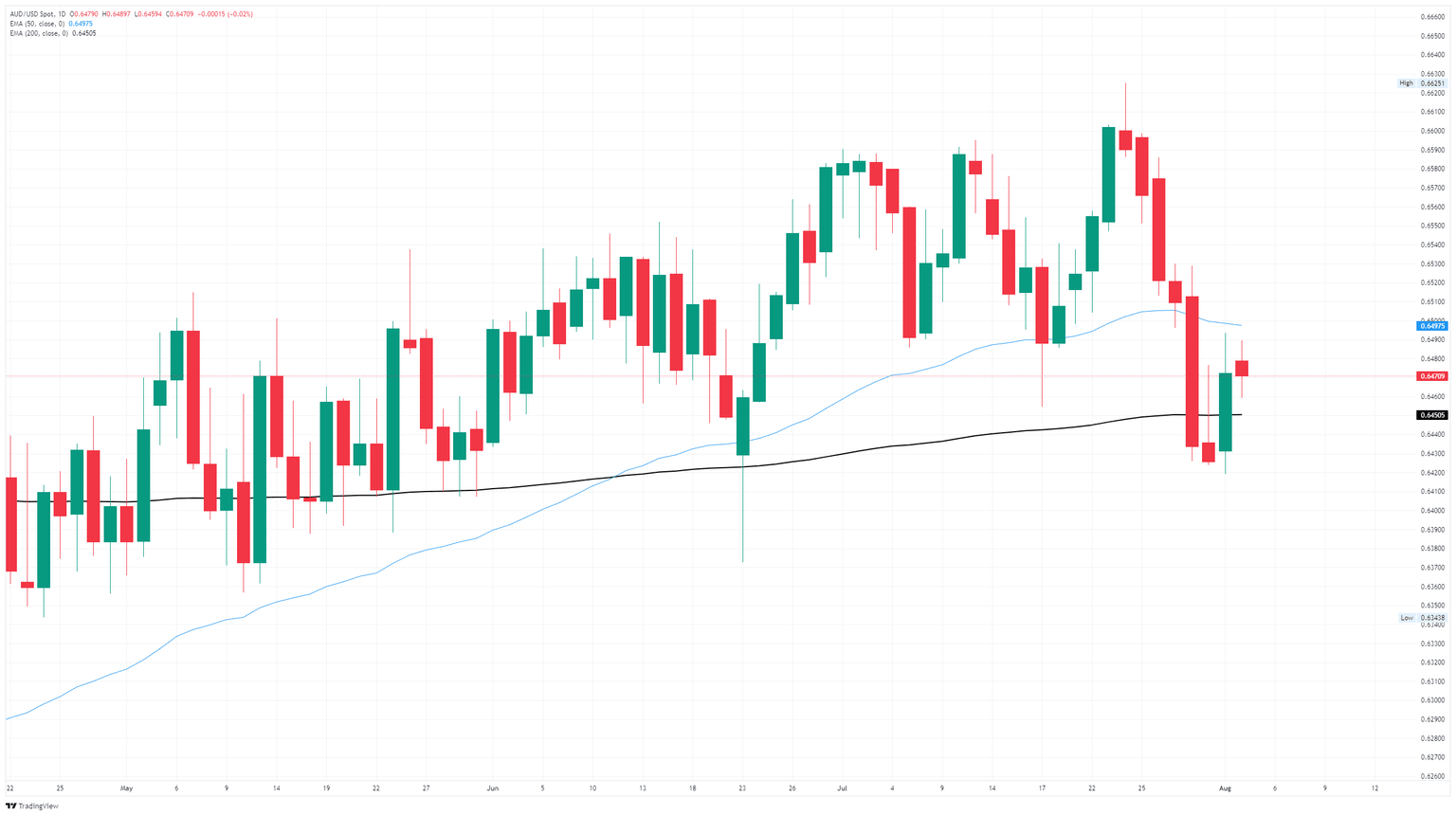

The Australian Dollar (AUD) held steady on Monday, holding onto last week’s late gains against the US Dollar (USD). AUD/USD kept a tight grip on the 0.6470 region, keeping the pair locked in against the 200-day Exponential Moving Average (EMA). A much-needed moment of Greenback selling helped to snap the Aussie’s six-day losing streak, and traders are now pivoting to watching for trade headlines.

Australia’s Melbourne Institute (MI) inflation gauge hit a 20-month high in July, rising 0.9% MoM, its highest single-month increase since December 2023. Australian Consumer Price Index (CPI) eased to 1.9% last week, dragging Q1 inflation metrics below the Reserve Bank of Australia’s (RBA) 2-3% target band and locking in an interest rate cut at the upcoming interest rate decision on August 12.

Australian markets remain exposed to fallout from the Trump administration’s whiplash tariff policies, keeping general risk appetite underbid in the Australian quarters. Australia is opening up its consumer market to beef imports from Canada for the first time since 2003, dealing a potential blow to US President Donald Trump’s claims that the US will be exporting huge amounts of American beef to the Australian markets as a result of his strong-arm tariff policies targeting Australia.

Data-light week puts trade headlines in the front seat

The Australian data docket is a mid-tier affair this week. Australian Trade Balance figures for June are due on Thursday and are expected to show a jump from $ 2.238B to $ 3.25B MoM; however, the figure is too backdated for investors to do anything about.

Before that, the latest Chinese Services Purchasing Managers Index (PMI) for July will print early Tuesday. Knock-on effects for the Australian Dollar could surface as data watchers wait for signs that the Trump administration’s tariff plans for China could have knock-on effects on the Australian economy. July’s Caixin Chinese Services PMI is expected to tick down to 50.2 from 50.6.

Australia abandons Musk’s Tesla as home battery system rebates kick in

EV superstar Tesla (TSLA) has been backsliding in global sales consistently in 2025, and the Tesla fall-off has now spread to the home battery market. Tesla’s global share in the sales of home batteries for power storage has shrunken from 20% to just 5% in seven months. The “brand destruction” by Elon Musk is incredibly poorly timed: Australian government rebates for home battery systems are kicking in this year, and Australia is on pace to sell as many batteries in the first ten weeks of the rebate program as were sold in the entirety of 2024.

According to a report by Australian market research firm Roy Morgan, Tesla and Elon Musk’s adjacent companies have slipped into the top 10 least-trusted companies in Australia, joining Chinese discount goods supergiant Temu, Musk’s X/Twitter, and Meta/Facebook as some of the least trustworthy companies in the Australian market.

AUD/USD daily chart

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.