Australian Dollar holds gains as US Dollar edges lower ahead of Retail Sales data

- The Australian Dollar holds its ground to start the week after posting modest gains against the US Dollar On Friday.

- China's Retail Sales rose 4% YoY in January-February, up from December’s 3.7% increase.

- Market expectations suggest that the Fed will keep its current policy stance unchanged on Wednesday.

The Australian Dollar (AUD) holds gains against the US Dollar (USD) in the European session on Monday, although markets remain cautious after US President Donald Trump reiterated that they will impose reciprocal and sectoral tariffs on April 2. Trump added that there won't be any exemptions for steel and aluminum and noted that reciprocal tariffs on certain countries will be implemented alongside auto duties. Additionally, an announcement regarding Russia-Ukraine talks may come on Tuesday.

Earlier in the day, the AUD/USD pair gained ground following the release of China’s economic data. Traders will likely observe the US Retail Sales data scheduled to be released later in the North American session.

China's retail sales grew by 4.0% year-over-year in January-February, improving from December’s 3.7% increase. Meanwhile, industrial production rose 5.9% YoY during the same period, exceeding the 5.3% forecast but slightly lower than the previous reading of 6.2%.

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.25% | -0.21% | -0.15% | -0.23% | -0.30% | -0.69% | -0.24% | |

| EUR | 0.25% | -0.09% | -0.29% | 0.02% | -0.18% | -0.46% | -0.02% | |

| GBP | 0.21% | 0.09% | 0.10% | -0.11% | -0.12% | -0.39% | 0.00% | |

| JPY | 0.15% | 0.29% | -0.10% | -0.08% | -0.37% | -0.50% | -0.22% | |

| CAD | 0.23% | -0.02% | 0.11% | 0.08% | -0.28% | -0.46% | -0.56% | |

| AUD | 0.30% | 0.18% | 0.12% | 0.37% | 0.28% | -0.24% | 0.19% | |

| NZD | 0.69% | 0.46% | 0.39% | 0.50% | 0.46% | 0.24% | 0.44% | |

| CHF | 0.24% | 0.02% | -0.00% | 0.22% | 0.56% | -0.19% | -0.44% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

The AUD could gain ground as China unveiled a special action plan over the weekend to revive consumption, lifting market sentiment across the region. The plan includes measures to increase wages, boost household spending, and stabilize stock and real estate markets. Any positive developments surrounding the Chinese stimulus plan could boost the Australian Dollar, as China is a major trading partner to Australia.

The AUD/USD pair may receive support from improving risk sentiment amid reports of a potential ceasefire discussion between US President Donald Trump and Russian President Vladimir Putin this week. Trump’s envoy, Steve Witkoff, stated on Sunday that he expects the two leaders to speak, adding that Putin “accepts the philosophy” of Trump’s ceasefire and peace terms, according to The Guardian.

Australian Dollar could gain ground amid improved risk sentiment

- The US Dollar Index (DXY), which measures the USD against six major currencies, is trading in negative territory around 103.50 at the time of writing. The Greenback faced headwinds after the University of Michigan (UoM) reported a decline in its preliminary Consumer Sentiment Index for March on Friday, falling to 57.9—the lowest since November 2022—from the previous reading of 64.7. This figure also came in below the consensus estimate of 63.1. Meanwhile, the UoM five-year Consumer Inflation Expectation jumped to 3.9% in March, compared to 3.5% in February.

- Markets widely anticipate that the Federal Reserve (Fed) will maintain its current policy stance when it concludes its two-day meeting on Wednesday. According to the CME FedWatch tool, traders have priced in nearly a 75% probability of a quarter-point rate cut by June.

- On Sunday, the Houthis declared that they had launched an assault involving 18 ballistic and cruise missiles, along with drones, aimed at the USS Harry S. Truman aircraft carrier and its escorting warships in the northern Red Sea. Meanwhile, the US defense secretary stated that the United States would continue striking Yemen's Houthis until they cease attacks on shipping, as the Iran-aligned group vowed to escalate in retaliation for deadly US strikes the previous day.

- US Treasury Secretary Scott Bessent said late Sunday that he was not concerned about the stock market despite multiple declines triggered by Trump's tariff threats. "I've been in the investment business for 35 years, and I can tell you that corrections are healthy. They're normal. What's not healthy is a market that only moves straight up," Bessent stated.

- US President Donald Trump’s decision to uphold a 25% tariff on Australian aluminum and steel exports, valued at nearly $1 billion. This move adds strain to Australia’s trade outlook, impacting major exports.

- Australian Prime Minister Anthony Albanese confirmed that Australia will not impose reciprocal tariffs on the US, emphasizing that retaliatory measures would only raise costs for Australian consumers and fuel inflation.

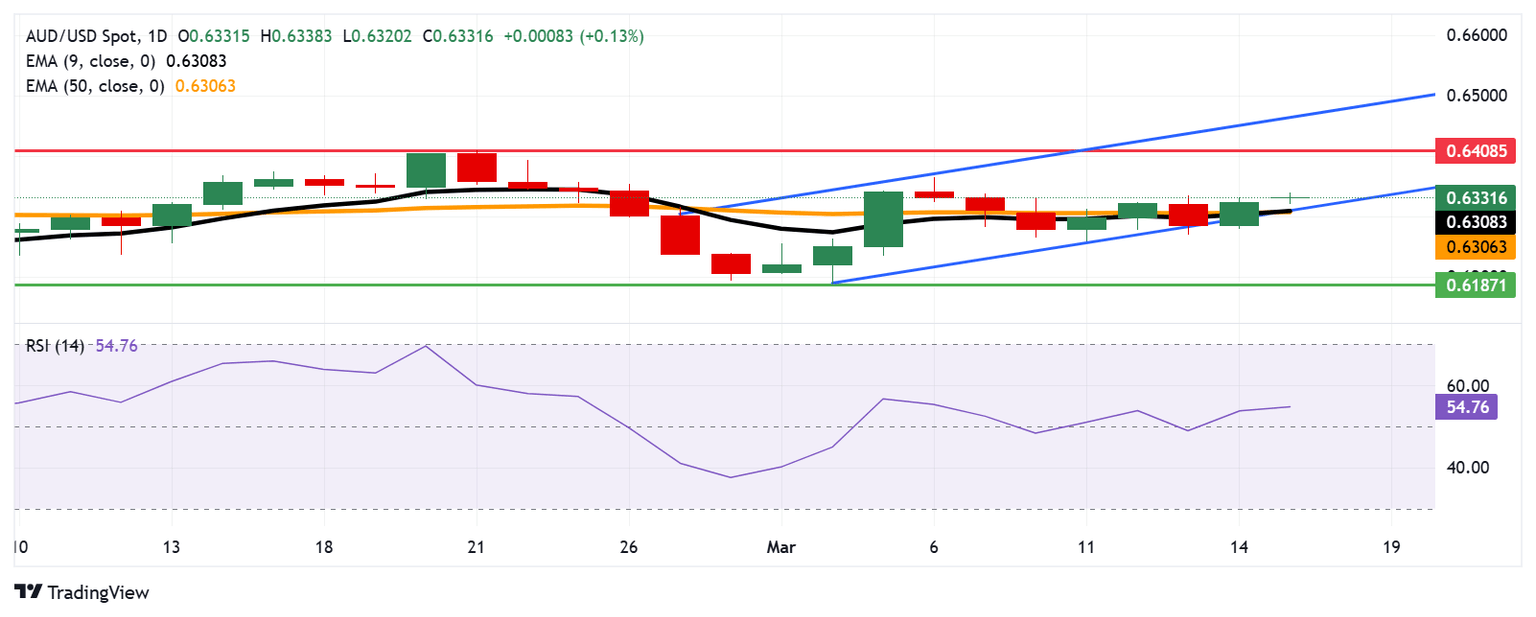

Technical Analysis: Australian Dollar maintains position above 0.6300, nine-day EMA

The AUD/USD pair is hovering around 0.6340 on Monday, maintaining a bullish outlook after reclaiming its position within the ascending channel on the daily chart. The 14-day Relative Strength Index (RSI) has also rebounded above 50, further supporting the positive momentum.

Immediate support is seen at the nine-day Exponential Moving Average (EMA) of 0.6309, followed by the 50-day EMA at 0.6306 and the lower boundary of the ascending channel. A decisive break below this critical support zone could weaken the bullish bias, exposing the AUD/USD pair to downward pressure toward the six-week low of 0.6187, recorded on March 5.

On the upside, the AUD/USD pair may attempt to retest the three-month high of 0.6408, last seen on February 21. A breakout above this level would reinforce the bullish bias, potentially driving the pair toward the ascending channel’s upper boundary near 0.6470.

AUD/USD: Daily Chart

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.