Australian Dollar holds gains due to increased odds of Fed rate cut in September

- The Australian Dollar gains ground as the RBA is expected to hold interest rates next week.

- National Australia Bank (NAB) anticipates that the RBA’s cash rate will remain stable at 4.35% until May 2025.

- The US Dollar loses ground as the Fed is expected to deliver three rate cuts this year.

The Australian Dollar (AUD) extends its gains against the US Dollar (USD) for the second session on Monday. This upside is attributed to the hawkish sentiment surrounding the Reserve Bank of Australia’s (RBA) policy stance. Unlike other major central banks, the RBA is expected to delay easing its policy tightening due to persistent inflationary pressures and a tight labor market.

Australian Retail Sales for June will be closely watched on Tuesday. On Wednesday, the second-quarter Consumer Price Index (CPI) data will be released, potentially providing insights into the future direction of domestic monetary policy. Some economists are cautioning against further tightening due to increased recessionary risks. Last week, data indicated that private sector growth in Australia slowed in July, with manufacturing activity remaining contractionary and growth in the services sector decelerating.

The AUD/USD pair gains ground due to a weaker US Dollar. Signs of cooling inflation and easing labor market conditions in the United States (US) have fueled expectations of three rate cuts this year by the Federal Reserve (Fed), starting in September.

Daily Digest Market Movers: Australian Dollar improves due to the hawkish mood surrounding the RBA

- National Australia Bank (NAB) anticipates that the Reserve Bank of Australia's (RBA) cash rate will remain stable at 4.35% until May 2025, according to a recent NAB Economics outlook. Looking ahead, the NAB Economics team predicts a decline to 3.6% by December 2025, with further decreases expected in 2026.

- In a media release on Monday, the Australian Prudential Regulation Authority (APRA) warned that arrears rates are increasing slowly. Following their latest quarterly assessment of domestic and international economic conditions, APRA announced that they will keep macroprudential policy settings on hold. These comments reflect their ongoing evaluation of both domestic and global economic environments.

- On Friday, the US Personal Consumption Expenditures (PCE) Price Index rose by 2.5% year-over-year in June, down slightly from 2.6% in May, meeting market expectations. On a monthly basis, the PCE Price Index increased by 0.1% after being unchanged in May.

- The US Core PCE inflation, which excludes volatile food and energy prices, also climbed to 2.6% in June, consistent with May's increase and above the forecast of 2.5%. The core PCE Price Index rose by 0.2% month-over-month in June, compared to 0.1% in May.

- Bank of America suggests that robust economic growth in the United States enables the Federal Open Market Committee (FOMC) to "afford to wait" before implementing any adjustments. The BofA notes that the economy "remains strong" and expects the Fed to begin rate cuts in December.

- Last week, concerns about the weak Chinese economy were heightened by an unexpected rate cut from the People's Bank of China (PBoC). The People’s Bank of China (PBOC), cut the one-year Medium-term Lending Facility (MLF) rate from 2.50% to 2.30% on Thursday. Additionally, the Bank of China, one of the world's largest banks, announced a 10-20 basis points cut in time deposit rates. Any change in the Chinese economy could impact the Australian markets as both countries are close trade partners.

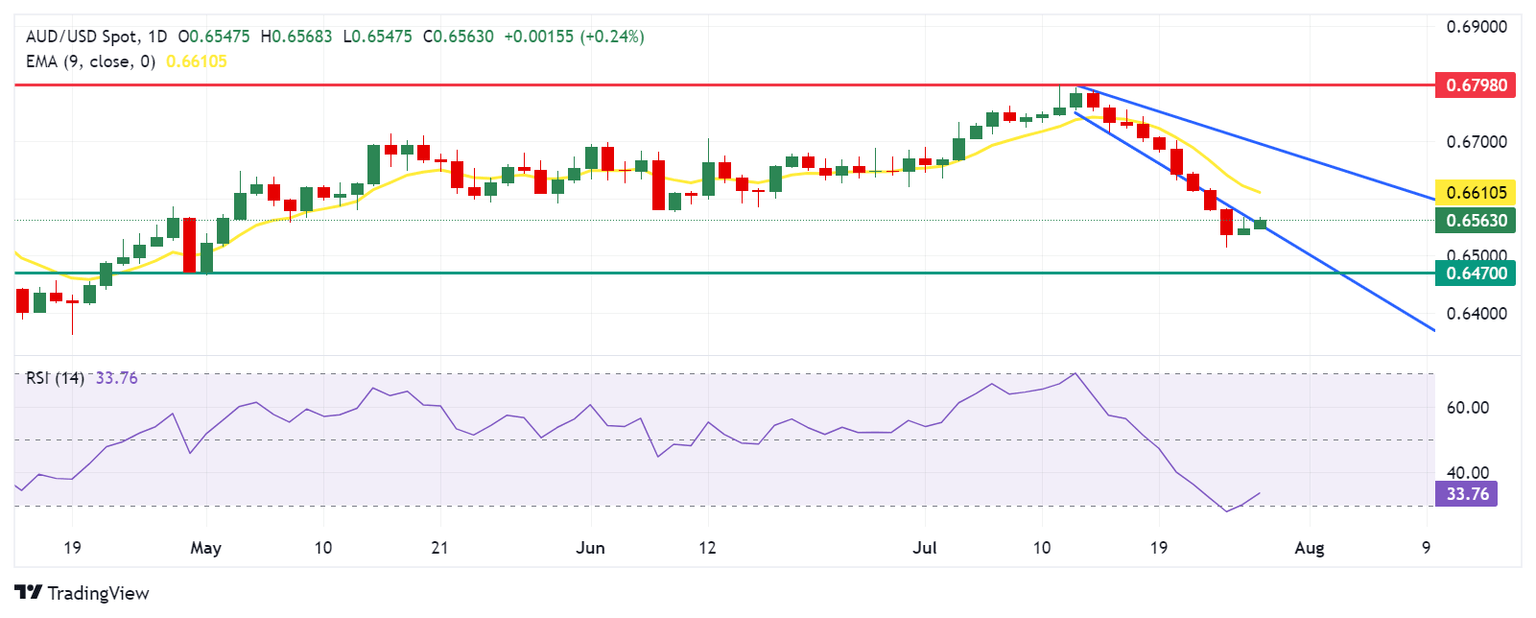

Technical Analysis: Australian Dollar moves above 0.6550

The Australian Dollar trades around 0.6560 on Monday. The daily chart analysis shows that the AUD/USD pair has returned to the descending channel, indicating a potential weakening of the bearish bias. The 14-day Relative Strength Index (RSI) is slightly above 30 level, suggesting the currency pair may be due for a potential correction soon.

The AUD/USD pair could find immediate support at the lower boundary of the descending channel around the key level of 0.6550. A break below this level could exert pressure on the pair to navigate the region around the 0.6470 level.

On the upside, key resistance appears at the nine-day Exponential Moving Average (EMA) at 0.6610. A break above this level could lead the pair to test the upper boundary of the descending channel around the psychological level of 0.6700, with a potential aim for a six-month high of 0.6798.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.02% | -0.06% | -0.23% | -0.06% | -0.07% | 0.02% | -0.07% | |

| EUR | 0.02% | -0.07% | -0.23% | -0.01% | -0.01% | 0.03% | -0.04% | |

| GBP | 0.06% | 0.07% | -0.20% | 0.03% | 0.06% | 0.11% | 0.04% | |

| JPY | 0.23% | 0.23% | 0.20% | 0.17% | 0.20% | 0.27% | 0.21% | |

| CAD | 0.06% | 0.01% | -0.03% | -0.17% | 0.01% | 0.05% | 0.00% | |

| AUD | 0.07% | 0.01% | -0.06% | -0.20% | -0.01% | 0.07% | -0.02% | |

| NZD | -0.02% | -0.03% | -0.11% | -0.27% | -0.05% | -0.07% | -0.07% | |

| CHF | 0.07% | 0.04% | -0.04% | -0.21% | -0.01% | 0.02% | 0.07% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.