AUD/USD rallies from Thursday lows to tap 0.6600

- The AUD/USD rallied from ten-day lows to retest the 0.6600 handle on Thursday.

- Moderating US Initial Jobless Claims is seeing a recovery in market sentiment.

- The Australian Dollar is rebounding against the broader FX market.

The AUD/USD is finding topside bids on Thursday, climbing three-quarters of a percent to retest the 0.6600 handle as market sentiment sees a late recovery heading into the US Nonfarm Payrolls (NFP) print slated for Friday to close out the trading week.

The Australian Dollar (AUD) slipped in the early Thursday market session, dipping into a two-week low near 0.6530 before catching a ride on a broad-market risk rally to bound back within reach of 0.6600.

US Initial Jobless Claims helped to fuel the broader market’s risk recovery, showing fewer than expected jobless benefits seekers. Initial Jobless Claims for the week ending December 1 printed 220K, slightly less then the market expectation of 222K. Initial Jobless Claims came in below the 4-week average of 220.75K, and saw only a minor uptick from the previous week’s 218K.

US NFP to close out the week as investors focus on the major data release

The Aussie will next have to grapple with the US NFP data drop slated for Friday’s American market session, and the median market forecast expects November’s NFP to show a net gain of 180K compared to October’s 150K print.

The University of Michigan’s Consumer Sentiment Index will also be printing on Friday, and is expected to show a similar moderate improvement from 61.3 to 62.0.

AUD/USD Technical Outlook

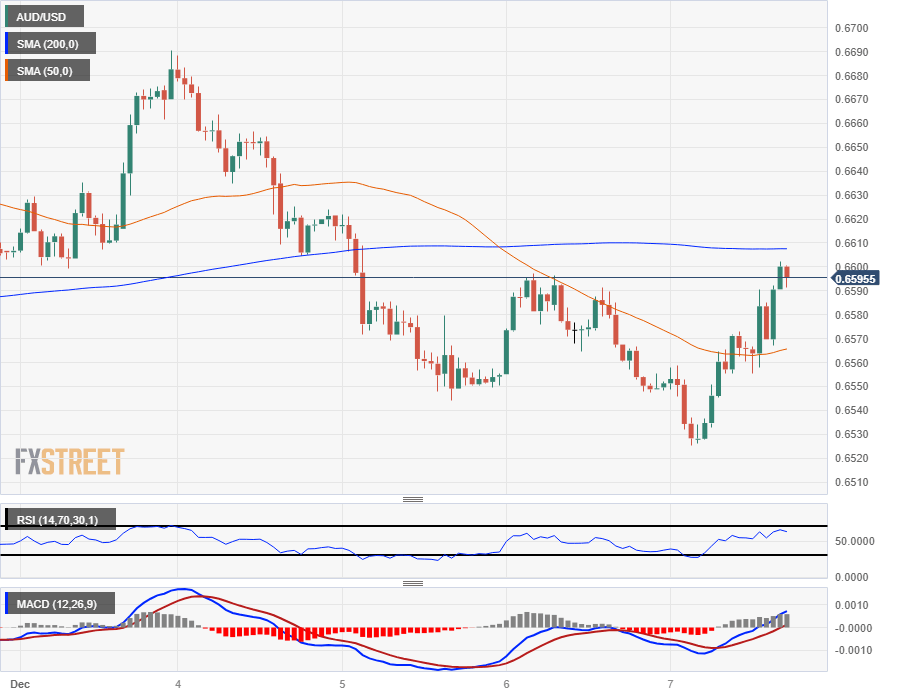

The AUD/USD’s Thursday rally sees intraday action capped off by the 200-hour Simple Moving Average (SMA) near 0.6610, and the pair’s rise back into 0.6600 is set to face difficulties on the charts as Aussie momentum remains limited.

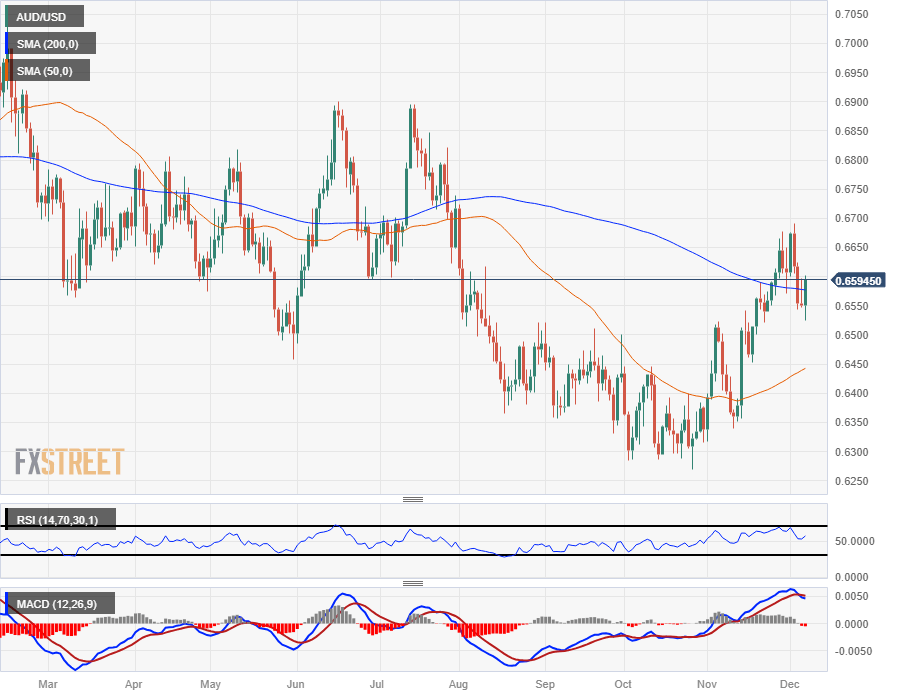

Thursday’s Aussie rally also sees the AUD/USD strung along the 200-day SMA on the daily candlesticks, after a firm rebound from Thursday’s bottom bids of 0.6525.

Looking further out, the AUD/USD is approaching a significant technical barrier, with 0.6600 serving as a major support level through much of early 2023’s chart action.

AUD/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.