AUD/USD Price Analysis: Uptrend extends

- AUD/USD is in a short-term uptrend that is extending.

- The pair is pulling back within a rising channel.

- It will probably find support at the lower channel line and then resume its uptrend.

AUD/USD extends its short-term uptrend as it trades in the mid-0.6550s on Monday.

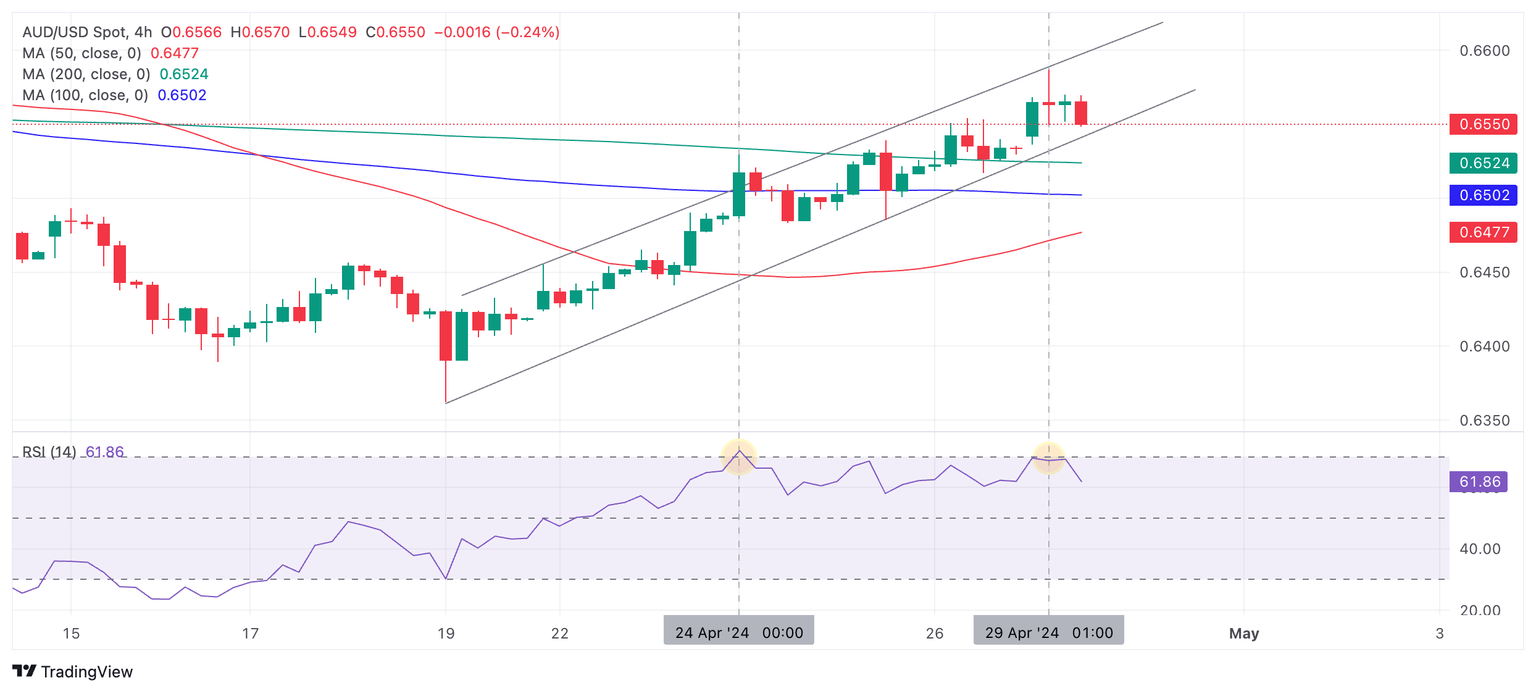

AUD/USD 4-hour Chartç

The pair has formed a neat channel higher on the 4-hour chart used to assess the short-term trend.

AUD/USD is currently pulling back within the channel but will probably find support at the lower channel line at around 0.6540, and – given “the trend is your friend” as they say – resume its bull trend thereafter.

The next target in AUD/USD’s march higher is probably the upper channel line at around 0.6600.

The Relative Strength Index (RSI) momentum indicator is not yet overbought, signaling the possibility more buyers may yet enter the market and push the pair higher. The RSI is, however, currently showing mild bearish divergence when compared with the peak of April 24 when the RSI poked into overbought (cricled). This is a slightly bearish sign.

AUD/USD has broken above all three of the major moving averages – the 50-4hr, 100-4hr and 200-4hr Simple Moving Averages (SMA) – a bullish indication in the near-term.

It would require a decisive break below the lower channel line for the price to signal a bearish breakout from the channel and the start of a deeper decline.

A decisive break would be one in which AUD/USD formed a long red bearish candlestick on the 4-hr chart that pierced below the channel line and closed near its low, or three consecutive red candles in a row that also broke below the channel line.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.