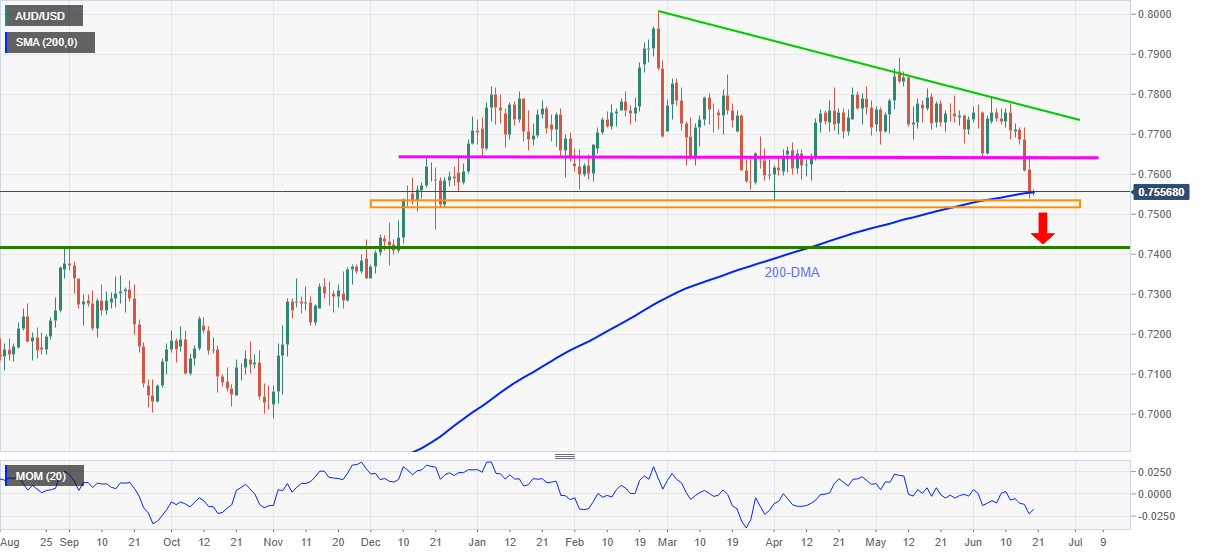

AUD/USD Price Analysis: Rebound from yearly low clings to 200-DMA

- AUD/USD remains range-bound below 0.7565, eases from intraday high of late.

- Failures to stay below 200-DMA, Momentum rebound backs recovery hopes.

- Six-month-old horizontal line guards immediate upside, bears need a clear break of 0.7520.

AUD/USD remains sidelined around 0.7550, edges lower of late, during Friday’s Asian session. In doing so, the Aussie pair portrays a corrective pullback from the yearly low while taking rounds to 200-day SMA (DMA).

Given the U-turn of the Momentum line from oversold territory, the latest recovery is likely to last longer if the quote manages to secure a daily closing beyond the 200-DMA level of 0.7555.

Following that, the 0.7600 round figure and multiple levels marked since late December 2020 around 0.7640-45 may test AUD/USD buyers before directing them to a downward sloping trend line from February 25, close to 0.7765.

On the flip side, the 0.7531-19 area comprising multiple lows marked since December 11, 2020 tests the pair bears targeting the August-September 2020 tops near 0.7420.

During the quote’s weakness past 0.7420, highs marked in October and early November of 2020, close to 0.7340-45, becomes the key.

Overall, AUD/USD sellers seem tiring around the key SMA support, suggesting the bounce off important support zone.

AUD/USD daily chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.