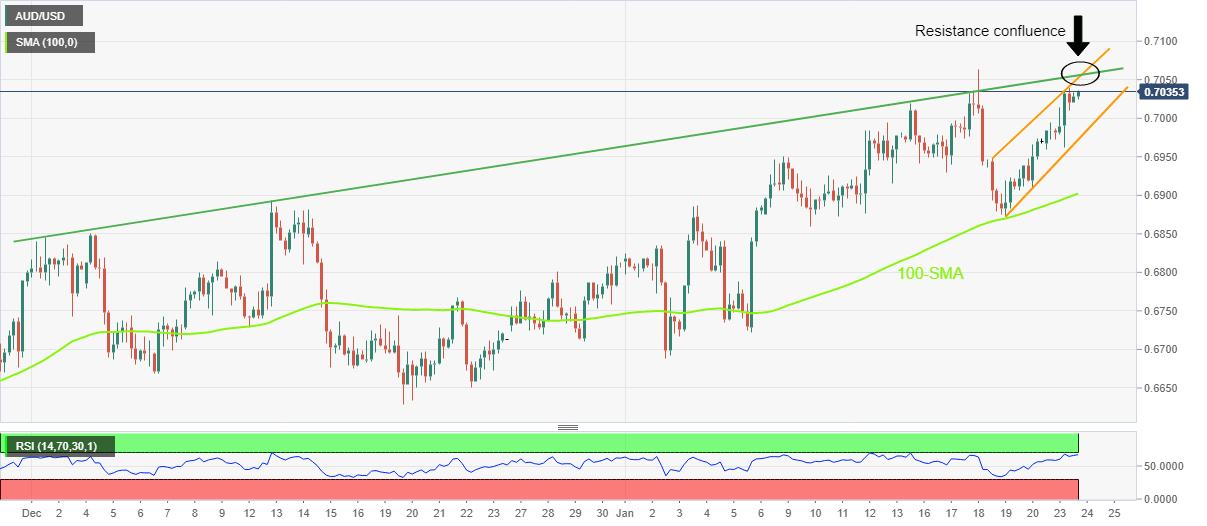

AUD/USD Price Analysis: Further upside needs validation from 0.7050-55 resistance confluence

- AUD/USD picks up bids to renew intraday high during three-day uptrend.

- Convergence of one-week-old bullish channel’s top line, ascending trend line from December 01 challenge buyers.

- Nearly overbought RSI restricts further upside of the Aussie pair.

- Bears remain off the table unless witnessing clear downside break of 100-SMA.

AUD/USD bulls keep the reins for the third consecutive day around 0.7030-35 during early Tuesday. In doing so, the Aussie pair stays inside a one-week-long ascending trend channel while justifying a firmer RSI (14).

It should be noted, however, that a seven-week-old upward-sloping resistance line joins the stated bullish channel’s top line near 0.7050-55 to pose a serious threat to the current advances.

Adding strength to the fears of the AUD/USD bulls is the RSI (14) line that approaches the overbought territory and suggests a pullback.

In a case where the Aussie buyers manage to cross the 0.7055 resistance confluence, the previous weekly high near 0.7065 may act as the last defense of the bears before directing the quote towards the August 2022 peak surrounding 0.7140.

Alternatively, pullback moves may initially aim for the 0.7000 psychological magnet and remain less harmful to the bullish trend unless breaking the short-term rising channel’s support line, close to 0.6970 at the latest.

Following that, the 100-SMA and the previous monthly high could challenge the AUD/USD pair sellers around 0.6900 and 0.6890 in that order before giving them control.

AUD/USD: Four-hour chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.