AUD/USD Price Analysis: Further upside hinges on 0.7045-50 resistance break, RBA

- AUD/USD remains sidelined after refreshing six-week high, mildly bid of late.

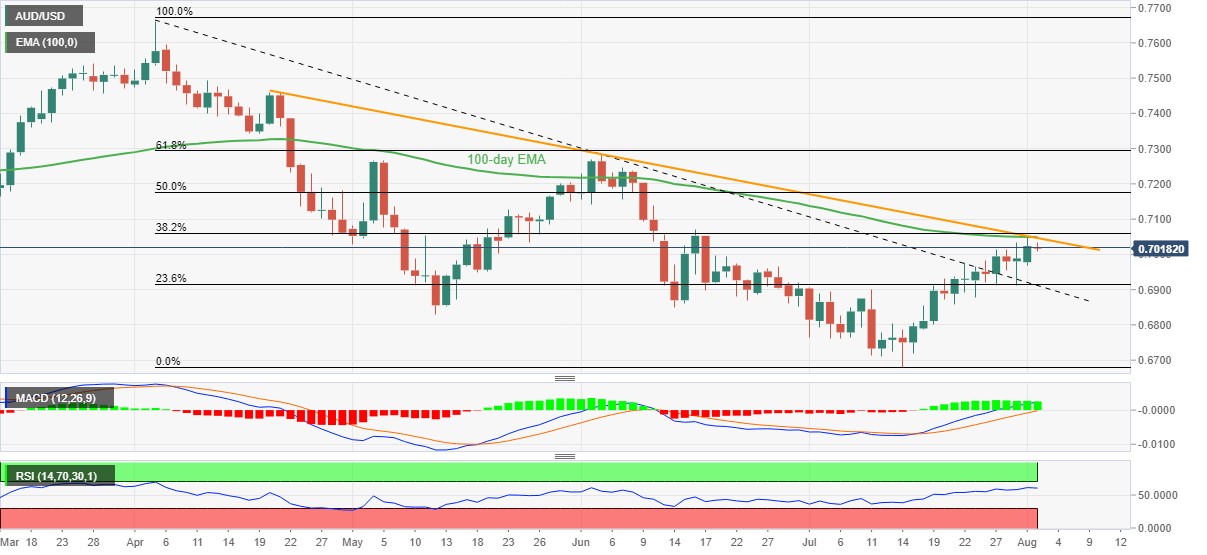

- A convergence of 100-day EMA, descending trend line from late April restricts immediate upside.

- Four-month-old previous resistance line could lure bears during pullback.

- MACD, RSI conditions favor buyers but it all depends upon the RBA.

AUD/USD takes rounds to 0.7025-30 during the mid-Asian session on Tuesday. In doing so, the Aussie pair flirts with the key hurdle to the north as traders await the Reserve Bank of Australia’s (RBA) Interest Rate Decision.

In addition to a joint of the 100-day EMA and the downward sloping trend line from April 20, fears that the RBA might refrain from too hawkish commentary due to the broad recession fears also challenge the AUD/USD bulls.

Also read: AUD/USD bulls take a breather below 0.7050 ahead of RBA Interest Rate Decision

It’s worth noting, however, that the first MACD signals and the RSI (14), not overbought, keep AUD/USD buyers hopeful. On the same line is the Aussie pair’s sustained trading beyond the downward sloping resistance line from April, now support around 0.6910.

Should the pullback moves drag the quote below 0.6910, the lows marked during mid-June and May, respectively around 0.6850 and 0.6830, will challenge the pair’s further downside before redirecting bears towards the yearly low of 0.6680.

On the contrary, a successful run-up beyond the 0.7050 hurdle needs validation from June 16 swing high near 0.7070 before fueling the AUD/USD prices towards 50% and 61.8% Fibonacci retracement levels of the April-July downtrend, close to 0.7175 and 0.7300 in that order.

AUD/USD: Daily chart

Trend: Further Upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.