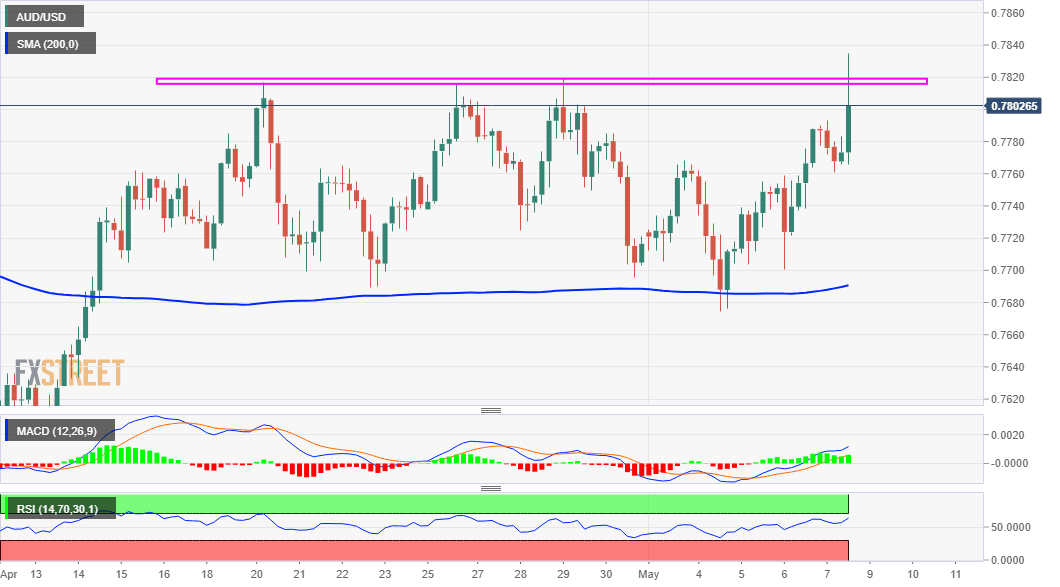

AUD/USD Price Analysis: Bulls struggle to find acceptance above 0.7815-20 supply zone

- The post-NFP USD selloff pushed AUD/USD to the highest level since March 18.

- The lack of any follow-through buying warrants some caution for bullish traders.

- The stage still seems set for a move beyond March swing highs, near mid-0.7800s.

The AUD/USD pair caught some aggressive bids during the early North American session and jumped to the highest level since March 18, around the 0.7835 region in the last hour.

The US monthly jobs report for April missed market expectations by a big margin and triggered a broad-based US dollar selloff. This was seen as a key factor that provided a strong lift to the AUD/USD pair. Apart from this, the underlying bullish sentiment further benefitted the perceived riskier aussie and remained supportive of the positive move.

Despite the combination of supporting factors, the AUD/USD pair struggled to capitalize on the momentum or find acceptance above the 0.7815-20 horizontal barrier and quickly retreated few pips from daily swing highs. The pullback warrants some caution before confirming a near-term bullish breakout and positioning for any further appreciating move.

Meanwhile, technical indicators on the daily chart maintained their bullish bias and are still far from being in the overbought territory. This, in turn, supports prospects for an eventual break through the mentioned barrier and an extension of this week's solid bounce from the 0.7675 region, or the lowest April 14 touched earlier this week on Tuesday.

Nevertheless, the AUD/USD pair now seems poised to surpass March monthly swing highs resistance near mid-0.7800s and aim to reclaim the 0.7900 round-figure mark for the first time since February 25. Some follow-through buying should pave the way for a move towards the 0.7965-70 region before bulls lift the pair further towards the key 0.8000 psychological mark.

On the flip side, weakness below the 0.7800-0.7790 region might now find decent support near the 0.7760 level. Any subsequent decline could be seen as an opportunity to initiate fresh bullish positions. This, in turn, should help limit the downside near the 0.7700 mark, which should now act as a strong near-term base for the AUD/USD pair.

AUD/USD 4-hour chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.