AUD/USD Price Analysis: Bulls flirt with 38.2% Fibo. level of this week’s downfall

- AUD/USD gained strong positive traction on Friday amid renewed USD selling bias.

- Sliding US bond yields, disappointing US Retail Sales weighed heavily on the buck.

- The stage now seems set for a move towards reclaiming the 0.7800 round figure.

The AUD/USD pair built on the previous day's goodish rebound from sub-0.7700 levels and gained strong follow-through traction on the last trading day of the week. The momentum pushed the pair to two-day tops, around the 0.7760-65 region during the early North American session.

A sharp fall in the US Treasury bond yields – amid the Fed's stubbornly dovish stance – prompted some fresh selling around the US dollar on Friday. The already weaker USD lost some additional ground following the disappointing release of US monthly Retail Sales figures, which, in turn, was seen as a key factor behind the latest leg of an uptick in the past hour or so.

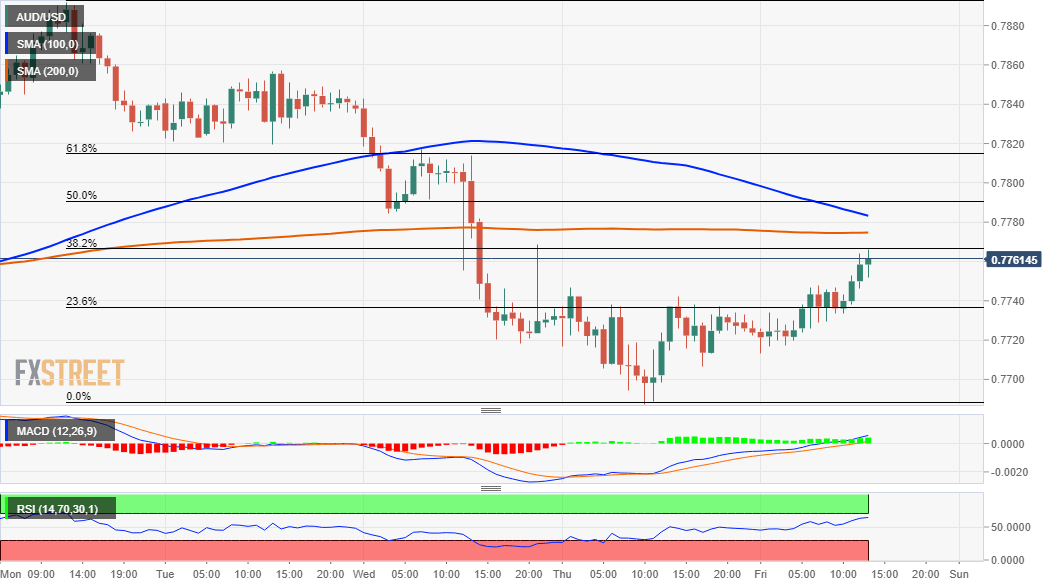

From a technical perspective, the AUD/USD pair was last seen hovering near the 38.2% Fibonacci level of this week's slide from the 0.7890 region, or the highest level since February 25. Given that technical indicators on the daily chart have just started moving back into the positive territory, some follow-through buying will set the stage for additional gains.

The AUD/USD pair might then accelerate the momentum and aim to reclaim the 0.7800 round-figure mark. This coincides with the 50% Fibo. level, which if cleared decisively will negate any near-term bearish bias and push the pair further beyond the 61.8% Fibo. level, towards challenging the next relevant hurdle near the 0.7845-55 region en-route weekly tops, around the 0.7890 region.

On the flip side, the 23.6% Fibo. level, around the 0.7735 region now seems to protect the immediate downside. This is closely followed by ascending trend-line support near the 0.7720-15 region, which if broken decisively will shift the bias in favour of bearish traders. The subsequent downfall has the potential to drag the AUD/USD pair back towards testing sub-0.7700 levels.

Sustained weakness below should pave the way for a slide towards the 0.7660 horizontal resistance breakpoint, now turned support, before the AUD/USD pair eventually drops to the 0.7600 round figure.

AUD/USD 1-hour chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.